A Greater Cincinnati fintech on a mission to make payments more inclusive for families has closed a $2 million seed round that will help it grow its team and further develop its platform.

Pay Theory, which is based in Evendale, closed a $2 million seed round led by Zeal Capital Partners, a Washington, D.C.-based venture capital firm, officials said Friday. Additional new investors include St. Louis-based SixThirty, the Ohio Impact Fund, Gaingels and Sica Ventures, a Columbus-based early stage investment company.

Pay Theory also received follow-on investments from California-based Double Eagle Venture Partners, Loud Capital in Columbus and other angels.

The funds will go toward product development and talent acquisition. Pay Theory, which is currently a team of 13, also hopes to hire for roles across sales, finance and software development, CEO Brad Hoeweler said.

“This is a major step forward,” Hoeweler said in a release. “It represents validation for our approach to inclusive finance. Zeal, SixThirty and the rest of our investor group bring deep experience in payments and fintech, (and) their investment exemplifies their commitment to our innovation in this fast-growing, ever-evolving space.”

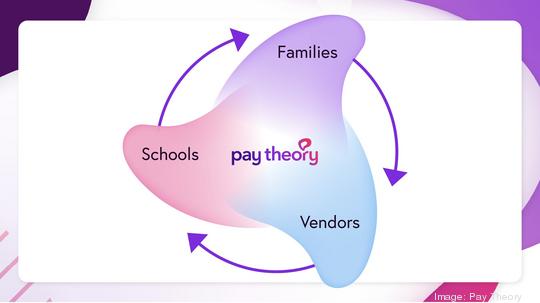

Pay Theory’s platform was initially tailored for K-12 schools but can be used for child care, health care services and kids activities, ranging from music lessons to sports. The company also sees broader applications at banks and credit unions. The idea is to ensure inclusivity for all families regardless of their access to a checking account or credit card, the company said.

Roughly 30% of public K-12 school families in the U.S. are un- or under-banked, or left without access to mainstream financial services. Similarly, more than half of Americans are living paycheck to paycheck. The Covid-19 pandemic has exacerbated challenges, Pay Theory said.

With its platform, families can pay for an online transaction in cash using a network of nearly 60,000 retailers nationwide, including Dollar General, CVS, 7-Eleven, Walgreens and Walmart.

The bill or fee can be issued to the family through a Pay Theory partner. A family is issued a barcode, either virtually on a smartphone or via email. The code can then be scanned by a cashier at a retailer and paid for using cash.

Pablo Martinez, Pay Theory co-founder and chief marketing officer, told me the company was able to move from proof of concept to a scalable product in 2021. The funding round will allow the company to “course correct” and expand its team. The company plans to build out its technology and add new features.

Pay Theory, which was founded in 2019, could grow to 20 employees by the end of the year, a number that’s contingent on a variety of factors.

“That’s natural with a seed stage startup, but we expect to grow, and there are a few very big clients, that at any point, if we convert those, that would really change what things would look like for us,” Martinez said. “Our goal is to target the entire socioeconomic spectrum in the U.S.”

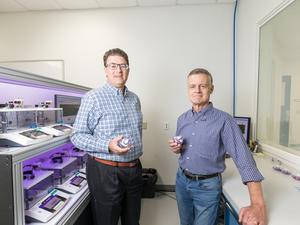

Martinez said Pay Theory has carved out a unique niche in the city’s fintech scene, although it’s still early-stage (the company’s total funding, with the seed round, now stands at $2.5 million). He credits that largely to its leadership team: Hoeweler founded Skipjack, one of the first internet payment gateways, which sold to Vantiv (now WorldPay) in 2009; and Eric Fulkert, co-founder and CTO, co-founded and exited Soundstr, a music technology company in 2018.

Fintech is also a growing point of emphasis across the Cincinnati ecosystem. FinTech Frontier, an initiative launched in 2020 and backed by Cintrifuse, JobsOhio, Western & Southern Financial Group and Fifth Third Bank, aims to highlight the Queen City as a growing hub for financial technology-focused entrepreneurs.

Fintech Frontier hosts a slew of virtual events and a marquee annual pitch competition, and last year, launched a new intern program, of which Pay Theory, Coterie Insurance and Akru (formerly Tokenism), were beneficiaries.

“Cincinnati is so underrated on a national scale, even international scale, as to what it can develop in terms of fintech,” Martinez said. “This is technology we truly feel is representative of the kind of fintech innovation that can come out of Cincinnati.”