While Greater Boston may not yet be the nation’s premier cybersecurity center, a new report highlights the region’s role as a fast-growing hub for this in-demand technology.

The report found that Greater Boston’s cluster of companies, universities, research organizations and investors have bolstered the local cybersecurity industry, even in the face of a global pandemic and shift in workstyles. Funding continues to flow to Boston-area cybersecurity companies, and analysts from this report expect numbers to remain high in 2022.

“The first quarter looks strong,” said Joe Maglitta, a content strategist and consultant who served as an analyst and editor of the report. “Everybody I’ve talked to believes that it will surpass this figure next year. So, 2021 was the record year, 2022 should be even more record-y.”

The report was published by Value Creation Labs (VCL), a management consulting group with a focus on digital production and venture capital, which launched in conjunction with this report. VCL was founded by Zach Servideo, a business consultant and host of the “Boston Speaks Up” podcast syndicated by BostInno. The group has already partnered with the likes of Endicott College, Vevo and Precise TV.

“We breathe enthusiasm, strategy and design into brands,” Servideo said in a statement. “We’re not trying to be a traditional venture group. Our model is a problem-solving model — more reminiscent of a management consulting firm — and our long-term goal is to develop our own IP and operate a next gen venture studio.”

Silicon Valley Bank, the New England Venture Capital Association, Glasswing Ventures and Accomplice partnered with VCL for this report.

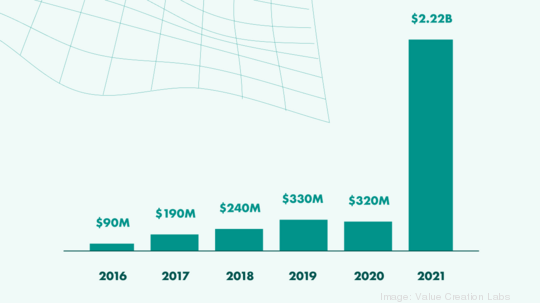

Year-over-year funding to Massachusetts cybersecurity companies increased fivefold last year, the report found. In 2021, investors funded 34 deals in companies totaling $2.75 billion, up from 26 deals for $530 million in 2020. Maglitta said funding in this industry has increased ten times the amount from 2015.

The vast majority of funding went to Boston-based companies, which brought in $2.22 billion in 2021. The largest deal was a $605 million Series F round for Synk.

“We knew there was activity happening,” Maglitta said. “The big surprise was how much the money had increased over not only the last five years, but the last year. That was really the thing that popped out.”

Maglitta said this growing investment in cybersecurity reflects the increased use of technology by companies and individuals, which is leading to an increase in cyber threats. The world saw a 105% surge in ransomware cyberattacks last year, according to the most recent SonicWall cyber threat report.

“Everything needs defending now, is kind of the shorthand of it,” Maglitta said. “It used to be you’d get people coming in over the moat in the castle. Now they’re coming in above you, below you, through the walls, hiding in Trojan horses. It’s kind of everywhere, all the time, from a bunch of different sources.”

The report also highlights growing cybersecurity sub-sectors. Maglitta said platforms that allow companies to combine a patchwork of tools will become more popular. At the same time, security companies that specialize in serving specific industries, like health care and fintech, will become more common. Maglitta said they also predict employing advanced analytics and AI and using clouds as the preferred delivery platform will grow.

Maglitta said it’s too early to say that Massachusetts is the nation’s cybersecurity hub — he thinks that title is still held by California. But the experts he spoke to for this report said it still matters where your security company is located, even after the remote-work shift, and Greater Boston is a strong environment for these types of companies.

“You’ve got a really deeply entrenched ecosystem here. We’ve got the investors that kind of all know each other. They know the universities. They have rich networks inside the companies. And you’ve got this endless stream of top-quality talent coming through the universities,” Maglitta said. “And yes, there are plenty of other smart people other places. But having that concentration of money, of talent…is a huge advantage.”