Critical materials startup IperionX Ltd. has reported progress for both its commercial operations and its nascent titanium mining business.

The Australian company (NASDAQ: IPX) with its executive headquarters in Charlotte announced yesterday it signed a commercial partnership agreement with Officine Panerai, an Italian luxury watchmaker, to produce watches made from recycled titanium. The metal for the upscale watches will be produced using IpereionX’s patented sustainable processes.

The high-end watches are slated to go on the market next year. IperionX CEO Taso Arima called it a “major milestone in the luxury goods sector” for his company.

“This demonstrates the potential in other consumer-facing sectors which are demanding fully recycled and sustainable, low-carbon materials,” he said. “(Some) of the most exciting sectors are the high-growth markets in smart watch, wearable device and smartphone markets.”

Producing medical- and military-grade titanium alloys in Tennessee

Anthony Serpry, research and development director at Panerai, said the deal is important to his company’s plans as well.

“Panerai is leading the way for luxury brands in both quality and sustainability,” he said. “The next-generation metals such as IperionX’s fully recycled titanium will enable Panerai to deliver on both.”

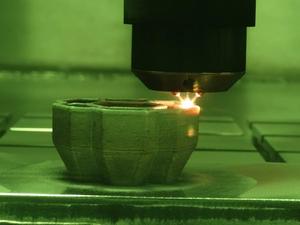

And late last week, IperionX announced that it has used other proprietary low-carbon technologies to produce military- and medical-grade titanium alloy powders using titanium mined at its proposed Tennessee mine.

The two announcements are unrelated, the company says. But each represents an advance for important parts of the company’s business model.

A lift from the Inflation Reduction Act?

The company is already producing titanium metals and powders from scrap at its pilot plant in Utah. The titanium and rare earth mine in Tennessee is the more speculative Titan Project, which is in the permitting process now but is at the heart of IperionX’s plans to bring titanium production back to the United States. Currently the U.S. is dependent on foreign countries including China and Russia for those strategic materials.

IperionX is still evaluating the 11,000-acre Titan Project, which it acquired in December 2020, for commercial production. The company says it mined a small sample of titanium ore there to test the capacity for refining it into high-grade titanium alloys.

“These innovative technologies can produce low-carbon titanium metal and its alloys directly from domestically sourced titanium minerals from our Titan critical minerals project in Tennessee,” Arima said, following the test.

He noted that the Inflation Reduction Act passed two weeks ago provides incentives from “reshoring critical low-carbon American supply chains” like what IperionX hopes to do in titanium and rare earths. He said the act establishes funding to accelerate emerging technologies that can reduce U.S. reliance on foreign supplies.

He said they include $40 billion for Department of Energy Loan Programs Office, $500 million for a Department of Defense industrial base program under the Defense Production Act and a 10% production tax credit for critical mineral and metal production.

Financial losses and need for continued funding

The early-stage company — Arima founded it in Australia in 2017 — knows it will need funding, from government and private sources, to reach commercial development.

The company has yet to turn a profit. It released its annual financial report earlier in August. That filing with the U.S. Securities and Exchange Commission shows it lost $21.5 million, or 16 cents per share, in the fiscal year that ended June 30. That follows a loss of $13.2 million, or 19 cents per share, in 2020.

“We believe that we will continue to incur net losses until such time as we commence commercial scale production of our critical minerals and/or titanium metals,” the company says in the filing. “The ongoing operation of the Group will remain dependent upon the Group raising further additional funding from shareholders or other parties.”

The losses are not unusual for capital intensive startup companies like IperionX. Arima was also a cofounder of Piedmont Lithium Inc. (NYSE: PLL), which has yet to turn a profit since it started in 2016.