A Chicago startup helping people pay off their student loans hit a big milestone this month, sending $10 million worth of payments on behalf of its clients.

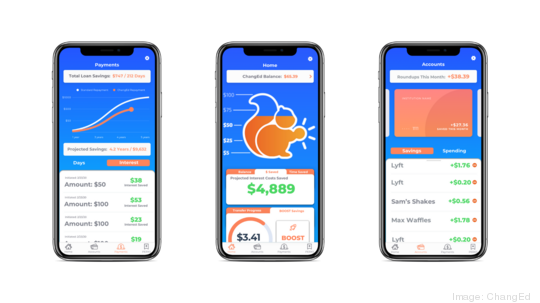

ChangEd, founded in 2016 by brothers Dan Stelmach and Nick Sky, charges users $1 per month to use its app-based service, which collects spare change from everyday purchases and directs it to paying down users’ student debt.

Early in the startup’s lifecycle, ChangEd appeared on an episode of Shark Tank and received a $250,000 investment from Mark Cuban. The exact terms of the deal were not disclosed.

Over the last year, ChangEd has doubled its user base and is now managing more than $2 billion of student loans, Sky said. In 2018, ChangEd users paid down $2 million worth of student loan payments. In 2019, that figure topped $4 million, and this year it has so far exceeded $10 million.

The startup has also helped dozens of people completely eliminate debt, Sky said.

To continue growing, ChangEd is participating in Techstars’ three-month MetLife Digital Accelerator.

The cohort, announced Tuesday, includes startups developing financial wellness and engagement products that help customers save money, tackle debt, stay healthy, care for seniors and children, and close the racial wealth gap. This year’s program is completely virtual because of Covid-19, but is normally hosted in Cary, North Carolina.

“This is huge for us in terms of working with a company like MetLife to distribute ChangEd to millions of more student loan borrowers,” Sky said.

To date, ChangEd has raised about $700,000 in outside funding and it now has nine employees, many of whom have student debt and use ChangEd to pay it down. Combined, ChangEd employees have more than $300,000 in student debt, Sky said.

Unlike many other companies, ChangEd hasn’t seen lasting negative effects on business from the Covid-19 pandemic, Sky said. In fact, Sky said user retention has been stronger than ever.

“We thought [Covid] would negatively impact us just because there was a lot of changes to student loans,” said Sky, reffering to the federal government putting a moratorium on monthly student loan payments until the end of the year. “But the user base that we have are actively looking to pay down their student loans, so our retention rate increased right after March.”

ChangEd is not alone in the student-loan repayment business. Apps like Austin, Texas-based Chipper and New York-based Pillar also help people manage and pay off student loan debt.