Despite record-breaking fundraising activity by early-stage Wisconsin companies last year, the state still lags behind its Midwest neighbors, according to a Wisconsin Technology Council report released this week.

Early-stage Wisconsin companies raised more than $483 million in 2020 in at least 114 deals — the most money raised in a year since the council began collecting the data in 2008. In 2019, startups in the state raised $454 million across 123 deals.

The money came from a mix of venture capital and angel investors, crowdfunding campaigns and accelerator programs, according to the report. It was primarily equity financing but also included debt and seed capital.

Venture capital firms invested $293 million in Wisconsin companies in 2020, compared with more than $3 billion in Michigan startups, $2.5 billion in Illinois firms and $1.8 billion in Minnesota companies, according to PitchBook data published by the National Venture Capital Association (NVCA) in March.

“Other states are doing more to support their early-stage economies through policy initiatives such as ‘funds of funds’ that lever public and private investment,” Tech Council president Tom Still said in a statement.

Lawmakers left the $100 million venture fund of funds that Gov. Tony Evers proposed earlier this year out of the final state budget.

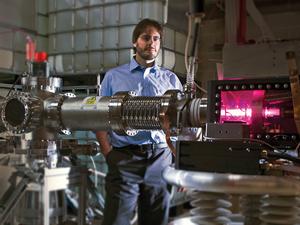

More than half of Wisconsin's 2020 fundraising dollars were raised by Madison-based Fetch Rewards and Janesville-based SHINE Medical Technologies LLC, which each raised $80 million, as well as Beloit-based NorthStar Medical Radioisotopes LLC ($70 million) and Pewaukee-based SunVest Solar Inc. ($50 million), the report shows.

SHINE Medical has topped the list of Wisconsin's largest funding deals since at least 2018, according to the report. The company has raised $650 million to date, including its recent $150 million round.

“It’s great to see major deals because it signals more companies are moving beyond the startup stage," Still said. "Much work remains to be done, however, to take full advantage of Wisconsin’s assets in research, technology and talent.”

Taking the top four companies out of the equation, the average round size was $1.8 million. The next-largest 2020 fundraising totals came from Vascugen Inc., EnsoData Inc., FluGen Inc., Zurex Pharma Inc. and OnLume Inc., which are all based in the Madison area, as well as Milwaukee-based Frontdesk Inc.

Companies in the Madison area have accounted for around half of the state's fundraising deals in recent years. Early-stage firms in southeast Wisconsin account for about a third of deals, according to the report.

Women-led companies made up 12% of Wisconsin's 2020 deals, compared with 22% in 2019. The Tech Council doesn't collect data to show the percentage of deals for minority-led companies but said it will attempt to track that in the future.

Among the 114 investment deals in early-stage Wisconsin companies, 31 deals included investment from 55 out-of-state investors, according to the report.