A well-funded insurance app has arrived in the land of Lincoln. And it could pose a threat to the state's insurance giants State Farm and Allstate, as well as the industry at large.

New York City-based Lemonade, an artificial intelligence-powered app that offers renters, condo and home insurance, announced it has launched in Illinois, its second state outside New York. Currently the site offers renters' insurance in Illinois, with homeowner and condo insurance to come soon. They're looking to reach 97 percent of the US population by the end of 2017.

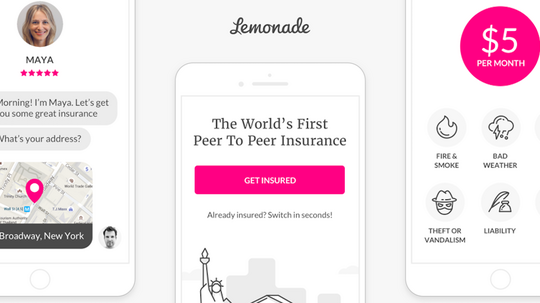

Lemonade, which launched last September, bills itself as a hassle-free insurance option with a social impact twist. Users interact with chatbots named Maya or Jim to input information about their coverage needs, location and property details, and Lemonade uses artificial intelligence to create a personalized policy for each user. They take care of cancelling an old policy, and take a flat 20 percent fee on monthly payments. Renters insurance starts at $5 per month, while homeowners insurance starts at $25 per month. The entire process is done via the web or mobile app.

Artificial intelligence also handles claims (offering lightning quick processing for simple claims--one claim was processed and paid in three seconds) though it passes more complex issues onto human brokers. But the tech is learning everyday, the company says.

There's a social good component as well. Any unused claim money is donated to the charity of the users' choice, in a program called 'Giveback.' Essentially, users choose a charity within the app and are lumped into a peer group with other people who choose the same cause. Lemonade uses premiums from the peer group to pay out claims, but if there's unused money from that group by the end of the year, Lemonade donates it to that charity.

That's a key difference from traditional insurance companies, which make their profit off these unused claims (and de-incentivizes the companies from making timely claim payments). Lemonade is a certified benefit corp, or b-corp, meaning social good and profit take equal priority.

Already they're poaching customers from local insurance giants: According to their website, 19 percent of their users switched from Allstate and 16 percent of users switched from State Farm. And it's particularly enticing to young consumers: 80 percent of the first 2,000 policies sold were to first-time buyers, the Economist reported.

Lemonade has raised a total of $60 million in funding (most recently a $34 million Series B last December) and investors include Sequoia Capital, General Catalyst, Thrive Capital, Tusk Ventures and GV (formerly Google Ventures).

"Lemonade’s forward thinking business model and incredible tech are now available for the Midwest, and that’s a good sign for both the tech industry and consumers,” said Bradley Tusk, CEO of Tusk Holdings (a Lemonade investor) and former deputy governor of Illinois in a statement. “As a former Illinoisan and a current New Yorker, Lemonade’s rapid expansion to Illinois is fantastic, and I look forward to watching Lemonade grow nationwide throughout 2017."