A Drive Capital-backed startup that helped businesses securely use OpenAI to analyze their own data has shut down.

Mantium Inc. essentially lost the race to release new products that could gain traction before OpenAI would launch a similar feature, co-founder and CEO Ryan Sevey told me.

Many startups building around the ChatGPT maker's backbone faced the same fate after the company released its own PDF reader last year, TechCrunch reported.

"That was devastating to a lot of companies, a lot of the early startups, because nobody saw that coming," Sevey said. "That is kind of the cautionary tale now. Is what you're building something OpenAI’s eventually just going to make irrelevant? Do you have a moat?"

New Albany-based Mantium wound down last month. Starting last fall, about 30 employees eventually left or lost their jobs.

Sevey has a new startup – his third – with one repeat investor, and doesn't plan to raise venture capital.

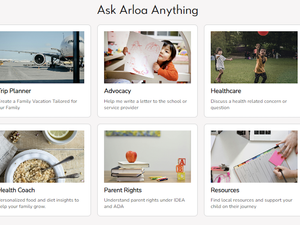

Arloa Inc. uses AI to guide parents of children with developmental disabilities through complex educational accommodations, therapy benefits and treatment plans.

Jason Montgomery, co-founder and CTO with Sevey on the first two startups, now is an independent cybersecurity consultant, according to his LinkedIn profile.

"There's so much to learn from the Mantium journey," Sevey said. "Part of the reason I did want to sit down and share it is, I can hopefully help others – because I do have founders reach out to me a lot about advice on the generative AI space.

"I always advise caution, and I always advise, you better make sure that OpenAI or somebody else can't do what you're doing."

How Mantium foresaw the importance of OpenAI for business

Sevey and Montgomery's previous AI startup, Nexosis Inc., used machine learning to help businesses forecast and solve problems such as inventory levels or staffing for a call center. It was acquired in 2018 by Boston-based DataRobot. The two headed the Ohio office for three years and left at the start of 2021. That was just a few months before a CEO shakeup at DataRobot, as reported by the Boston Business Journal.

Mantium launched shortly thereafter, with a $12.75 million round led by Columbus' Drive Capital LLC and Silicon Valley-based Top Harvest Capital.

The two co-founders wanted to create business applications for OpenAI's technology called GPT (not yet chatting), which their DataRobot colleagues scoffed was just for video games.

In retrospect, Mantium and fellow AI startups raised too much money, Sevey said. Especially in the Midwest, investors expect a startup to hit certain metrics before backing a larger subsequent round or acquisition.

The model that worked for Nexosis was solving customer problems as a small, nimble startup – using a new technology that the rest of the market was slower to adopt.

"The difference here is that the incumbents (like Google and Microsoft) jumped on generative AI," Sevey said. "This is getting rapidly adopted faster than any other technology we've ever seen. ... We needed more time.

"And the other unfortunate thing with raising money is investors expect you to spend that money," he said. "We certainly were getting a lot of pressure to build, build, build – that was the mentality back in 2022."

Plugging into OpenAI: Necessary entry to a losing race

Mantium integrated into OpenAI's large language model, but built guardrails to make it easier and more secure for users without a technical background.

A lot of startups tap into existing infrastructure like this instead of spending tens of millions to build something the larger company does better, he said. For example, any business that sends automated texts probably is subscribing to Twilio instead of building that function from scratch.

OpenAI's terms of service say, "We will not use customer content to develop or improve the services." But that doesn't preclude the company from building tech that competes with smaller startups. The company did not respond to a request for comment.

"We would be ahead of the curve, or so we would think," Sevey said. "A lot of startups were in the same boat as us."

Mantium reaches a critical juncture

As ChatGPT soared in popularity and rapidly advanced, Sevey and Montgomery decided to pivot to applying their decade of cybersecurity experience.

At a board meeting last summer, he said, Mantium faced a choice: raise money to build cybersecurity for AI, or pursue a recent acquisition inquiry.

"At that meeting the investors gave 100% confidence that the company would be supported by the investors with at least $5 million in additional capital," Sevey said.

The board also advised against pursuing the acquisition. Instead, directors encouraged hiring vice presidents for sales and marketing, and recommended a recruiting firm.

"We left that board meeting feeling very, very good," he said. "Why would you say something that you know, if this doesn't happen, it's going to be very, very, very bad?"

Will Gokey, whose North Dakota family fund invested in both Nexosis and Mantium, said he set aside about $500,000 toward the $5 million round he understood was happening.

"It started to become more urgent, that round we were talking about," said Gokey, vice president of the family's Pepsi bottling plant. "It never seemed to materialize. ... Everything came to a head in a far more dramatic manner than it needed to."

Sevey made the formal pitch to Drive Capital's partners in October – and was turned down. Shortly after came the first layoff.

Chris Olsen, who was not the partner on Mantium's board, told Columbus Business First that it would be inappropriate for the firm to comment on discussions in board meetings. The board member deferred comment to Olsen.

A difficult aspect of venture is most VC-backed companies don't make it, Olsen said in an interview. Startups have a limited amount of time to use investment capital to build a business from scratch.

"They need to innovate and develop and ship products customers are willing to buy," Olsen said. "People investing in Drive are counting on the money to be in their bank accounts when a teacher needs a pension to pay for rent.

"We can't fund everything infinitely. ... If there are teams struggling to produce revenue, and other teams produce easily, we have to allocate capital appropriately."

The final efforts to save the company

After that meeting, Mantium entered "scramble mode."

Sevey said a key adviser told him, "You've done more to try and save this thing than I think I've ever seen any CEO ever do. ... Maybe it's time to just call it."

He didn't, yet.

Throughout the process, Sevey said, he tried to keep employees up to date, but things were changing quickly and dramatically.

"How do we save this?" he said. "Now it gets even worse."

Mantium received a letter of intent to acquire the company in the fourth quarter, Sevey said, at a proposed price that would cover its bank loan. He presented the terms to the lender, which would need to sign off on the deal.

Around Christmas, the bank called the offer "a material adverse change" and swept the deposit account – about 90 days' worth of operating cash.

For the next attempt to save the company, a single investor and Sevey brought a proposal to the board.

Gokey – Sevey's friend, first Nexosis customer and first investor – would purchase the loan from the bank and convert it to interest-only payments.

According to both Gokey and Sevey, the other investors at first said that without the debt pressure, they could put in more capital for the operating pivot. Mantium would have to cut staff first.

Gokey bought the loan, he said, "with the expectation there was going to be a round of financing."

The others changed their minds, he and Sevey said.

"It’s been very frustrating that the goalposts kept moving," Gokey said.

Sevey made one last pitch for a new model: using AI for a very specific niche of subject-matter expertise, instead of content-agnostic software.

The board advised closing Mantium and starting fresh. At the end of January, Sevey incorporated Arloa in Delaware, with Gokey the only outside investor. Today the service has some 4,000 users on a wait list.

"The main message I would say: Don’t count on someone else to ride in and save the day," Gokey said.