Boston-area startups, tech companies and related firms brought in a grand total of $5.1B last month, fueled by major raises by biotech and software companies.

The largest raise was in biotech: Gene therapy startup Dyno Therapeutics signed a $1.8B agreement with drug giant Roche and its subsidiary, gene therapy pioneer Spark Therapeutics, to develop treatments for CNS- and liver-associated diseases. Close behind in dollar signs was Vista Equity Partners’ new $1.7B investment in Somerville software startup SmartBear.

A handful of venture capital firms, which are listed below but which we did not include in the total, also raised a collective $1.1B, which will be invested in the coming months.

FYI, we cover startup funding news in the BostInno Beat newsletter every weekday. Stay on top of who’s getting funded by signing up right here. See you in the inbox.

Below are the startups and related firms that raised capital in October, according to data compiled by BostInno.

Autonomous Vehicles

Autonomous boat startup Sea Machines raised $5M in the second tranche of its Series B round, bringing the round to $20M total. This second close included follow-on investments by the Brunswick Corporation, TechNexus, Toyota AI Ventures, NextGen Venture Partners and Dolby Family Ventures. BostInno wrote about the first tranche in July.

Biotech

Boston- and Miami-based Aegle Therapeutics, a biotech developing extracellular vesicles as therapy, closed a $6.5M Series A round from Tellus BioVentures, New World Angels, DEFTA Healthcare Technologies and DeepWork Capital. Aegle’s therapy is initially being developed to treat dystrophic epidermolysis bullosa.

Invetx, which is developing therapeutics for animal health, raised an additional $10.25M in Series A financing, bringing the total amount to $25.5M. New investors include Casdin Capital and funds managed by Tekla Capital Management.

AZTherapies, a Boston-based biopharma developing neuroinflammatory disease treatments, closed a $33.6M Series C-1 financing led by Duopharma Biotech Berhad.

Growing genomics testing company Sophia Genetics, headquartered in Boston and Switzerland, raised $110M in a Series F round led by Israeli-based investor aMoon and Japanese conglomerate Hitachi’s venture arm. Sophia will use the funding to nearly triple its Massachusetts staff.

Framingham-based Alzheon, a clinical-stage biotech developing medicines for Alzheimer’s and related diseases, raised $2.4M in equity in a $50M funding round, per an SEC filing.

Cambridge-based Vigil Neuroscience raised $30M in equity in a $50M funding round, per an SEC filing.

Cambridge-based Walden Biosciences launched with a $51M Series A round led by ARCH Venture Partners and UCB Ventures. Walden is seeking to develop breakthrough medicines that reverse the progression of both rare and common forms of kidney disease and restore renal function.

Cambridge-based Janpix, a biotech company developing monovalent small molecule protein degraders of STAT proteins as novel therapeutics, closed a $10M Series B round led by Medicxi.

Nimbus Therapeutics pulled in $60M from two new investors, RA Capital Management and BVF Partners.

Gene therapy startup Dyno Therapeutics inked a $1.8B deal with drug giant Roche and its subsidiary, gene therapy pioneer Spark Therapeutics, to develop treatments for CNS- and liver-associated diseases.

Instylla, a Bedford-based company developing minimally invasive liquid embolic products designed for use in peripheral vascular embolotherapy, closed a $25.4M Series B round. Backers included new investors Excelestar Ventures, Catalyst Health Ventures and Amed Ventures.

Waltham-based GoodCell (officially LifeVault Bio) raised $17.9M in equity, per an SEC filing.

Bedford-based Ixcela, a biotech startup that can conduct a gut health test via a pinprick of blood, raised $3.8M in equity in a $5.3M funding round, per an SEC filing.

West Bridgewater-based Theromics, a startup behind a radiofrequency and microwave medical device technology to optimize ablations of lesions and soft tissue, raised $1M in equity in a $2M funding round, per an SEC filing.

Be Biopharma launched with $52M in financing and a scientific approach developed at Seattle Children’s Research Institute. The Series A round was led by Atlas Venture and RA Capital Management, with the Longwood Fund, Takeda Ventures and others joining in on the action.

AavantiBio, a Cambridge-based gene editing company, launched with a massive $107M Series A round. Perceptive Advisors, Bain Capital Life Sciences, RA Capital Management and Sarepta Therapeutics all participated.

Talaris Therapeutics closed a $115M Series B round led by Surveyor Capital and Viking Global Investors.

Scorpion Therapeutics launched with $108M to develop what it hopes will be the next generation of precision medicines: treatments that target specific, individualized genetic targets linked to a patient’s ailment.

Woburn-based microfluidics startup Erbi Biosystems raised $2M in equity, according to an SEC filing.

Solid Biosciences, a Cambridge-based firm focused on treatments for Duchenne muscular dystrophy, raised $40M in equity, per an SEC filing.

Flagship Pioneering spinout Senda Biosciences launched with $88M in funding. The biotech plans to combine knowledge in the microbiome — the trillions of bacteria naturally abundant in and around the human body — computational biology, environmental genomics and more to create new drugs.

Q32 Bio, a Cambridge biotech developing biologic therapeutics to restore healthy immune regulation, closed a $60M Series B financing co-led by OrbiMed Advisors and Acorn Bioventures.

Centrexion Therapeutics, a biotech focused on developing and commercializing non-opioid, non-addictive chronic pain drugs, raised $40.5M in equity, debt and convertible notes, with Lilly and Exome Asset Management joining as new investors.

Cleantech & Greentech

The Massachusetts Clean Energy Center (MassCEC) and the Baker administration announced $1.6M in funding for 12 energy efficiency and clean energy startup companies and researchers. The funding comes from the MassCEC’s Catalyst, InnovateMass and AmplifyMass programs. Here are the awardees:

- Altus Thermal (Melrose) - $65K

- Onboard Data (Cambridge) - $250K

- ADL Ventures, LLC (Boston) - $125K

- Worcester Polytechnic Institute (Worcester) - $150K

- Fraunhofer USA (Brookline) - $127K

- Alloy Enterprises (Somerville) - $65K

- Castalune LLC (Boston) - $65K

- Harvard University (Cambridge) – $65K

- Makoto US (Brookline) - $65K

- University of Massachusetts Lowell (Lowell) - $65K

- Titan AES (Salem) - $250K

- Montague Bikes (Cambridge) - $250K

Bridging Recovery for Innovators Driving Green Energy Solutions (BRIDGES), a program backed by MassCEC, Breakthrough Energy Ventures, Schneider Electric, Clean Energy Venture Group and Saint-Gobain NOVA, announced $1.9M in funding for eight local cleantech startups. Each of the below companies will receive $100K:

- AeroShield (Cambridge) manufactures super-insulating transparent materials for energy efficient windows.

- Blackburn Energy (Amesbury) created RelGen, a hybrid charging solution that is road-proven and charges truck batteries faster to provide power for autonomous sensors, liftgates, air conditioning and components such as electric pumps or fans, while reducing emissions in the global trucking market.

- Boston Materials (Bedford) is enabling the mass-adoption of lightweight composites to drastically reduce transportation emissions.

- EnergySage (Boston) is a marketplace for solar energy and battery systems, as well as community solar, allowing both residential and commercial customers to comparison-shop online.

- Raptor Maps (Somerville) builds software that analyzes solar plant performance and organizes the data into a transparent system of record.

- Solstice (Cambridge) offers a turnkey platform for the community solar industry, educating and connecting communities to solar gardens and creating financial innovations such as EnergyScore that expand renewable energy access.

- Transaera (Somerville) is developing energy-efficient, sustainable cooling using novel composite materials.

- WeSpire (Boston) is a behavior change technology platform that helps companies engage their workforce in sustainability, wellbeing, social impact and inclusive culture initiatives that drive environmental, social and business value and inspire employees to build a better working world.

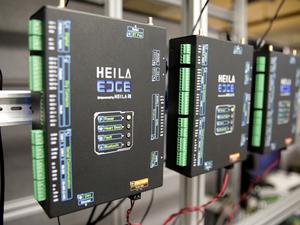

Heila Technologies, the five-year-old Somerville startup that develops hardware and software to integrate renewables and batteries on a microgrid, pulled in a $2.5M seed round to build out its technology platform. The round was led by Table Rock Infrastructure Partners, an equity firm focused on helping municipalities with critical infrastructure projects, with support from the MassCEC and other individuals.

ZwitterCo, a Boston-based startup that uses nanofiltration membranes to filter wastewater and one of our 2020 Startups to Watch, raised $1.9M in equity in a $3.5M funding round, per an SEC filing.

Ginkgo Bioworks spun out a new startup: Allonnia, a Boston-based bioremediation company focused on waste management challenged like industrial wastewater treatment, soil remediation and solid waste management and upcycling. Allonnia has pulled in a $40M Series A round backed by Ginkgo Bioworks, Battelle, General Atlantic, Cascade Investment and Viking Global Investors. Within a day of officially launching, Allonnia said it was awarded $2M by the U.S. Department of Energy to develop new methods for deconstructing and upcycling existing plastics. This is a collaboration with Battelle Memorial Foundation and the National Renewable Energy Laboratory, per an email to BostInno.

Cybersecurity

Harvard-based Oort, an early-stage startup focused on the intersection of cybersecurity and edge computing, raised $3.5M in equity in a $3.9M funding round, per an SEC filing.

Cybersecurity firm Onapsis raised $55M in Series D financing led by Caisse de dépôt et placement du Québec and NightDragon with participation from .406 Ventures, LLR Partners and Arsenal Venture Partners.

NormShield, a Boston-based cyber risk rating startup, closed a $7.5M Series A round. The round was led by Moore Strategic Ventures with participation from existing investors Glasswing Ventures and Data Point Capital.

IoT data integrity startup Aperio Systems closed an $8.5M Series A round led by National Grid Partners, the venture investment and innovation arm of National Grid.

Edtech

Text message-based learning platform developer Arist brought in $1.9M in seed funding led by Acadian Ventures, Global Founders Capital and Craft Ventures, with participation from Y Combinator—which Arist graduated from earlier this year—Soma Capital, Emles Venture Partners, Hack VC, Rebel Fund and Liquid 2 Ventures. Arist also secured checks from angel investors Derek Schoettle, CEO of Cloudant, and Adam Goldstein, founder of Hipmunk.

Fintech

PayByCar, a Boston-based fintech startup behind an in-vehicle payment platform, completed a $2M pre-seed round of funding consisting of convertible notes, per an email. PayByCar did not disclose investors beyond the descriptions of “a leading firm in intelligent transportation systems” and “a leader in the connected car sector.”

ConnectPay, a Foxborough-based online payroll services provider, raised $6M in debt, per an SEC filing.

Funds

Boston-based VC firm OpenView Venture Partners, which focuses on business software, closed its sixth and largest fund at an oversubscribed $450M.

Boston-based biotech-focused venture capital firm RA Capital Management raised $461M for its second venture fund.

The Engine, the venture firm spun out of MIT to tackle “tough tech,” raised $230M for its second fund, mostly from MIT with Harvard joining as a limited partner.

Health Tech

Boston-based Etiometry, which develops clinical decision-support software for the intensive care environment, raised $2M in equity in a $7M funding round, per an SEC filing.

Waltham-based digital health startup Linus Health raised $9.9M in equity, per an SEC filing.

Burlington-based health care startup Squid Ink raised $30.2M in equity, per an SEC filing.

Cohere Health, a Boston-based digital health startup, closed a $10M funding round led by Flare Capital Partners and Define Ventures.

Boston-based Whoop closed a $100M financing, making the startup behind the eponymous fitness tracker a so-called "unicorn." The Series E round, led by IVP, a California-based later-stage venture capital firm, brought Whoop's valuation to $1.2B and counts SoftBank Vision Fund 2 as a new investor.

Medical Devices

Encora Therapeutics, a medical device startup working on building affordable, non-invasive neurostimulation devices for those affected by movement disorders, raised $1.3M in pre-seed funding. The round was led by Innospark Ventures, with participation from Good Growth Capital (GGC), the Technology Accelerator Company and the SDX Holding Company.

Lexington-based medical equipment manufacturer Hemanext raised $16.8M in equity in a $44.5M funding round, per an SEC filing.

Boston-based medical equipment manufacturer Renovia raised $5M in equity in a $14.5M funding round, per an SEC filing.

Other

Menstrual product startup The Organic Project (TOP) received a $5K Covid-19 relief and recovery grant from The Red Backpack Fund, an opportunity for small businesses and nonprofits from The Spanx by Sara Blakely Foundation. Read more about TOP here.

Wareham-based craft cannabis company Trade Roots closed $4.9M in Series A financing from Greg Wirsen, Liz Wald and others.

Boston-based Perch, a company that acquires and operates top Amazon Marketplace businesses, closed $123.5M in new financing. The round was led by Spark Capital and includes past investor Tectonic Ventures, with Boston Seed as a new investor.

Harvard Business School and Harvard's Department of Stem Cell and Regenerative Biology received a $25M gift from 1993 alumni Chris and Carrie Shumway to fund programs promoting leadership in life sciences, including the new joint degree MS/MBA Biotechnology: Life Sciences.

Robotics, Hardware & IoT

Boston-based Realtime Robotics raised $2M in equity in a $10M funding round, per an SEC filing.

Eight-year-old actnano, a Cambridge-based startup behind safe nanocoatings for printed circuit boards, pulled in $12M in a Series A round. The round was led by Emerald Technology Ventures, with Material Impact, Henkel Tech Ventures, GC Ventures America and Ireon Ventures participating.

Worcester-based IoT startup BluStream raised $1.1M in equity in a $1.2M funding round, per an SEC filing.

WoHo, short for “World Home,” launched with the mission of reimagining prefabricated construction with sustainable materials that can be retooled into homes, retail spaces, laboratories or parking garages. WoHo kick-started its mission with $4.5M in seed funding led by The Engine, MIT’s venture fund dedicated to “tough tech” problems.

Watertown-based wireless power transfer startup WiTricity closed a $34M investment round led by Stage 1 Ventures with participation from Air Waves Wireless Electricity and a strategic investment by Mitsubishi Corporation.

Software

Boston-based CrowdComfort, a mobile app that enables employees to report service requests with geolocation, text and photos, raised $5.8M in equity in an $8.9M funding round, per an SEC filing.

Cambridge-based API infrastructure company Solo.io raised $23M in a Series B round co-led by prior investors Redpoint Ventures and True Ventures.

Digital preservation startup Preservica received an additional $3.8M investment from Mobeus Equity Partners.

OmniView Sports, Boston-based maker of YourZone, an app that integrates fantasy leagues and sportsbooks to personalize how fans watch sports, raised $630K of its latest $2M seed financing round.

Tone, a Boston-based texting platform for brands to communicate with customers, raised $4M in seed funding led by Bling Capital with participation from Day One Ventures, One Way Ventures and TIA Ventures.

Cambridge-based Ovation.io, which develops solutions for molecular diagnostics labs, raised $21.3M in equity in a $21.5M funding round, per an SEC filing.

Smartvid.io raised $5M in new financing led by insurtech-focused firm IA Capital Group, with participation from Building Ventures, Companyon Ventures and Converge, among others.

Boston-based Syrg, a startup that helps connect workers with gigs, raised $3.8M in equity in a $4.8M funding round, per an SEC filing. ICYMI, Syrg CEO Rahkeem Morris appeared on the Boston Speaks Up podcast earlier this year.

Unison Computing, a Somerville-based public benefit corporation behind an open-source functional programming language, raised $4.7M in equity, according to an SEC filing.

Boston-based Ambassador Labs (f.k.a. Datawire), developer of the Kubernetes-native API gateway Ambassador, secured $18M in Series B funding led by global venture capital and private equity firm Insight Partners.

Worcester-based Blustream, an after-sale customer engagement company, raised $3M led by York IE.

Sym, a Boston, MA- and San Francisco, CA-based security workflow platform for engineers, disclosed the investors in its $9M Series A round. The round was led by Amplify Partners, with participation from angel investors Gerhard Eschelbeck, former CISO of Google; Sri Viswanath, CTO of Atlassian; and Jason Warner, CTO of GitHub. Sym disclosed in an SEC filing a day prior that it had raised $12.2M in equity.

SmartBear took on a 50 percent investment—the equivalent of about $1.7B, Axios reported—from Vista Equity Partners. The Somerville-based software company now splits its ownership between Vista and Francisco Partners.

The Wanderlust Group, which includes subsidiary marina operating platforms Dockwa and Marinas.com, closed $14.2M in Series B funding. It is using that funding to double down on its mission of bringing the outdoors online, starting with a new platform called Campouts, which CEO Mike Melillo calls “the RV version of Dockwa.”