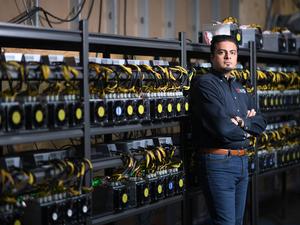

One of the reasons Khalid "Ken" Parekh launched fintech company Fair was to democratize access to financial tools for immigrant and refugee populations. When Kabul fell after the U.S. military withdrawal from Afghanistan earlier this year, he saw an opportunity to help.

The Fair platform offers lending, investment and retirement services to customers via a membership model. The halal-certified fintech company is a subsidiary of Houston-based Amsys Group, which operates companies in IT, health care, blockchain technology and more. Amsys raised $20 million from investors in order to finance the fintech venture.

Parekh, founder, chairman and CEO of Fair, said the neobanking platform has a lot of features designed with immigrants and refugees in mind — offerings like international money transfers, early access to direct-deposit funds, debit cards for kids and access to a network of more than 55,000 ATMs. So Fair reached out to World Relief, the nonprofit humanitarian organization working to resettle tens of thousands of Afghan refugees into U.S. communities.

"Fair has partnered with World Relief and other agencies to not only teach these refugees financial literacy about how to do banking in America, [but also] Fair is giving them free bank accounts," Parekh said.

Calla Parker, strategic partnerships director for World Relief based in Austin, said the organization provides a lot of resources to refugees resettling in the U.S., and one of their biggest needs is access to banking services. But World Relief often finds there are barriers, religious or otherwise, to refugees gaining access to financial services.

"The banking institutions that we have are not halal-compliant, or there are language barriers, or they're intimidated to go into a brick-and-mortar building because it's all so new," Parker said. "Many times, unfortunately, they're not always received with dignity and respect in those spaces, so they avoid them."

It wasn't enough to give refugees access to Fair accounts, Parekh said — they also needed the technology necessary to access their accounts. Amsys Foundation is donating smartphones, including the first month of wireless service, to refugees that open a Fair account.

In September, Fair announced a wealth-building investment account offering capable of returning annual dividends of up to 4%. In order to remain halal-compliant, Fair accounts do not earn interest. The company pays dividends as a form of profit-sharing based on the assets generated from investing pooled funds.

Fair is partnered with Everett, Washington-based Coastal Community Bank, a subsidiary of Coastal Financial Corp. (Nasdaq: CCB), as its FDIC-insured sponsor bank. Fair itself does not operate branches with deposits.

Fair's board of directors includes Samuel Golden, former ombudsman for the Office of the Comptroller of Currency, and Manolo Sánchez, a Fannie Mae director, Rice University adjunct professor and former chairman and CEO of BBVA Compass.