Entering the final month of a tumultuous 2020, Colorado technology and startup funding slowed a bit.

We tracked nearly $132 million in funding across eight deals in November, falling short of October's totals of $182 million in funding across 13 deals.

We cover funding rounds, acquisitions and other transactions in our daily newsletter, The Beat. You can sign up for that here. We gathered some of the state’s top fundings from November in a roundup below:

Quantum atomics company ColdQuanta raised $32 million in Series A funding as the interest in quantum computing grows. The round was co-led by Global Frontier Investments and LCP Quantum Partners, with current investor Maverick Ventures and new investor Foundry Group also participating. The company will use the funding to advance the development of quantum computers, quantum positioning systems and real-time quantum signal processing based on ColdQuanta’s Quantum Core technology.

Denver-based Demoflow, is a collaborative remote selling platform that integrates with and complements platforms such as Zoom, Salesforce and Slack. To fuel its growth, Demoflow announced a seed capital raise of $1.6 million led by FirstMile Ventures, with other major participants including Slack Fund, RTP Seed, Next Frontier Capital and Heroic Ventures.

While the early days of the pandemic were as economically stressful for JumpCloud as they were for other businesses, the company quickly showed its value, helping businesses adjust to the remote work environment. With that success at its back, the company announced that it raised a $75 million Series E funding round led by Blackrock, with participation from existing investor General Atlantic. More on the funding from the DBJ here.

Highwing, an insurance technology company born out of IMA Financial Group to help commercial insurance brokers and carriers accelerate workflows through its open data platform, announced that it has closed a $4 million fundraising round from several leading investor groups. Erik Mitisek, formerly the CEO of the Colorado Technology Association, is the head of Highwing. More on the company from the DBJ here.

Denver-based Nymbl Science, a startup developing digital fall prevention solutions for older adults, announced the closing of a $4 million Series A funding round. Cobalt Ventures, LLC, the investment arm of Blue Cross and Blue Shield of Kansas City, led the round with additional participation from other Nymbl investors. The funds will accelerate the expansion, support and technical needs of Nymbl’s system, growing the company’s ability to meet the needs of older adult populations through Medicare Advantage and Single-Payer insurance systems.

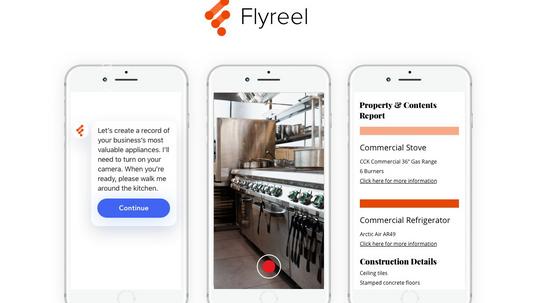

Denver startup Flyreel, an AI solution for residential and commercial property insurance, announced that it has closed a $10 million Series A financing round. CEO and co-founder Cole Winans said the Covid-19 pandemic has forced property insurance providers to accelerate and enhance their digital strategies. He said Flyreel has stepped up to aid in that digital adoption. The company now serves 15 major insurance providers and has raised $18 million to date to support customers using its proprietary AI assistant and computer vision technology. That technology aims to improve property underwriting, risk management and claims outcomes.

Denver's Welltok, an enterprise SaaS company for the health care industry, has brought on $5 million in equity funding from 72 investors, according to a Form D filing.

Denver's Infinicept, a startup that helps software companies take advantage of embedded payments, announced a new funding round led by Mastercard and MissionOG. The round will help the company accelerate growth and adoption for its flexible payments infrastructure platform. Infinicept has more than 250 software, banking and fintech customers in 25 countries, and yearly payments volume has increased 800%, the company said. More on the round here.