Capitalize VC announced a direct investment from Bank of America this week for its initial fund.

While the amount of the investment was not disclosed, it serves to help boost a fund that hopes to even the playing field for Black and Latino startup founders when it comes to venture capital fundraising with a particular focus on early-stage companies.

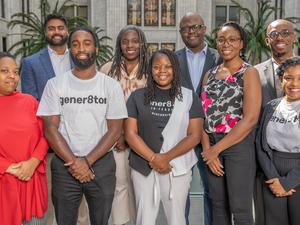

Based in Chicago, Capitalize VC plans to raise $10 million for Fund I, which will focus on investing in Black and Latino founders developing e-commerce infrastructure technology and consumer brands. Founder Tessa Flippin hopes to close the fund in 2023.

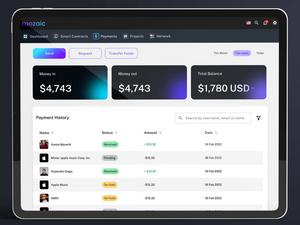

The new VC plans to back around 40 startups from this first fund with six investments already made to four portfolio companies, all of which are founded by Black and Latino entrepreneurs.

Capitalize reports that more than 60% of closed capital in the fund is committed by Black or Latino limited partners. More than 50% of the capital is committed by female investors, and approximately 34% of capital is committed by first-time limited partners.

After graduating from business school in 2016, Flippin, a former investor at Chicago’s TechNexus Venture Collaborative and founder of fintech startup La Plataforma, knows firsthand the challenges that continue to exist for Black and Latino founders. Recent industry headwinds may have only worsened some of these challenges after making some headway prior to 2022.

“It’s easiest to pitch a company to somebody who is familiar with the problem, so for a lot of Black founders, oftentimes they’re solving problems that are potentially a new problem for an investor who is unfamiliar,” Flippin said. “Familiarity with the problems that diverse founders are trying to solve is definitely a huge hurdle for the VC space, which historically has not been very diverse.”

The investment from Bank of America comes as venture capital fundraising in Chicago dropped precipitously in 2022, with local startups raising nearly 34% less money from VCs throughout the year than they did in 2021.

The down market has made it even more challenging for Black and Latino founders, according to Flippin. Black startup founders raised an estimated $2.3 billion out of the $215.9 billion in U.S. venture capital allocated in 2022. That's about 1% — a slight drop from the 1.3% raised in 2021, according to TechCrunch's analysis of Crunchbase data.

“It’s always been difficult as a diverse founder to fundraise, and when capital dries up, it just becomes even more challenging,” Flippin said.