Zach Marks and Cheng Cheng worked together for a decade in finance. Marks began his career in South Sudan providing financing to farmers, while Cheng helped finance community banks in Tanzania.

The duo saw “a massive need” for alternative financing during those experiences, Marks told L.A. Inno.

“It’s easy to take for granted how easy it is to get a credit card or a loan in the U.S., but these were places where it was almost impossible for people to get formal financing from banks,” he said. “Solving this challenge has become the focus of my career.”

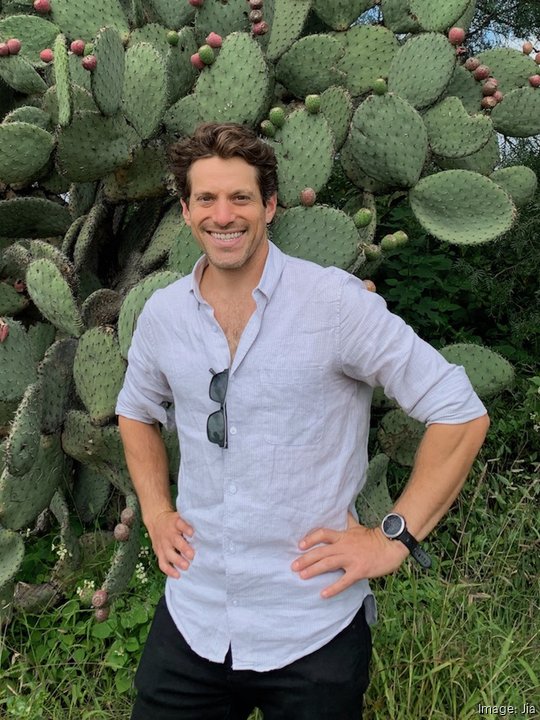

Ultimately, the solution for the duo was Jia, which provides “fair” and affordable financing to small businesses owners around the world to help them grow.

It does this using blockchain technology.

The duo founded the company last year and launched it recently, providing financing to small businesses in Kenya and the Philippines with capital sourced using blockchain technology. Those who borrow using Jia get to participate in the startup's token rewards system, which gives them an ownership stake in Jia.

“Our main value proposition to entrepreneurs is the ability to grow their businesses in a financial community where they participate not just as customers, but as owners,” Marks said. “This is based on our core belief that being an owner changes the behavior of small business owners within a financial community. We’re confident this leads to higher retention and loyalty among our borrowers."

Funding

In May, the company raised a seed round of more than $4 million. Investors in Jia's round included TCG Crypto, BlockTower Capital, Saison Capital and Draft Ventures.

Jia is using these funds to expand its operations in Kenya and the Philippines, as well as exploring new markets in Africa, Asia and Latin America.

The startup has also created “an on-chain liquidity pool” for global investors. It was seeking to raise $100,000 through this pool and was oversubscribed within 24 hours, Marks said. Jia used that first $100,000 to provide financing to more than 200 small businesses in Kenya, all within one week, he added.

Foundation

Marks met Cheng, who serves as Jia’s chief product officer, seven years ago when she hired him at Tala, a fintech company. At Tala, Marks held several positions, ending with director of business development. He helped scale that company from a few thousand borrowers to more than six million. Those borrowers have received over $3 billion in credit across Africa, Asia and Latin America, he told L.A. Inno.

In terms of fintech in general, the duo believed the lending industry was still too transactional.

“We feel blockchain is perfectly suited to meet this demand in a way that’s far more sustainable, affordable and fair than the current options on the table,” Marks said. “Banking has been transactional forever. We’re changing that.”

Target demographic

Jia targets small business owners across a range of industries, including health care, food service and transportation.

“Many earn around $1,000 per month, and despite operating successful businesses, struggle to secure formal financing through traditional banks,” Marks said. “This prevents them from scaling and ultimately impacts their profit margins.”

Take Elishaphan Obuya for example. He’s a doctor and the founder of a small private medical facility in Kenya who oversees a handful of staff. Hundreds of patients visit his clinic each month.

He was unable to get financing from banks or traditional financial institutions. So, he borrows from Jia to keep his shelves stocked with lifesaving medicines.

Marks tells L.A. Inno that a company like Jia is “more relevant now than ever.”

“There’s a massive unmet need” for financing business and innovation in emerging markets, he said.

Competition

Jia’s most direct competition is digital lenders that fill the void traditional banks have left in emerging markets, Marks said.

The startup differentiates itself from the competition in a couple of ways.

For one, the cost of its financing is “considerably lower” than its competitors, Marks said, adding that digital lenders can be expensive, typically charging fees up to 20% per month. Jia’s rates are between 2% to 7%.

The company also offers longer repayment periods — up to 12 months depending on the type of loan and the risk profile of the borrower.