Battelle regenerative medicine spinoff AmplifyBio LLC has landed up to $50 million in debt financing from a Silicon Valley "venture lending" firm, which will help the contract research organization speed facilities expansion and technology development.

Hercules Capital Inc. (NYSE: HTGC), based in Palo Alto, has provided non-dilutive loans to national brands such as Carbon Health, Impossible Foods, Lyft and Postmates (which Uber acquired in 2020).

AmplifyBio can use the credit to augment development of its preclinical testing technology for cell and gene therapies at its two sites in Central Ohio and a South San Francisco lab over the coming two years, CEO Kelly Ganjei said in a news release.

"In both places, we are adding service capabilities focused on the characterization that is essential for better understanding the safety and efficacy of next-generation therapeutics," he said. "These funds will allow us to securely accelerate our business plan."

The startup has grown to nearly 250 employees since spinning out of Battelle 18 months ago. The Columbus research nonprofit provided $100 million worth of backing, including the West Jefferson headquarters and laboratory and equipment. Venture capital firms invested another $100 million: Viking Capital Investments, Casdin Capital and Ohio's Narya Capital. The Hercules financing in contrast is non-dilutive, meaning the co-owners don't give up equity.

AmplifyBio added 28 new clients in 2022, its first full year, which enabled it to add some 100 jobs since the spinout, Jerry Hacker, executive vice president and chief commercial officer, told Columbus Inno in a statement. Revenue is not disclosed.

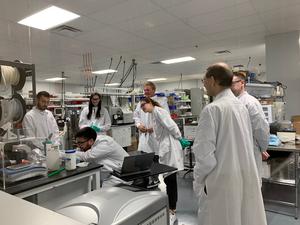

Customers are pharmaceutical makers and research institutions developing cell and gene therapies. AmplifyBio takes a project from early research through commercial development and clinical trials – such as testing toxicity and safety, testing whether the therapy is effective in a lab dish or in animals, and designing systems to determine how different parts of a genetic sequence function in the proposed therapy.

AmplifyBio acquired the Bay Area laboratory last year and aims to open a New Albany research center this summer.

Recently the startup joined Battelle and Nationwide Children's Hospital spinoff Andelyn Biosciences Inc. in a partnership that was named one of just three teams that can bid on individual jobs within an eight-year, up to $149 million program of the National Institutes of Health. The partners can bid on individual work orders from the National Institute of Neurological Disorders and Stroke as it seeks to develop gene and cell therapies for neurological disorders being developed by U.S. research institutions or within the agency.

Hercules lends to high-growth, VC-backed tech companies in areas including life sciences, software and renewable energy, with fewer regulatory hurdles than a commercial bank, according to its website. Its primary revenue source is interest on loans, according to regulatory filings, with a mix of fixed rates as high as 14.5% as well as single-digit percentages over the prime rate.

AmplifyBio is "creating next-generation platforms, tools, and services to amplify and accelerate the development of new therapies and vaccines," Bryan Jadot, Hercules senior managing director and head of its life sciences group, said in the release. "This substantial capital commitment from Hercules aims to help AmplifyBio achieve its growth objectives and to continue to advance its capabilities."