Nine startups, including four from Cincinnati, have been named finalists in FinTech Frontier’s inaugural pitch competition, and those companies will get to present their best business ideas to some of the city’s biggest industry players next week.

The contest, presented by Cintrifuse, Western & Southern and Fifth Third, is looking for the “best and boldest ideas” in the future of fintech, or financial tech. At stake is $60,000 in prizes – one of the largest prize pools in the nation this year. Organizers received more than 50 submissions from 15 states and seven different countries.

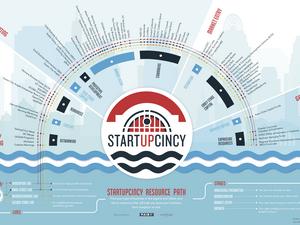

“We are thrilled with the diversity of submissions,” said Pete Blackshaw, CEO of Cintrifuse, a Cincinnati startup catalyst. “The pitch competition and FinTech Frontier are putting the region on a global map as an epicenter for innovative solutions and financial technology.”

FinTech Frontier is a new initiative. The goal is to highlight Cincinnati as a growing Midwest hub for financial technology. Cincinnati is one of only a few U.S. cities to house the headquarters or major operations of several large banks, insurance companies and payments processors, and leaders want to seize that opportunity.

The pitch competition offered two themes for entrepreneurs: "closing the gap,” or enabling financial security for consumers by expanding access and/or affordability of financial tools; and “powering business,” which is described as empowering business and consumer experiences from the back office to the front door.

The FinTech Frontier pitch contest finalists are:

- Debtle, based in New Orleans. Debtle's cloud-based platform enables organizations and individuals to negotiate, settle and collect bad debt accounts.

- Earnestly, based in Cincinnati. The company automates the collection and reconciliation of earnest money payments, agent fees and commission disbursements.

- Fleri, based in Columbus. It founded a marketplace for immigrants to compare and purchase health insurance policies for loved ones back in their home country.

- Habit Insurance, based in New York City. Habit bridges (re)insurers with last mile distribution partners who have large pre-existing communities and the right context to show information and sell insurance products.

- Honeycomb Credit, based in Pittsburgh. Honeycomb Credit unlocks growth opportunities for small businesses to build financially empowered communities by crowdsourcing funding.

- InsureLife, based in Raleigh. InsureLife provides an AI-powered network orchestration platform for insurers that digitally connects their financial services products with consumers and agents so they interact anytime, growing sales in a contactless world.

- MortgageBite, based in Cincinnati. MortgageBite allows consumers to shop anonymously for the best mortgage rates and fees in their area through an auction-style marketplace.

- Rente, based in Cincinnati. Rente is a digital platform for landlords to more efficiently manage their properties, while simultaneously improving the renter’s experience through credit reporting.

- WiProsper, based in Cincinnati. WiProsper aims to improve community wealth by enabling the community to participate in and benefit from venture ownership.

A winner will be announced at the pitch competition at 1:30 Oct 29. The event is fully virtual and open to the public. Attendees will be able to vote for their favorite pitches. Registration can be found here.