The Valley of Death: where many great ideas and great companies go to die. The pit of possibility marks the period of every startup life where operations have begun but companies have yet to claw their way out and into profitability.

While some are able to self-fund or seek the support of friends and family, others are thrust into the world of investment pitching with the ultimate challenge of selling a non-existent product or service. Without the necessary funds and support to get started, a startup will sink lower into the Valley of Death where many companies stay forever.

“Those earliest rounds of capital are the hardest because that is where there is the most risk – often before there is any revenue in the business or even a product to evaluate. ... Few investment funds or high-net-worth individuals have the wherewithal to invest at this stage,” said Mike McCann, vice president of innovation and engagement at The Entrepreneurs’ Center (EC) in Dayton.

The U.S. Bureau of Labor Statistics data from 2022 shows about 20% of businesses fail during the first two years of being open. That number jumps to 45% during the first five years and 65% during the first decade.

Dayton startups are not invulnerable to the data, in fact, the issue is prevalent enough that local accelerators and startups pursue new methods to accumulate funds and investment opportunities to combat the steep climb to profitability.

Top startup sectors seeing successful fundraising in 2023: Advanced manufacturing, advanced materials, sensors, medtech, software, generative artificial intelligence.

Based on Dayton’s technical talent and R&D expenditures, strength in these segments should continue into 2024 and beyond.

But with economic uncertainties continuing in the market, especially amid prolonged fears of a potential recession, the market is especially difficult to navigate for startups. However, local entrepreneur Katie Hill, who is a former entrepreneur in residence at the EC, believes despite the dip, Dayton’s startup investment market is stronger than ever.

“Not every startup needs millions,” Hill said. “Dayton can provide the level of support most need. We can meet it faster here than we’ve ever been able to.”

How Dayton startups at varied levels are working to escape the Valley of Death

McCann said Dayton startups are at a disadvantage with the lack of comparable venture capital firms seen on the Coasts as well as the recent decline in the venture capital market since its 2021 peak – both in number of deals and the amount of capital deployed.

While Dayton is not home to hundred-million/billion-dollar venture capital firms, the region has a plethora of investors and funding opportunities for innovators. Clients in the EC portfolio were able to raise $100 million in funding in 2023.

“We have active investors coming to the table,” McCann said. “We have companies able to get access to venture capital funds and firms and strategic corporate investors to help them grow.”

Hill said Dayton startups for the most part are seeking hundreds of thousands rather than millions – which is available in Dayton’s pool of funding resources. But to complement the available funding, for those seeking higher dollar opportunity, looking outside the region is the next step.

Prominent sources of funding and growth in Dayton:

- SBIR TAP – a SBIR training program with a nationwide footprint. The program, launched by the EC and Air Force Research Laboratory educated more than 400 potential SBIR applicants who went on to access more than $1.5 billion in SBIR grants.

- EC Angels – a network of almost 50 investors who make deals based on local startup pitches. Investments range from $5,000 to north of $100,000 per individual, per deal. Local startup Hybrid Works shows the power of the network, starting with $30,000 in angel funding and recently raising $3.2 million to expand their business.

- Other non-dilutive funding: Ohio Third Frontier’s Technology Validation Startup Fund (TVSF), Federal Small Business Innovation Research and Small Business Technology Transfer (SBIR/STTR) programs. TVSF recently funded three clients with $350,000 in grant funds – Kilele Health, Medical Interface Solutions, and Raider Technologies.

Dayton brothers Xavior and Ilyaas Motley of ARMA are seeking to transform various industries with their innovative spray-on glove technology. However, lack of opportunity and interest in the region forced the Motleys to move their research and development to Columbus. Now, the innovators have sought an opportunity in southern France through additive manufacturer Villa Blu.

The manufacturer offered them $100,000 to help further establish their prototype, set to be developed in Cleveland and establish proof of concept. The brothers will remain in France for six months before returning to Ohio to seek $400,000 in additional funding. Xavior Motley said ARMA already has a few capital sources in the pipeline in Ohio for their return.

“I don't think that these investors are taking chances,” Xavior Motley said. “It seems like they rather take the safe route and invest in a smaller business that looks beautiful, inside and out. And they're gonna find their return on investments, rather than seeing this outlandish idea that might not have everything together but seems promising.”

While the Motleys aim to bring their manufacturing operations back to Dayton one day, the team of seven will continue to bring their concept to life outside the area.

“I think that it's disappointing to see that a French company took the chances on us and not someone from our hometown,” Ilyaas Motley said. “But that doesn't discourage us from coming back home and developing what we see best.”

While savvy investors appreciate entrepreneurial enthusiasm and energy, McCann said that alone won’t make them reach for their checkbook. Investors get excited when they hear customer enthusiasm and energy for what the entrepreneur is building. Thus, proof of concept is an integral step.

“There's higher quality ideas here that don't get funded then in other parts of the country where the worst ideas get funded, just because there's more access to capital,” Hill said.

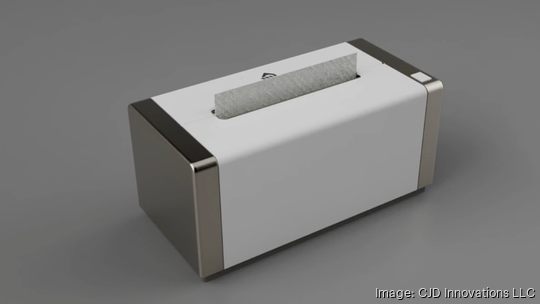

While the Motley brothers pursue the first look at their innovation turned reality, entrepreneur Chris Danis seeks a partnership and manufacturer to push his prototype to commercialization. Danis has established his prototype for the Wet Wipe Wizard, a dispenser of sanitation wipes with the push of a button, and is now set to hit proof of concept.

After winning $25,000 through the University of Dayton Flyer Pitch Competition and investing hundreds of thousands in his own money, Danis will test the Wet Wipe Wizard at an assisted living facility in Cincinnati. Once he establishes proof of concept, he hopes to find a manufacturer to create up to 100 devices and prove commercialization.

“I was naïve,” Danis said. “I didn't realize how much it costs for research and development, prototyping and everything else. ... Funding is the lifeblood of a startup.”

Danis has continued to pursue other forms of funding to bring his retiree dream to life but is open to another company coming in and carrying the product to the market for him. He stressed that at a certain point, startups need an outsider to break in, validate the idea and support it.

“When money is tighter, then it's harder to push those valuations higher because investors just aren't as eager,” Hill said. “For that reason, it's a little less friendly of an environment for entrepreneurs right now because valuations are sort of leveling out as a result of investors having other places where they can put their money and get decent returns.”

But Hill has found her own success in funding, despite the tumultuous market, with more on the way through her startup Unlisted.

Unlisted is a platform helping home buyers and agents express interest in residential properties before they’re listed for sale. Since launch in March 2022, the platform has raised over $600,000 in EC Angel funding.

With a breakthrough in sales over the last month, representing a 400% increase in revenue, Hill said she’s prepared to hold off on additional funding rounds. But when the time comes, she plans to aim for up to $2 million in funding – seeking investors this time outside the Dayton region.

“What you really don't want to do is get backed into a corner and have no choice but to take money from whatever investor you can find and whatever terms they give you,” Hill said. “That's the worst possible scenario. You want to raise from a strong position where you have lots of interests and you can choose the investors that align with you – the best that sets you up for success in the future.”

And that’s exactly why entrepreneur Amit Gupta turned down a large investment opportunity over a decade ago.

Aeroseal sought funding during the 2010 housing crisis. Their initial attempt was a resounding failure, not because opportunity fell short but because founder Gupta said the $10 million offer was not beneficial.

“Nobody was fixing (the issue of energy leakage in buildings),” Gupta said. “So when I found this technology, I said this has a worldwide application… In some way I thought that it could be a very big company, but it didn't come about as I imagined.”

After acquiring the company for $1 million, following fundraising from family and friend investors, and growing through his own profits Gupta got his first taste of funding a decade later in 2021. The Series A funding round was completed at more than $30 million, followed by $67 million in Series B funding earlier this summer.

Gupta said his Series A investors came back to provide additional fundraising in Series B. He said his success came from finding bigger players to write bigger checks that matched his company philosophy.

“Money will come,” Gupta said. “The world is looking for good ideas. The world is looking to make things better. When the world is not responding to you, you have to go back to the drawing board to see why the world is not embracing you. Yes, you have to persist and insist that the world adapts to you. It’s not easy even if it’s right. But if you keep doing it, it’ll come.”

In 2023, Aeroseal employs 225 employees and has sealed about 60,000 homes and 100 million square feet of commercial buildings.

Top things to consider from Gupta:

- “Seek funding as late as possible and, when you do seek funding, always try to take a little bit more than what you think you need. Founders are inherently optimistic people. They think the world is going to bend their way, but the world has its own way. Sometimes it doesn't bend as fast as quickly or as much as you'd like it to bend.”

- “People who are only worried about raising money are not focused on the business. They would not make progress… If you constantly look for that benchmark of success, you have already defined that success. If you focus on being on the right journey, the success will come.”

- When seeking funding, founders should have good alignment of their philosophies and what the fund is designed to do. Getting a financial partner only, may result in misaligned missions and philosophies. Founders should also take care to make sure the time horizon of the fund is aligned with the investor’s expectation.

- The people you build a company with are important as well as creating a culture where they are challenged and have fun doing their job.

- “Whether success comes in the way they've imagined the success to be or not, creating something is success in my mind itself.”

Expectations for Dayton’s 2024 market

While the 2024 market remains a mystery, especially amid uncertain economic conditions and an upcoming election, one thing remains certain. Dayton startups will continue to seek capital across all stages, from proof-of-concept to market entry to scaling and growth.

McCann seeks to grow the EC Angels in 2024 with investors from across the country. The expanded network would address the capital gap and providing an outlet for mentorship for those who may not receiving funding on their first pitch attempt. He said as investors consistently see and make deals, they are likely to remain organized and grow participation and the number funding provided over time.

The EC is also working to help facilitate and provide additional investment opportunity for startups through partnership with other venture funds across Ohio and the Midwest.

“Venture capital does tend to be fairly local within a certain range, but it's not like Cincinnati and Columbus are on the other side of the world,” McCann said. “Some of the funds based in other areas have sectors and areas that they're interested in and that they tend to invest in. But there's been pretty consistent willingness for those firms to invest across Ohio.”

Regional strength in market sectors including advanced manufacturing, advanced materials, sensors, medtech, and software are expected to continue alongside the boost in generative AI.

“Based on the region’s technical talent and R&D expenditures, we expect strength in these segments to continue into 2024 and beyond,” McCann said.