The Triad has long battled neighboring metros — particularly Charlotte and the Triangle — for people, jobs and resources. But in recent years, the Triad has carved out its own identity to keep and grow those people, jobs and resources.

That identity is as an innovation hub, especially health-care innovation. The Triad has one of the largest shares of funding from the National Institute of Health in the state and has strong ties between its innovation ecosystem and health-care systems. Since 2018, the area has experienced a 600% increase in life sciences economic development projects, said Mark Owens, president of Greater Winston-Salem Inc.

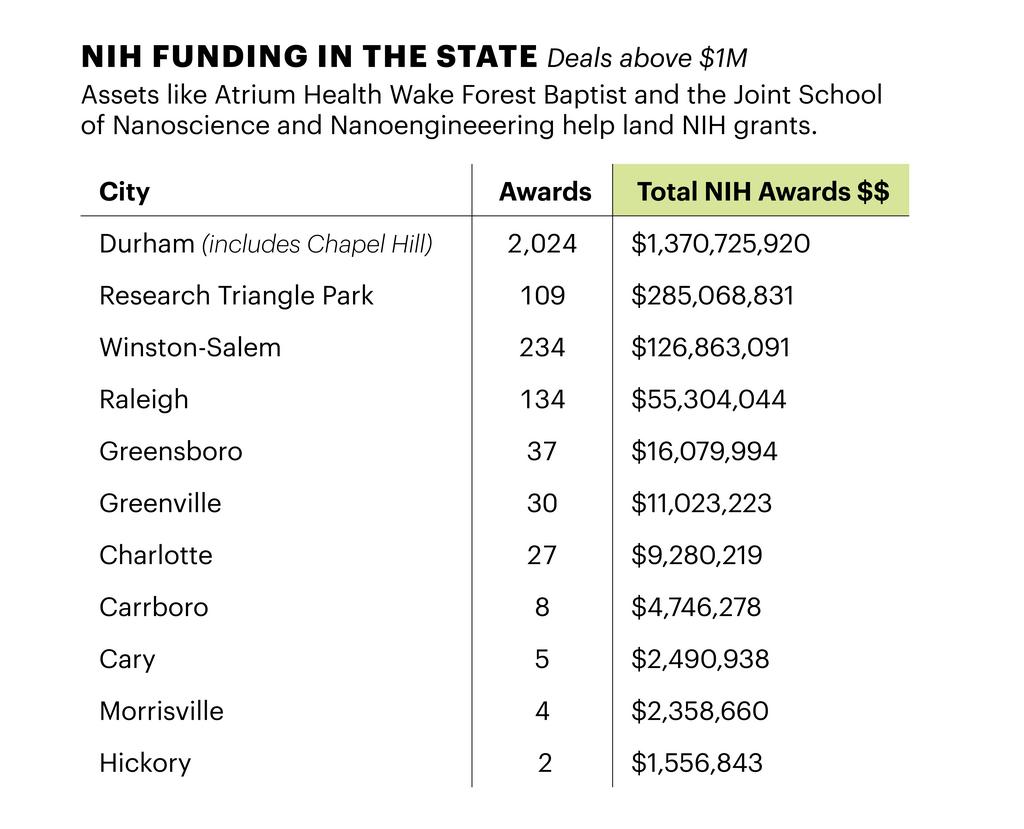

In 2021, Winston-Salem ranked third in North Carolina and 52nd in NIH funding among nearly 1,000 of the nation's largest cities, with 234 grants totaling almost $127 million. Greensboro ranks fifth in the state with 37 grants worth more than $16 million, ranking it 158th among those nearly 1,000 cities. More broadly, there were 276 grants across the 12-county Triad, for a total of $145 million in NIH funding in the region.

Of course, it helps to have many major universities engaged with health-care systems. There are roughly 23,000 degrees distributed in the region annually, Owens said, of which 10,000 are in the life sciences and health-care industries.

Wake Forest University received almost $125 million in funding from the NIH in 2021 alone, making it the third-highest recipient in the state, according to the Blue Ridge Institute for Medical Research. Of the 164 grants the university received, 31 of them were more than $1 million.

“Anytime there’s outside investment, it provides economic opportunities for individuals that are living here or for individuals who are moving here for that,” Owens said. “Typically, in health care and life sciences, those jobs are a little higher paying than some of our other industry sectors.”

Covid-19 also brought about many changes that could allow the Triad to capitalize on its identity for health-care innovation. Mid-size cities have in many cases attracted those who are re-evaluating priorities and favor more affordable communities. Owens believes that trend favors the Triad's metros.

“The tide has already started to shift,” Owens said. “You’re going to see those impacts in about two to three years down the road as we’ve been able to take of advantage of who we are during Covid and hopefully come out of that economically stronger than we were before.”

Venture capital, however, remains a concern. An analysis of 2021 Pitchbook data reveals that the Winston-Salem and Greensboro-High Point metros rank in the bottom 10 of 55 of the largest metros across the U.S., both in the number and value of venture capital deals. Pitchbook reported 10 deals in Winston-Salem for a collective $20 million, and five deals in Greensboro-High Point for a collective $50 million. The Raleigh-Cary, Durham and Charlotte-Gastonia-Concord MSAs each fell into the middle third of those 55 metros for 2021 based on the number of deals and the value.