The Covid-19 pandemic didn't slow down the amount of money flowing to Chicago's startups in 2020 as the city's tech scene raised nearly $3 billion in venture capital funding last year.

In an increase from 2019's decade high of $2.2 billion, Chicago tech companies raised $2.8 billion in 2020, according to a new report from Pitchbook and the National Venture Capital Association. It's the most raised in Chicago since Pitchbook began tracking VC statistics in 2006.

Nationally, $156.2 billion was invested into U.S. startups, which was a record high, according to Pitchbook. In 2019 companies raised just over $138 billion. However, the number of deals declined slightly, according to the report, with 12,254 companies raising capital last year compared to 12,285 in 2019.

Deal volume was also down in Chicago last year. Locally, 273 companies raised VC funding in 2020, a more than 10% drop from the year prior. However, Pitchbook analyst Kyle Stanford said that number is likely to increase as Pitchbook continues to gather data and companies report end-of-year funding rounds.

Despite the many challenges that Covid-19 presented to U.S. businesses, the VC industry proved resilient in 2020, Stanford said, buoyed by venture capital funds that had record amounts of dry powder last year and a tech industry that became increasingly relevant in our everyday lives during the pandemic.

"Tech was just pushed straight to the forefront of everyone's everyday life," Stanford said. "Groceries were now delivered by apps. Productivity software allowed distributed workforces to collaborate and work somewhat seamlessly as they would have in the office. All that capital was ready to push into all these tech-enabled industries that received tailwinds from the pandemic."

In the early months of the pandemic, many VCs in Chicago were bracing for a venture capital slowdown. But after raising $456 million in Q1 and $494 million in Q2, Chicago finished the year strong with $696 million and $1.1 billion raised in the final two quarters of 2020, respectively. Some of the year's top deals include a $250 million round for health care startup VillageMD, a pair of mega-rounds for Tempus ($100 million in March and $200 million in December), and $100 million for logistics tech startup Project44.

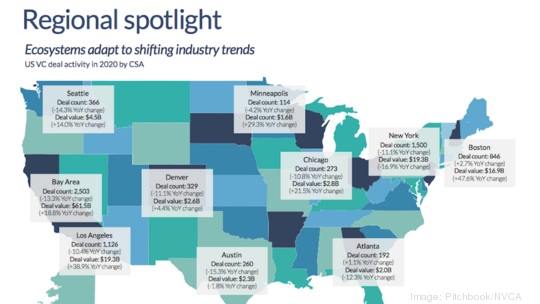

Despite new highs in Chicago VC funding, the majority of capital remained concentrated in the country's traditional tech hubs. The Bay Area ($61.5 billion), New York ($19.3 billion), L.A. ($19.3 billion) and Boston ($16.9 billion) were far and away the top cities for VC funding in 2020. Chicago also fell behind Seattle, which raised $4.5 billion last year, but outpaced cities like Austin ($2.3 billion), Denver ($2.6 billion) and Atlanta ($2 billion).

Stanford said it will likely take until later this year or 2022 to determine just how much of an impact the pandemic will play on the VC funding landscape. One trend he expects is that non-traditional tech hubs may see increased VC activity as tech talent opts to leave expensive cities like San Francisco and New York. This could prove beneficial to Chicago, he said.

"You're not only going to see talent and dollars move out of Silicon Valley, but you’re going to see talent that would have moved from Chicago to Silicon Valley to start a company instead decide to stay and start a company at home, where they live and where they’re originally based," he said.

Time will tell if Chicago will see gains from the current tech migration out of Silicon Valley. But early numbers from LinkedIn show Chicago is seeing some of the steepest declines in tech workers moving to the city versus moving out, a metric LinkedIn calls an inflow/outflow ratio. Chicago's inflow/outflow ratio was -12% from Aril to October compared to the same period last year, which was behind only the Bay Area, New York City and Boston.