Thousands of businesses have relocated to Florida in recent years, and investors have been quick to follow.

Florida received the third-largest amount of private equity dollars last year, according to a report American Investment Council released this week. In total, investors backed 570 Florida-based companies with $74.4 billion of capital, an increase from 363 companies and $59.4 billion in 2020.

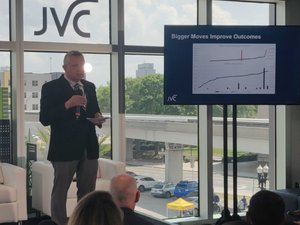

The geographical scope of where private equity investments are flowing is much broader than in years past, according to AIC President and CEO Drew Maloney. The top 20 regions for PE investment span 14 states, with California and Texas as the only two to receive more dollars than Florida.

Florida is growing as an investment hub in large part because of the influx of individuals and businesses to the state, Maloney said. There were 367 active PE funds in Florida as of last year, according to AIC.

“Ten or 15 years ago, you would’ve seen more concentration along the coasts and closer to urban centers, and now you’re seeing large private capital hubs in Tampa, which is getting a significant amount of money, or Miami or Nashville,” he said.

District 20 in Southeast Florida, which touches portions of Broward and Palm Beach counties, received $19 billion in private equity investments, the fifth-largest amount among U.S. congressional districts. In 2020, companies in district 23, which also touches portions of the Greater Miami area, received $12.2 billion in private equity capital.

Notably, Florida ranked second nationally for health care deals with 94 PE-backed companies at the end of 2022, according to the report. In Tampa Bay, Kinderhook Industries’ $500 million investment in Physician Partners was the region’s largest private equity deal in 2022.

Florida is also an emerging hot spot for manufacturing, with 49 PE-backed companies receiving private equity dollars in 2022, according to the report.

Over the last decade, venture capital and private equity firms have invested $210 billion in Florida companies. The estimated total economic impact of those investments exceeded $85 billion, creating 465,000 jobs and generating $26.8 billion in household income, according to another study published earlier this year.

While big-dollar deals garner the most attention, more than 60% of investments in the U.S. went to small businesses, Maloney pointed out. Private equity partners were key for helping small businesses navigate the pandemic and, now, economic turbulence in a rising rate environment, he said.

“We work side by side with management, whether it’s supply chain issues, interest rates or debt, or trying to figure out how to build a distribution facility or marketing,” he said. “That’s why you see so much growth in these companies once there’s an infusion of dollars.”