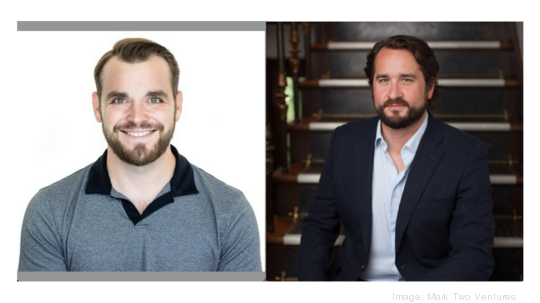

Two venture capital investors, Patrick Cooney and Glenn Clayton, have created their own firm and chosen Nashville as their home base. The entrepreneurs-turned-investors already have made their first $1 million investment and are weighing five or six prospects in Nashville — central to their broader mission of boosting tech and startups in the Southeast. But get this: You don't even need to have a business to potentially earn their money.

Name: Mark Two Ventures (stylized as MKII)

Meet the co-chiefs: Clayton, who lives in Nashville, is a serial entrepreneur who has scaled several companies and netted a total of $35 million of early-stage funding. Cooney, who lives in Birmingham, Alabama, co-founded and is president of Simpeo, which now operates in 25 states and has annualized revenue of $300 million.

Ideal prospect: In an interview, Cooney said Mark Two Ventures isn't focusing on select industries or sectors. Generally, the target is software or software-based businesses. "We want them to be pre-seed, or even pre-formation, if that makes sense. It could just be someone with a great idea," Cooney said. "We like to get involved as early as possible … even before a company has formed," and build that new company from scratch.

Why Nashville: Cooney called it a "no-brainer." "Nashville, No. 1, is geographically a central hub for the Southeast. It's got a lot of reach," he said. "Secondly, the city's growing rapidly. It's dynamic. Nashville really incentivizes and gets behind new businesses and economic growth. It's full of professionals who not only are from there, but also a lot of people have moved there. We really liked that characteristic, from a talent perspective."

Why the Southeast: Both are from Alabama and both previously lived in New York City before returning to the region. "Many people think what’s holding back startups in the South is a lack of capital, but we don’t think that’s true, or at least it's not the primary factor," Clayton said in a statement. "The biggest asset that founders in markets like New York and San Francisco have is access to a deep network of experienced talent who know the playbook on how you build and scale startups the right way. That’s exactly what we want to offer to startups in the South."

Typical investment range: $500,000 to $1 million per investment, with most investments likely at the $1 million mark, Cooney said.

First investment: Astound, in Birmingham

Deal-flow target: Ten to 12 investments over the next 18 months, Cooney said.

Another wrinkle: In addition to individual startups, Cooney and Clayton are in talks with multiple larger companies who are looking to spin out and commercialize their technology.

Getting in touch: patrick@mk2v.com; or, the firm's website.