With plans to go to the moon and Mars, Rocket Lab USA Inc. is about to rocket to another aspirational destination: the stock exchange.

The Long Beach, California-based aerospace company announced plans in March to go public via a reverse merger with special purpose acquisition company (SPAC) Vector Acquisition Corp. (Nasdaq: VACQ), which is backed by San Francisco-based Vector Capital.

Vector’s annual shareholders meeting is set for Friday, where they’re expected to approve the business combination. When the deal closes, Vector will change its name to Rocket Lab USA Inc., and the combined company will trade on the Nasdaq under the tickers “RKLB” and “RKLBW.”

After the deal goes through, Rocket Lab said it will have about $750 million in pro forma cash on hand, including private investment in public equity (PIPE) of $470 million from Vector Capital, BlackRock and Neuberger Berman, among other institutional investors, at $10 per share.

The company forecast it will reach adjusted EBITDA positive in 2023, cash flow positive in 2024 and $1 billion in revenue in 2026.

Meanwhile, a proxy statement filed with the Securities and Exchange Commission last month provides a rare peek at Rocket Lab’s financials that reveal the company has been operating, unsurprisingly, at a deficit.

The company reported net losses of $55 million, or $6.61 per share, on revenue of $35.2 million in 2020. The year before, net losses were $30.4 million, or $3.79 per share, on revenue of $48.4 million.

Rocket Lab attributed the slowdown in its revenue last year to the pandemic due to customers delaying launches, plant shutdowns and travel restrictions.

“We expect to continue to incur net losses for the next several years and we may not achieve or maintain profitability in the future,” the company said in the risk factors section of the proxy statement.

Rocket Lab also said that its independent auditors raised “substantial doubt about our ability to continue as a going concern” due to the company’s history of recurring losses, negative cash flows and significant debt.

In anticipation of shareholder approval, Rocket Lab has announced it will release its financial results for the second quarter on Wednesday, Sept. 8.

Rocket recovery

Meanwhile, Rocket Lab’s arrival on the stock market comes as the company is recovering from an anomaly during its 20th mission on May 15 that resulted in the loss of its payload.

The mission, dubbed “Running Out of Toes,” launched at 4:11 a.m. Pacific time from Launch Complex 1 on New Zealand's Māhia Peninsula with a successful lift-off, first-stage burn, stage separation and second-stage ignition.

But almost 200 seconds into the flight, the second stage ignited then veered sharply off screen of the live feed. Rocket Lab confirmed in June, “Shortly after the stage two ignition, the engine computer detected that conditions for flight were not met and performed a safe shut down.”

Onboard — and lost — were the second and third of nine BlackSky Earth-observation microsatellites scheduled to launch this year.

The company said the second stage remained within its planned launch corridor and didn’t endanger the public, its teams or the launch site.

Meanwhile, the secondary objective of the mission — Rocket Lab’s second attempt to recover the rocket booster — proceeded as planned.

Rocket Lab said it has since been able to replicate the issue in testing and has added redundancies to the ignition system to prevent it from happening again, including modifying the igniter’s design and manufacture.

The company has subsequently been cleared by the FAA to resume rocket launches and completed its own review, returning to business last month with a mission for the U.S. Space Force.

The failed “Running Out of Toes” mission came 10 months after an anomaly resulted in the complete loss of Rocket Lab’s 13th mission, dubbed “Pics or It Didn't Happen,” in July 2020.

In that case, the company identified the cause of the incident as “a single anomalous electrical connection” that ultimately led to a safety shutdown. As a result, the payloads aboard — which included seven satellites for Canon, Planet and In-Space Missions — did not deploy.

Before that, Rocket Lab's first Electron rocket flight “It’s a Test” failed to reach orbit in May 2017.

In the hopper

With its latest launch, Rocket Lab has deployed 105 satellites across 18 successful missions using its Electron rocket.

The company has opened a second launch pad at the Mid-Atlantic Regional Spaceport in Wallops Island, Virginia. A couple of missions slated to lift off from Launch Complex 2 had to reroute to New Zealand as Rocket Lab awaits NASA certification of its flight termination system software, but when the site is operational, the firm said the two complexes will be able to support more than 130 launches per year, as well as offer geographic diversity and redundancy.

Meanwhile, Rocket Lab has been working on recovering and reusing rocket boosters. So far the company has used a parachute system to slow its Electron launch vehicle down from speeds greater than Mach 8 as it reenters Earth’s atmosphere and splash it down in the ocean, where it will be recovered and returned to Rocket Lab’s Production Complex for inspection.

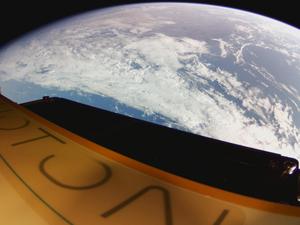

Rocket Lab has also diversified its offerings with its Photon spacecraft, a satellite platform designed and built in-house that enables small satellite customers to focus on delivering their services from orbit (and making money) rather than building their own satellite hardware. NASA has tapped Rocket Lab’s Photon for missions to both the moon and Mars.

In addition, Rocket Lab is working on a bigger reusable rocket with an eye toward delivering payloads and people to low-Earth orbit, the space station, the moon and beyond. The Neutron is an advanced eight-ton payload class launch vehicle designed for mega-constellation deployment, interplanetary missions and human spaceflight.

The company said in the proxy statement that it aims to be “an end-to-end space company,” delivering “reliable launch services, spacecraft components, satellites and other spacecraft, and on-orbit management solutions.”