Venture capital firm Mutual Capital Partners said it’s reached the first close on a new fund with more than $32 million, with a target size of $50 million.

The Westlake, Ohio, firm said it plans to back up to 10 early-stage health care companies across the Midwest and other markets. The fund will write initial checks of between $2 million and $4 million.

“Target companies are generating revenue, create highly engineered, differentiated products, operate in target markets of over $500 million with exceptional management teams, and these companies are located outside of major tech markets,” the firm said in a statement. “Our team has never seen more opportunity to invest in transformative technologies outside the coasts than right now.”

Mutual Capital Partners said it’s already made two investments: The firm participated in a $20 million investment in Authenticx, a consumer interaction data company in Indianapolis, as well as a $12 million investment in IotaMotion of Iowa City, Iowa, which is developing robotic-assisted systems for cochlear implant surgery.

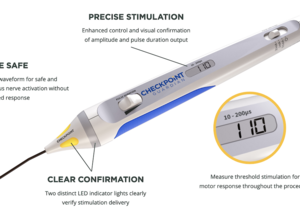

Previously, Mutual Capital participated in a $37 million fundraise by SPR Therapeutics in Highland Hills, Ohio, and a $16 million fundraise in Checkpoint Surgical Inc., an Independence, Ohio-based company that is developing medical devices to protect and repair nerves.