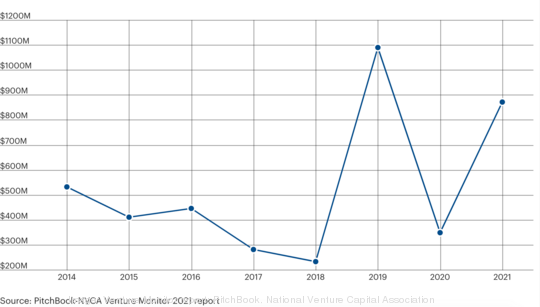

Venture-backed companies in Greater Nashville hauled in more than $870 million of investor money in 2021, part of a record-shattering year for venture investment nationwide.

That’s one upshot from the latest Venture Monitor report, compiled by PitchBook and the National Venture Capital Association. The report breaks down the all-time-high $329.9 billion invested in more than 17,000 deals nationwide — a record number of deals for a year, and a dollar value that nearly doubles the prior benchmark, set in 2020.

The tally for Nashville-area companies is the second-highest in the past eight years, and larger than three of the last four years added together. It's another indicator of the rising attention on the region's tech sector, which is still relatively small but ranks among the fastest-growing in the nation.

While the storyline of companies fleeing California is real, the data also provide some context on Silicon Valley's enduring stature in the tech economy. Startups in Silicon Valley attracted 36 cents of every dollar invested in 2021, and accounted for half of the year's total $774.1 billion of exit value (created when companies went public or were acquired). The money investors put into Nashville accounted for 0.26% of the record $329.9 billion of venture capital invested nationwide.

Some Nashville highlights

- Monogram Health posted the year's single-largest raise, of $160 million.

- Built Technologies Inc. raised $212 million over two rounds in 2021, accounting for one of every four dollars invested in area companies. The second of those raises came at a valuation of $1.5 billion — vaulting the construction fintech business into "unicorn" territory.

- Also, Wayspring (formerly known as AxialHealthcare) had a $75 million raise.

- The 81 area investments tracked by the report last year average to $10.8 million per raise.

- The biggest exit of the year was Franklin-based Clover Health Investments Corp. (Nasdaq: CLOV), which went public in January 2021 by merging with a so-called "blank-check company" or special purpose acquisition company.

Of note

The report doesn't include Silicon Ranch Corp.'s $775 million raise from December, because of how PitchBook categorizes the type of funding backing that company.