The Western New York Impact Investment Fund was a bet that impact investing can work in Buffalo.

Four years later, its key stakeholders are saddling up for another ride.

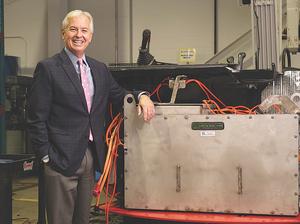

The Impact group is actively raising its second fund with a target of $8 million to $10 million, CEO Tom Quinn said.

Nearly $7 million has already been pledged through the fund’s initial group of partners – 11 philanthropies and individuals from Western New York – and Quinn said he’s confident the goal will be met with new participants.

New investors include a group of notable business executives, including Rene Jones and Brigid Doherty, Teo and Jennifer Balbach, and Jack Greco.

Quinn said that while he’s confident that he’ll hit the $8 million to $10 million target for the second fund, he is actively seeking more private individuals who are interested in participating. Besides their initial contributions, investors help source deals and mentor portfolio companies as they seek to grow.

“We’re raising again because we’ve proven what we set out to prove,” Quinn said. “There is a pipeline and a funnel of deal flow in Buffalo that meets our social and financial terms.”

The fund introduced the concept of impact investing in Buffalo, seeking to support the core financial success of companies along with their dedication to environmental sustainability, neighborhood development and other measures.

Its investments have included Garwood Medical Devices, a startup that established headquarters earlier this year on Northland Avenue in Buffalo; Viridi Parente, a lithium ion startup scaling its business in a former automotive factory on Delavan Avenue; and CleanFiber, a tech-enabled recycling firm which established a factory on the former Bethlehem Steel property in Lackawanna.

It also invested in Circuit Clinical, a fast-growing clinical trials startup based in Seneca One Tower.

“We believe in betting on our winners and that’s why you see us investing in some of these companies two or three times,” Quinn said. “We don’t get in and wait to see what’s going to happen. We stick with these companies.”

Quinn said the fund has also clarified and expanded its own understanding of “social impact” in the eight counties of Western New York. The group has a dedicated social impact committee that vets potential investments and monitors portfolio firms.

Foundations get an opportunity to take an ownership stake in the firms they are supporting, along with detailed ongoing feedback about how their money is being used.

“You give people money and then it makes money,” he said. “This is sustainable philanthropy.”