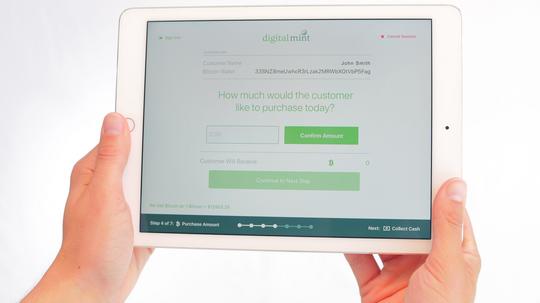

DigitalMint, a Chicago startup making it easier to buy bitcoin through ATMs, is expanding throughout the U.S. as it works to make owning cryptocurrency more accessible.

Founded in 2014, DigitalMint has more than 350 Bitcoin ATMs and teller locations in 26 states that allow consumers to buy cryptocurrency instantly and store it in bitcoin wallets, offered through services like Jaxx.

DigitalMint can be found in places like convenience stores, grocery chains and gas stations. It has official partnerships with dozens of companies, including Circle K, United Check Cashing and Continental Currency Services.

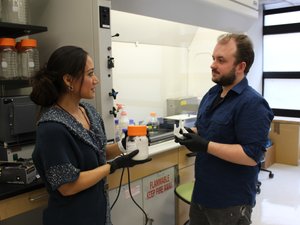

The startup was launched by CEO Jonathan Solomon and President Marc Grens, who has a background in finance and became interested in cryptocurrency back in 2013. He met Solomon, the creator of the Chicago Bitcoin Meetup and a former Coinbase employee, during a bitcoin event at a Lincoln Park brewery.

Soon after, Grens and Solomon launched DigitalMint, with the first couple kiosks being placed at co-working space Blue Lacuna in Pilsen and Geek Bar in Wicker Park, which is now closed.

Though many people buy cryptocurrency and bitcoin online and through apps that connect to their bank accounts, DigitalMint allows consumers to use cash, delivering bitcoin instantly. Doing so also allows for the startup to serve underbanked individuals and reduce instances of fraud.

DigitalMint makes money by charging its partners a fee to have an ATM or teller services in their space. The startup markets itself to partners by promising that through offering DigitalMint services, the establishment will attract increased foot traffic and additional passive revenue.

The startup, which has so far raised some angel funding, currently has 26 employees, and even though the coronavirus crisis has dampened many startups’ plans to grow this year, DigitalMint says it is still hiring. Grens said the startup is filling roles in business development, accounting, compliance and software engineering.

DigitalMint is still growing, but the currency its product depends on—Bitcoin—has not been immune to the economy’s challenges amid the COVID-19 crisis. When the markets were tumbling in March as coronavirus shut down the U.S. and other parts of the world, Bitcoin’s value also dropped considerably.

But bitcoin’s value has bounced back quicker than the economy. Before the crash, bitcoin was trading for about $10,000. As of press time, bitcoin was trading for about $9,300, according to Coindesk.

“The bitcoin price has actually catapulted back much faster than the stock market has,” Grens said.

Over the last year, Chicago's cryptocurrency industry has made headlines. Bay Area-based Coinbase shuttered its Chicago office last April, less than a year after announcing big plans for a Windy City expansion.

However, a few months later, Tyler and Cameron Winklevoss, founders of cryptocurrency exchange Gemini, announced that there were opening a Chicago office.

Additionally, Yan Pritzker, the former chief technology officer at Chicago startup Reverb, founded Swan Bitcoin in 2019, a platform for buying bitcoin that essentially serves as a savings account.