Steve Case's Rise of the Rest mission began as a bus tour across the U.S., where the AOL co-founder traveled to dozens of cities across the heartland and other corners of the country not named Boston, New York or the Bay Area.

It was a mission to find and invest in startups operating outside of traditional startup epicenters, and help uplift those local economies along the way.

The Rise of the Rest mission further evolved into a $150 million VC fund with backing from big names like Amazon's Jeff Bezos and Google's Eric Schmidt.

Now, "Rise of the Rest" is the title of Case's latest book, which launched last week, and aims to highlight the work being done in startup cities throughout the U.S., and encourage entrepreneurship in these cities that traditionally have not been known as startup powerhouses.

The emergence of cities not named Silicon Valley becoming destinations for tech talent and startup creation has been well documented.

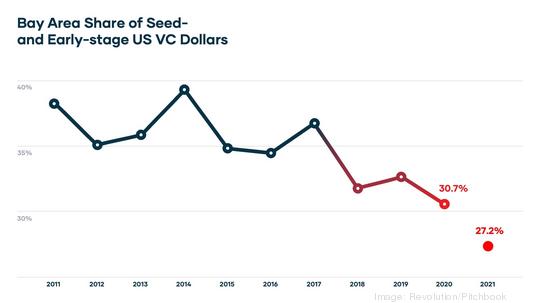

Places like Austin, Los Angeles, Seattle, Atlanta, Chicago and elsewhere have seen billion-dollar startup exits and an influx of venture funding in recent years. In fact, the percentage of total seed-stage and early-stage venture capital invested in Bay Area startups fell below 30% last year for the first time in 10 years, according to a report from Case's firm Revolution and VC data company Pitchbook. That's down from around 40% in 2014.

Cities that attracted the the most early-stage capital from Bay Area and New York investors included Los Angeles, Seattle, Washington, D.C., Austin, Denver and Chicago. But, as Case told American Inno in an interview, it's not just a handful of cities taking a bite out of Silicon Valley's apple. It's many.

"I think the biggest story for people that haven’t been paying attention to this is it's not just one or two or three cities on the rise. It really is several dozen cities on the rise," Case said. "That's I think the big 'aha' for us over the last decade. I think people might know this city or that city, but most do not realize the breadth of how this is playing out and the potential impacts. It's really quite encouraging."

"The era of a few superstar cities dominating the innovation economy is over," he continued.

Case's new book details how startups in these under-the-radar cities, like TemperPack in Richmond, Virginia, Freightwaves in Chattanooga, Tennessee, and AcreTrader in Arkansas are growing fast and boosting their local economies along the way.

"There was this sense that Silicon Valley had an insurmountable lead because it had this culture around innovation," Case said. "People wanted to be there because it's where most of the venture capital was. It's where most of the successes were. The sense was the Rise of the Rest cities, the only thing they really had going for them was lower cost of living. Now, people realize there's a broader set of advantages some of these cities have."

The pandemic has become a "tipping point" for this so-called Rise of the Rest trend, Case said, as remote work allows companies to hire from anywhere, and gives workers more options around where they live.

"We’re at an inflection point over the last decade since we started this," he said. "We have seen more interest in different communities in terms of what’s going on with startups. We’re seeing more people start companies. We’ve seen more investors, both locally and nationally, backing companies ... We’re starting see more significant exits and people are starting to say, 'Huh, maybe these places really can launch some pretty interesting, pretty valuable companies.'"

The brain drain that once plagued many cities across America is starting to subside, Case said, as graduates boomerang back to live and work in their hometowns.

"This notion you had to be in Silicon Valley or you weren’t part of the innovation economy, I think we’ve moved away from that," he said.

Even as the pandemic accelerated remote work, it hasn't eliminated the importance of place, Case said. As more work is done online, the need for physical connection in these cities still remains.

"There are some fully remote companies. But I think most companies still will see value in clustering together, both in terms of people on their teams as well as clustering together in cities with other entrepreneurs," Case said.

The focus of Rise of the Rest started on physical locations, but it also explored the types of founders getting venture dollars. Case said over 40% of the startups in the Rise of the Rest portfolio are startups led by women or a person of color.

"Early on, we decided to be intentional also about not just leveling the playing field in terms of place, but also leveling the playing field in terms of people," he said.

The Rise of the Rest fund has seen a handful of exits, like AppHarvest's public launch and Kansas City-based Backlot Cars' $425 million acquisition. Case said the fund has seven unicorns, startups valued at $1 billion or more.

It's a sign, he says, that the Rise of the Rest mission is working.

"This is a moment. We hope each of these startup communities really seize it and turn it into much more of as movement that really is sustainable and can have a transformative impact on their communities."