From the first idea to pre-seed. From seed to scale. Tech startups often need outside funding to support their endgame goals.

These days, Buffalo’s emergent technology scene has many more serious (as in, full-time) startup entrepreneurs who think their ideas can become the next big business in town.

Just as there are more startups themselves, the investment scene is also reshuffling around the funding opportunities that exist here.

Simply put, there are a lot more investors in town than 10 years ago. Sorting out where to go, and whom to pitch, can be confusing.

Here are some options:

The nonprofit, led by CEO Marnie LaVigne, was a startup itself not too long ago. Now it is a robust engine of early-stage investments throughout western and central New York.

Launch NY will consider startups at the very earliest stages, often partnering them with one of its Entrepreneurs-in-Residence and seeking to prepare companies to enter the market and court larger rounds of investment.

Launch NY has several investment vehicles – including a for-profit limited partner fund, a nonprofit fund, a network of investors who will consider deals on an individual basis and diversity-focused programs such as Founders Go Big.

UB Innovation Fund/Cultivator program

The University at Buffalo has placed a renewed focus on startup companies in recent years, including the introducing of its Incubator @ CBLS facility on the Buffalo Niagara Medical Campus, which hosts companies coming from the university and the community.

That program includes several related investment initiatives, including the Cultivator accelerator program, also aimed at early-stage companies seeking to validate their idea. Companies have access to up to $100,000 in funding as they complete phases of the program.

UB’s $10 million Innovation Seed Fund – capitalized through Empire State Development Corp. – also invests in local companies at the pre-seed and seed stage.

Western New York Impact Investment Fund

WNY Impact Investment Fund has invested more than $8 million in local companies since it debuted several years ago.

While not startup-specific, the fund actively considers local startups that can also articulate how they’ll have a positive impact on the community, whether through hiring in underprivileged communities or initiatives around the environment and diversity.

A co-founder of ACV Auctions, Greco has morphed into a whirlwind of startup investment activity throughout western and central New York, contributing to well more than half of the startup deals that get closed in Buffalo. Greco also leads the weekly Buffalo Bridge newsletter.

Greco is among a rising group of successful entrepreneurs-turned-angel investors in Buffalo. The list includes John Jahnke, the Orchard Park-based CEO of software unicorn Tackle.io; and Dan Magnuszewski, another ACV co-founder.

The mother of all U.S. startup business competitions exists in Buffalo. State-funded 43North completed its seventh competition in 2021 and is gearing up for another one this year. A handful of local startups typically end up as finalists each year, competing for a $1 million grand prize and $500,000 startup prizes (styled as investments). They also get a year’s worth of free office space in 43North’s incubator in Seneca One Tower and access to other services.

S2 Ventures Partners is the Traveling Wilburys of startup investment groups in Buffalo. The entity is led by Ron Faso and John Baldo, longtime leaders of another startup investment network. More recently, they enacted a merger of sorts with the group led by Chuck Lannon, one of Buffalo’s most prolific startup investors, who is handing off the keys to his own extensive network of investors (who have come together to support Athenex, PostProcess Technologies and Circuit Clinical, among other companies). The combined super group will make investments out of S2, with Faso and Baldo planning to take active roles investing in local startups.

Scott Friedman and Andrea Vossler lead the Varia Ventures project, an investment entity that also provides consulting and legal services to startups.

Buffalo-based Varia Ventures is among the local groups to invest in Viridi Parente, the lithium ion battery startup on Buffalo’s East Side; and MimiVax, a Roswell Park Comprehensive Cancer Center spinoff.

Grand Oaks is the family office brand for billionaire entrepreneur Tom Golisano, who founded Rochester-based Paychex and is the former owner of the Buffalo Sabres.

Golisano has become an important part of Buffalo’s startup ecosystem, pushing on even after the well-publicized implosion of Bak USA. Grand Oaks is the lead investor in Viridi Parente, has invested in PostProcess Technologies and also supported Kickfurther, a fast-growing crowdfunding/inventory startup that moved to Buffalo after winning a 43North award.

Another Rochester-based investment source with a heavy interest in Buffalo, Impellent Ventures launched its first venture capital fund in February 2020 (led by an investment from Grand Oaks and other limited partners).

Impellent Ventures is led by managing partner David Brown and has invested in several Buffalo startups, including Ognomy, 3AM Innovations and Kickfurther.

Led by native Western New Yorker Lauren DeLuca, Motivate Capital is preparing for its second venture capital fund. Motivate Capital, which is based in Chicago, invested in Buffalo-based HELIXintel in its first fund. The fund has a region-agnostic approach to its portfolio but DeLuca has a deep local network and an affinity for his hometown.

Empire State Development Corp.’s venture capital arm invests primarily in seed and Series A rounds, and has contributed to a handful of Buffalo startups over the years. Its portfolio includes Kangarootime, PostProcess Technologies, SomaDetect and ShearShare. New York Ventures is led by Jennifer Tegan, who previously had success as one of the leaders of Ithaca-based venture capital firm Cayuga Venture Fund.

The Buffalo Angels were among the vanguard of early-stage capital sources in Buffalo, and continued actively investing in local startups through the pandemic. Now, having mostly spent through its second fund, the group is considering whether to raise more money or proceed in another way. Individual members of the Buffalo Angels group are known for investing their own money alongside the fund in deals they particularly like.

The Buffalo Angels are associated with the Western New York Venture Association, which hosts open-to-the-public meetings with presentations from startup companies.

The Rochester analog of the Buffalo Angels – an accredited network from the business community who come together to support local startups. The Rochester Angels have been known to come into deals in Buffalo – most recently investing in Circuit Clinical.

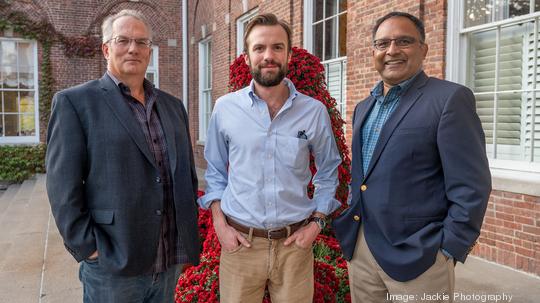

Syracuse-based Startfast is an early-stage venture capital firm investing out of its second fund. Led by managing partners Nasir Ali, Chuck Stormon and Mike Quigley, Startfast recently made its first Buffalo-based investment: backing Buffalo digital health firm Patient Pattern.

Speaking of firms with local ties that recently made their first local investment, Chloe Capital recently invested in ShearShare (The connection began at October’s 43North competition, where Chloe Capital partner Kathryn Cartini watched ShearShare pitch and eventually win an award).

Chloe Capital is a seed stage venture capital firm with partners based in Ithaca and the Albany region, and which invests in high-growth, women-led startups.

University of Rochester-affiliated Excell Partners is a venture capital firm that has been investing in startups across New York state for years, with an increasing emphasis on backing diverse teams.

Syracuse-based Armory Square Ventures was among the early investors in ACV Auctions. While ACV remains its only local investment, Armory Square’s portfolio spans New York state.