Redwire Corporation (NYSE: RDW), the Jacksonville-based space conglomerate that went public through a SPAC merger eight months ago, reported a net loss of $17.3 million in the first quarter, though revenues increased year-over-year.

Redwire Corp. also reported a loss of 28 cents per share for the quarter, which closed March 31, according to documents filed with the Securities and Exchange Commission. That’s an increase of seven cents from the 21-cent loss it posted this quarter last year.

The earnings per share results beat Wall Street expectations by one cent, according to analysts at Jeffries & Co.

Although revenue grew to $32.9 million — a 3.7% increase over the same period last year — expenses also jumped to $22.7 million, compared to $14.7 million during the first quarter of 2021. The increase was driven by a $9.7 million increase in “selling, general and administrative expenses” and a $730,000 increase in research and development costs, though transaction expenses were reduced by $2.4 million.

The report comes just six weeks after Redwire’s first filings with the Securities and Exchange Commission — 2021 fourth-quarter and year-end earnings reports. The filings were delayed for months, after the company said an employee had notified them of potential accounting issues with a business subunit.

In its first-quarter earnings call, Redwire said its first-quarter performance was slightly below expectations, with delays in contract awards, supply chain disruptions and inflation having a negative impact. In response to analysts' questions about its full-year forecast, Redwire emphasized its $274 million backlog as of March 31 and $547 million in bids submitted and under review as of May 9. The company added that its backlog will drive better performance in the second half of the year, though contracts often move from one quarter to the next.

Outside of its finances, the space conglomerate touted the position it was awarded on a $950 million indefinite delivery-indefinite quantity (IDIQ) contract to support the U.S. Air Force’s Advanced Battle Management System. It also said it has been contracted to deliver multiple high-gain antenna systems for a national security space LEO satellite constellation.

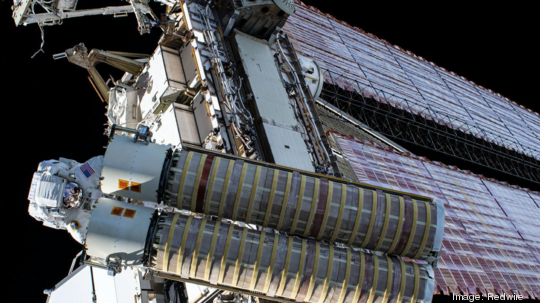

Redwire added that it delivered on a fourth Roll-Out Solar Array (ROSA) wing for the International Space Station ahead of baseline schedule. The wing, it said, is also utilized for the DART NASA planetary defense mission. It also delivered equipment for the Artemis III Orion Camera System, developed for NASA’s Orion Spacecraft.

Redwire CEO Peter Cannito assured investors during the conference call that the space has “tremendous growth potential that could far outpace other segments in annual growth rates,” despite near-term industry volatility due to “recent developments.”

Demand signals, including from national security, Cannito added, remain strong, with the conflict in Ukraine highlighting how critical space architecture is to the future.

Cannito said he anticipates accretive M&A opportunities to increase in the second half of the year.

Shares closed Thursday at $3.70. Redwire’s 52-week high is $16.98, and its 52-week low is $3.65.