One of Greater Cincinnati’s best-funded startups has agreed to be acquired by an East Coast-based public company in a deal worth $300 million, including earnouts. Once closed, it will stand as one of the region’s top three exits ever.

Teleflex Inc. (NYSE: TFX), a global medical technology company based in the Philadelphia suburb of Wayne, Pa., has entered into a definitive agreement to acquire Blue Ash’s Standard Bariatrics, a medtech company developing devices for the surgical treatment of obesity.

Under terms of the agreement, Teleflex will acquire Standard Bariatrics for an upfront cash payment of $170 million at closing. There’s also additional consideration of up to $130 million payable upon the achievement of certain commercial milestones, valuing the deal at $300 million.

That would make it one of the region’s largest startup exits. Last November, Vndly sold to Workday Inc. (NASDAQ: WDAY) for $510 million. Mason-based biotech Assurex Health sold to Myriad Genetics in 2016 for around $300 million, including earnouts.

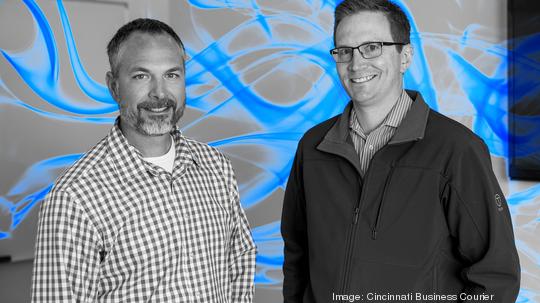

Standard Bariatrics CEO Matt Sokany said several “strategics,” or interested buyers, came knocking on their doors starting in the spring. Teleflex, he said, proved the best match with the company’s short-term and long-term goal.

“It's really indicative of the solid team, and the solid capability we’ve built over the last couple of years. (Teleflex) is not just buying revenue,” he told me. “This is going to accelerate our growth and the investment in this business. They made it very clear to us when we went through this process. It’s a big win for Southwest Ohio. It's a big win for the state. And it's a win for all our investors.”

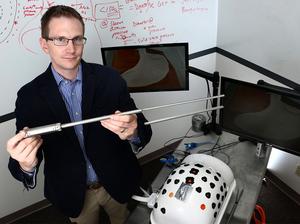

Standard Bariatrics, founded in 2014 by Dr. Jon Thompson, a UC Health surgeon, has raised more than $55 million in its quest to help surgeons more easily perform laparoscopic sleeve gastrectomy, a common weight loss procedure.

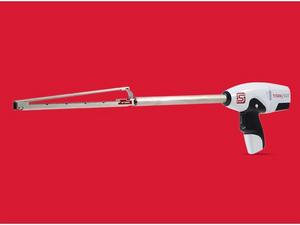

Its flagship device, the Titan SGS, a first-of-its-kind surgical stapler, received Food and Drug Administration approval last year and launched commercially in the third quarter of 2021, with accelerated adoption nationwide.

The stapler meets an unmet need in sleeve gastrectomy, Thompson said, by offering surgeons the longest, continuous staple cutline. That means users can achieve more consistent and symmetrical sleeve pouch anatomy, which leads to better outcomes for patients.

Locally, the company has raised funds from Queen City Angels, RC Capital and CincyTech as well as JobsOhio's growth capital fund, North Coast Ventures and Accelerant in Dayton in the state. In June, the company was honored as a Cincy Inno "Fire Award" winner in the health care and biotech category, a premier recognition for companies and people setting the local innovation economy ablaze.

Its team is now at 57. In terms of Standard’s future footprint in Greater Cincinnati, Sokany declined to talk specifics. He did say Teleflex is supportive of the company’s planned office move later this year. Standard has signed a lease for a larger 35,000-square-foot space, also in Blue Ash, neighboring its current headquarters.

Teleflex currently doesn’t have stapling capabilities, unlike similar medical device companies like Ethicon or Medtronic. Sokany said that means the company will be able to lean on Thompson and his team to help drive further innovation in the space. There’s also opportunities for the company to expand outside of stapling in the future, “which is very exciting for the team here,” he said.

Teleflex plans to finance the acquisition by borrowing under its revolving credit facility.

Liam Kelly, chairman, president and CEO Officer of Teleflex, said, said the transaction is expected to be “immediately accretive” to Teleflex’s revenue growth.

Overall, Standard Bariatrics’ revenues for 2022 are expected to be approximately $15 million. For fiscal year 2023, the transaction is expected to contribute between $30 and $35 million of revenue, the company said.

“Teleflex’s strategy is to invest in products and technologies that can meaningfully enhance clinical efficacy, patient safety and comfort, reduce complications, and lower the overall cost of care,” Kelly said in a release. “The acquisition of Standard Bariatrics adds an exciting and differentiated product serving the large and growing sleeve gastrectomy market, which we estimate to be approximately 120,000 procedures annually in the U.S.”

Teleflex has more 14,000 employees worldwide. The company reported $2.81 billion in 2021 fiscal year revenue.