SOMAVAC is set to celebrate its fourth anniversary April 28. It had chosen that date to officially launch its product, a wearable and portable surgical drain pump designed to improve the recovery experience after an operation.

Now, in the wake of the COVID-19 pandemic, the local startup’s kickoff has been postponed.

Life for a fledgling business is never easy. But, in a world where the coronavirus has spread throughout the economy and left many companies and investors with severe symptoms, Memphis startups have been forced onto an even shakier path.

Start Co. and Epicenter — business development services that aid startups — recently doled out information to applicants for their Summer of Acceleration program: seed funding is expected to drop 22% this quarter; some startups sourcing overseas have seen delays in their supply chains; and the road ahead is expected to have rougher terrain.

“This is the biggest issue — that there’s a lot of uncertainty on all of these topics,” said Esra Roan, SOMAVAC CEO and cofounder. “It’s tough times, you know. … Especially for pre-revenue or very early revenue startups, it’s going to be extremely challenging.”

SOMAVAC — which received clearance from the U.S. Food and Drug Administration (FDA) in 2018 — first saw impacts from the coronavirus in early 2020, when it heard that workers in China wouldn’t be returning to factories after the Chinese New Year.

The company was expecting parts from the country, and those shipments were delayed. But, this was just the beginning. While Roan noted that the shipments did arrive several weeks ago, SOMAVAC is now feeling the effects of the virus more directly.

The startup’s six-person team has split up, left with no choice but to work remotely. And, though Roan has been able to get more meetings with potential investors — because so many are stuck at home — she doesn’t know what types of decisions they’ll make.

There have been a lot of mixed messages, she said, and people could be more hesitant to invest given the uncertainty in the economy.

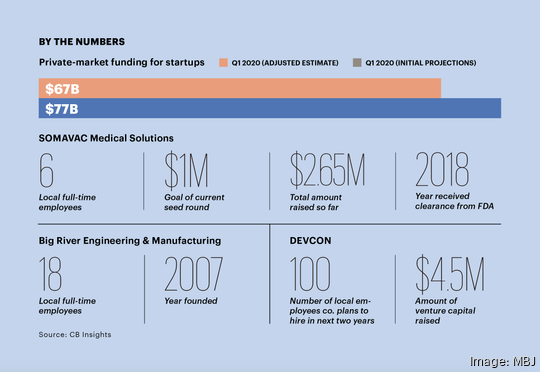

Recent forecasts seem to back that up. According to a recent article in The Wall Street Journal, CB Insights — a market intelligence group — has put total private-market funding for startups at $67 billion in the first quarter, down from an initial forecast of $77 billion.

As Leslie Smith, CEO of Epicenter, explained, many venture capital groups are hunkering down to wait and see what happens. That doesn’t bode well for entrepreneurs.

“What we need in our portfolio is free-flowing, flexible, responsive capital, across the entire span of the companies in which we work,” Smith said. “The realities and the needs are in a little bit of tension with one another right now.”

For SOMAVAC, this means reaching the goal of its open, $1 million seed round could be difficult.

“We have to do more with the dollars we’ve already raised,” Roan said. “How can we extend each dollar we have?”

At the moment, the company has raised about $2.65 million, a number that includes money from the current seed round. It’s also generated revenue from two limited releases of the product.

Bringing in more revenue right now will be challenging, especially with the official launch of the surgical drain pump on hold. Access to hospitals – which will make up a large chunk of SOMAVAC’s clientele — is extremely limited. Roan sees that as a good, safe measure, but it’s not doing her company any favors.

SOMAVAC was scheduled to hold training sessions at St. Jude Children’s Research Hospital in late March and early April. One of the organization’s surgeons has already used its product, and the startup was to show the drain pump on a wider scale.

Both sessions were canceled.

“Those are the types of things that are happening that have changed the dynamic of how quickly we can be out there,” Roan said.

Epicenter, meanwhile, has been working constantly, learning how it can best help the startups it supports. The organization aids new businesses across a variety of industries, and they’ve been impacted in different ways.

Place-based businesses have been most effected by the stay-at-home-order, Smith said, while technology-based companies — especially those in the medical device sector — have seen key customers shift around the response to the coronavirus, impacting lead development and sales channels.

While Smith feels that Epicenter has been well-prepared to deal with the pandemic, thanks to work with dozens of community partners over the years, managing hasn’t been easy.

“This has been unexpected, unprecedented, and overwhelming, to say the least,” she said. “Trying to respond to a changing environment on a daily, sometimes hourly basis, and understanding how this is impacting our local entrepreneurs, has definitely been a full-time effort.”

Smith, a board member of the D.C.-based Center for American Entrepreneurship, has been in discussions with policy makers at the federal level about the support startups and small businesses can use.

President Donald Trump signed a $2.2 trillion economic stimulus package March 27. A sizable portion of the funding is to help prevent workers from losing jobs and keep businesses from going under. This includes $350 billion in support loans through the Paycheck Protection Program through the Small Business Administration.

But, as Smith noted, not every small or new business will qualify.

Some startups have actually had an increase in customers during the pandemic. With so many companies working remotely, DEVCON, a cybersecurity software business, has seen an uptick in inbound leads.

Still, each day brings something unexpected.

“Every day is a new day,” said Maggie Louie, DEVCON’s CEO. “If somebody could say, ‘Now also, aliens, ’ I’d have to say, ‘Yeah … that seems right.’”

While DEVCON is in a decent position — it’s raised $4.5 million in venture capital — Louie is still being careful.

Because no one knows when the pandemic will end or how long it will take for the economy to recover, she’s re-forecasted her budget multiple times.

She knows how much in expenses it will have each month and how far the company can go, just with what’s in the bank — and she encourages other startups to take similar measures.

“I think in startup land, as we’re going out for fundraising, there’s always the need to be ambitious in your projections and shoot for the moon. But, now is just not the time,” Louie said. “You really need to be very conservative about what your projections are so that you’re able to be realistic.”

Due to current circumstances, Louie has also tried to make sure her employees are alright emotionally. DEVCON recently implemented a “chicken soup” month, where PTO is not being recorded. If employees need time off or a mental health day, they’re welcome to take it.

Options like that, Louie said, are important for the well-being of employees.

Smith shared similar sentiments, noting the effects the coronavirus has had on small businesses.

“I can categorically say that the emotional toll of this moment — on all of our small business owners, startup entrepreneurs, and founders — is significant,” she said. “These folks take all of the risk in our economy. They employ our neighbors, and do so at great personal and organizational risk. The pressure of all that is really tense at this moment.”