A working capital survey conducted by Leawood-based C2FO showed that nearly one in four businesses say they don’t have enough liquidity to operate during the next 12 months and that 22% plan to increase prices by 6% or more.

Inflation is the big driver, and even if many of these companies raise prices, they won’t see a positive effect on cash flow for months because clients take 30 to 90 days to pay their invoices.

Companies could go to the bank and ask for a revolving line of credit, but that’s getting increasingly expensive as the Federal Reserve Bank pushes interest rates up. If the Fed raises rates an additional 75 basis points in July, businesses will see about a 75% increase in the prime rate in the first half of this year alone.

C2FO’s survey showed that 30% of respondents said going to the bank isn’t even an option. The survey also showed that 19% of businesses said a lack of access to capital negatively affected them in the past year; 46% said high interest rates posed a serious obstacle.

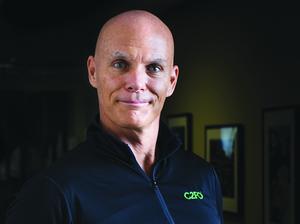

Chris Atkins, president of capital finance and capital markets for C2FO, said banks are starting to look closer at debt service coverage ratios. Losing cash flow to inflation pushes that ratio down to the point where banks get concerned about a company’s ability to repay loans.

“If you’re moderately or considerably leveraged right now, this is going to be a huge problem,” Atkins said. “If you’re on an adjustable-rate product, you might be sensing that your relationship with the bank is getting more strained as your profitability goes down.”

C2FO, however, doesn't involve credit at all. It created a platform that allows businesses to get access to accounts receivable faster. Instead of a supplier waiting 60 to 90 days to get paid, it can negotiate a small discount on C2FO’s platform to get paid earlier, giving it access to the working capital it needs without taking on more debt.

“A large buyer facing 10% inflation and battling gross margins can get another 50 to 70 basis points through C2FO and help their suppliers at the same time because that’s cheaper working capital than a bank, so it’s a win-win,” Atkins said. “For the supplier, if they’re being asked to take on debt with a personal guarantee, when they could accept a small discount for early payment from their buyers, their answer should always be no. There’s no risk for the supplier at C2FO.”

That value proposition should push C2FO’s growth to even higher rates. It took the company 10 years to fund $100 billion in early payments on its site. In the past two years, it reached $200 billion. The goal now is to reach $1 trillion in the next four years, and it appears that C2FO has tailwinds now to help it reach that lofty goal.

“Look, we’re not rooting for a recession because that hurts everybody,” Atkins said. “But we do think that our product will show really well in a recession because the big corporates will have a lot of cash and we don’t think deposit rates are going to go up much for a while. The Fed is going to be aggressive to get inflation under control, and it’s going to be painful in between. It’s why we continue to coach businesses to take control of as much as they can as quickly as possible.”