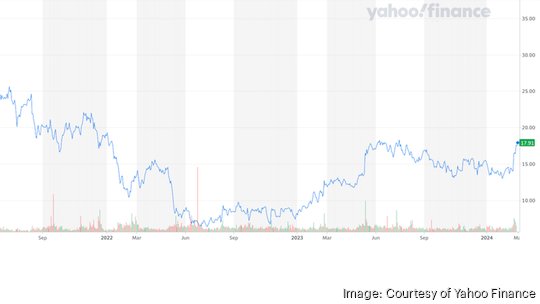

The value of the 43North Foundation’s stake in ACV decreased significantly from 2021 to 2022, tax filings show.

The foundation, formed by 43North to administer the proceedings from ACV’s initial public offering, had a total of $66.45 million at the start of 2022 from investments in publicly traded securities. By year-end, that number was about $46.39 million, based on public documents filed with the Internal Revenue Service.

Despite that 30% drop, $46.39 million still was a bit above the $40.64 million that the foundation made when ACV went public in 2021. Buffalo Business First first reported that amount last year based on public filings after those involved with 43North and its foundation declined to disclose the amount.

ACV’s stock price closed at $8.21 on Dec. 27, 2022. Since then, the price has risen, coming in at $15.15 as of market close Dec. 29, 2023. The price hit $17.51 as of market open Feb. 29, 2024.

“The market is vastly different today than two years ago,” said Bill Maggio, who chairs the 43North Foundation board and is past chairman of 43North. “The value of the portfolio at that time was a reflection of where the market was when the 990 was filed.”

The 43North Foundation’s IRS public documents for 2023 have not yet been filed, and Maggio did not disclose the financials from last year.

The foundation is materially different now than what is shown in the 2022 filings, he said.

"We're looking forward to getting to work to have ... a transformative impact on Western New York," Maggio said.

ACV, an online marketplace business for automotive dealers, is the first software startup founded in Buffalo to have achieved unicorn status, meaning it was valued at a billion dollars or more by the venture capital firms investing in it.

It also was the $1 million grand prize winner of 43North’s 2015 pitch contest. As part of the terms, the organization got a 5% equity stake in the then-private startup. The company has since grown to a company with about 2,000 employees globally. In March 2021, it became a publicly traded company on the NASDAQ.

The milestone marked not only proof-of-concept for the region that successful startups can be built here, but it also led to economic windfalls for multiple players in the Buffalo-area, including 43North, a largely state-funded accelerator and incubator.

In fiscal 2021, the 43North Foundation had net assets or fund balances of $67.4 million. That number dropped by year-end 2022 to about $47.25 million, largely due to a net unrealized losses on investments of about $20.85 million.

ACV had a net income loss of $102.2 million in 2022, compared to $78.2 million the year prior, according to the company’s U.S. Securities and Exchange Commission filings. The business’ net income loss for 2023 was $75.26 million.

J.P. Morgan analysts wrote in their Q4 2023 report: "With a large addressable market with plenty of whitespace, combined with ACV's robust inspection capabilities and continued focus on product and tech, we see potential for strong multi-year growth trajectory with improving profitability. We believe cyclic time is favorable today while valuation is also compelling at current levels in context of targeted growth rates and multiples at e-commerce bellwether peers."