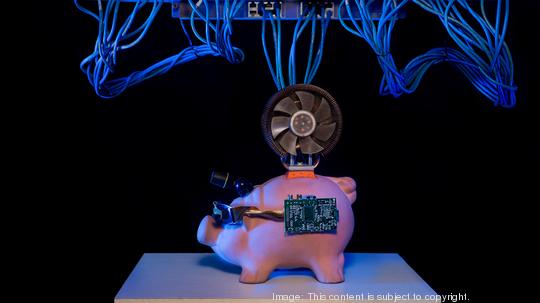

Cryptocurrencies have polarized audiences.

There are those who claim that it's the digital revolution world economies have been waiting for, and then there are those who dismiss it as a sophisticated Ponzi scheme. Either way, there is no escaping from the flurry of companies riding the surging wave.

And the latest entrant is a company called Oneiro NA that's launching a VC-backed, unpegged digital currency called 'ndau' (pronounced en-dow). The founders of this new coin claim that it's "the world's first buoyant coin optimized for long-term value."

Oniero NA is a Boston-based company run by an assorted group of tech professionals specializing in fintech -- its CEO Jim Kent was most recently the CFO of Foxboro-based software automation company, ICONICS Inc.

ndau's founding principle is not baseless: Even with all its shiny promises as the currency of future, Bitcoin's volatility has been a sticking point for most investors. The Bitcoin volatility index stands at 2.77% for a 30-day estimate.

And Oneiro is positioning ndau to counter that instability by incentivizing investors to hold the currency long-term (the team defined long-term as one year). They do this by levying an extra fee for selling the coin when the market is down, making it harder to liquidate. "If ndau's price is depressed, you would have to pay an extra fee to sell it," said Ken Lang, CTO at Cosimo Venture Partners, a Boston-based early-stage VC fund that is backing Oniero.

Boston-based COSIMO recently launched COSIMO X -- a tokenized VC fund focusing on early-stage deep tech companies with a particular concentration on blockchain technology, spanning industries such as artificial intelligence, AR/VR, IoT, and cybersecurity. The fund claims to disrupt the traditional VC model by issuing tokens that are tied to the fund's portfolio companies, mostly in deep tech and blockchain technologies.

Venture capital activity in cryptocurrency startups has only been on the rise. From December 2017 to March 2018, crypto startups raised $434 million in VC funding, the most ever for a three-month period. To what end? According to Bitcoin News, 46 percent of the initial coin offerings launched in 2017 have already crashed and burned, despite raising a whopping $104 million. And an additional 113 projects are considered to have “semi-failed.”

If that's not alarming enough, this should be: the Securities and Exchange Commission is not going easy on digital currencies. It recently rejected several proposals for a bitcoin ETF (In July it rejected Winklevoss twins' proposal for the same), and earlier this week, in its first-ever enforcement action, fined a cryptocurrency hedge fund and an ICO superstore for false advertising, misrepresentation and illegal sales.

The merits of blockchain technology and its decentralized structure also serves as a sticking point among critics. In June last year, the Financial Times pointed to an academic paper published by researchers at the University of Cagliari in Italy that studied Ethereum's potential to propagate Ponzi schemes.

"Blockchains and smart contracts might really be the next “disruptive” technology, as many companies, newspapers, and researchers start to believe. However, they can also offer new opportunities to tax-evaders, criminals, and fraudsters, who can take advantage of their anonymity and decentralization....Overall, we have observed that, in these first 1.5 years of life of Ethereum, there have been a multitude of experiments to implement Ponzi schemes as smart contracts: indeed, ∼ 10% of the 1384 contracts with verified source code on etherscan.io are Ponzi schemes."

That shouldn't be bewildering when you consider that $1.1 billion in cryptocurrency was stolen in the first half of 2018 and with ease. Remember when a 20-year-old Boston student alone stole $2M by hacking phones?

While ndau claims to have built-in stabilization and governance, the dollar proceeds from the sale of the coin go to a fund that acts like an endowment fund investing in assets like hedge funds, precious metals, and equity that are still subjected to market risks.

Only time and money can tell if ndau be just another also-ran or an outlier. But cryptocurrencies are in a long tunnel that hasn't seen the light yet.