Ohio State University has a stake in a record-breaking year for IPOs: A spinoff just raised more in its debut than any other company licensing university technology.

Entrada Therapeutics Inc. raised $181.5 million before expenses in its offering just over a week ago, which sister publication Boston Business Journal dubbed one of the largest biotech IPOs to date this year. The Boston-based company sold 9.1 million shares at $19 each, the midpoint of its range, then rose about 20% in its first few hours of trading.

Entrada (Nasdaq:TRDA) spun out of Ohio State in 2018 and raised more than $175 million in venture capital – including $116 million in April. Before that, its $59 million initial round was the largest launch ever for university startup.

Investors include Goldman Sachs, Wellington Management Co., Point72 and others. For the IPO, Goldman Sachs, Cowen and Evercore ISI were joint bookrunners. Entrada was one of two Boston-area biotechs to go public on the same day, making it 24 for the year in the region.

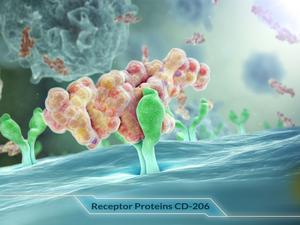

Dehua Pei, an OSU chemistry and biochemistry professor, co-founded Entrada and invented its core technology, using peptides – short chains of amino acids that are smaller than proteins – to deliver therapeutic agents inside cells. About 75% of disease-causing mechanisms occur inside protective cell walls that most pharmaceuticals can't cross or can't survive once inside, rendering them "undruggable," the company said in a regulatory filing.

Entrada's first targets are rare, devastating diseases including the fatal Duchenne muscular dystrophy and other neuromuscular and inflammatory disorders.

Ohio State publicized the April venture round, but has not made an announcement about the IPO. University spokespeople were not immediately available for comment.

Dublin-based Navidea Biopharmaceuticals Inc., a public biotech, got its start in 1983 as Neoprobe Corp., licensing cancer-detection tech from Ohio State. The company raised $8.2 million in its 1992 IPO, according to a regulatory filing.

But the company abandoned that technology long ago, after the U.S. Food and Drug Administration demanded more (and expensive) studies before approval. A new startup founded by the original inventors has licensed an improved formulation from OSU.

Rowan Walrath of Boston Business Journal contributed to this report.