Startup investor Techstars is actively raising capital for its next fund.

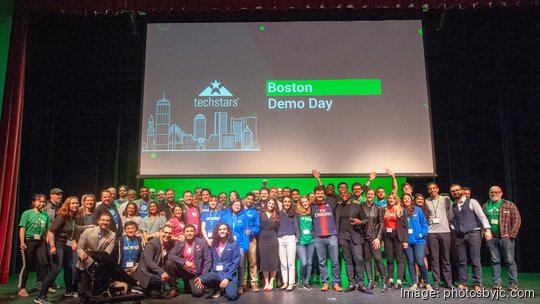

Techstars offers in-person, virtual and hybrid accelerator programs across 36 cities and 12 countries, including in Boulder where the organization is based, and in Boston. Since its founding in 2006, it has invested in notable Boston businesses like Bevi, which went through the Techstars winter 2014 program and raised $70 million last year, and CareAcademy, a 2017 Techstars participant that recently acquired a digital healthcare training and job placement company and secured an investment from a Goldman Sachs fund.

According to a recent filing with the U.S. Securities and Exchange Commission, Techstars plans to raise up to $150 million. It is unclear when the company plans to close this latest fund and how exactly the capital will be used.

Techstars declined to comment due to regulatory restrictions.

In March 2022, Techstars partnered with JPMorgan Chase & Co. (NYSE: JPM) to invest $80 million in nine cities around the U.S. In April 2022, Techstars announced a new fund called the Rising Stars Fund, which supports underrepresented founders of U.S.-based, early-stage companies.

Prior to that, it raised $42 million in 2019 for global expansion.

This latest round comes at a time when venture capital activity across the U.S. is on a decline due to the failures of financial institutions like Silicon Valley Bank and steep inflation. It also comes as experts are predicting startups will have a harder time raising capital, making investors like Techstars increasingly important.

Techstars had a long partnership with SVB. The bank even become a national sponsor for the accelerator program 12 years ago and offered special rates to Techstar startups.

"SVB played a major role enabling founders to build businesses," Techstars CEO Mäelle Gavet told the DBJ in April. "Depending upon what shape it takes in the future, there is a real likelihood that startups will have a harder time getting banking services or capitalizing their early-stage companies."

Helping early-stage companies grow and raise capital is something Techstars has done for the last 17 years.

Techstars started in Boulder, launching its first accelerator program in 2007. Although legally still based in Boulder, Gavet previously told the DBJ that the company is “very, truly distributed, from a physical perspective and a mindset perspective.”

As of last April, Techstars had employees in more than 30 U.S. states and 16 countries, with only two people on the leadership team based in Colorado.

The next local accelerator program will take place in Boulder and begin on July 10 with a focus on pre-seed and seed-stage startups in the B2B fintech realm. This accelerator is one of two Boulder programs offered each year.

Hannah Green contributed to this story.