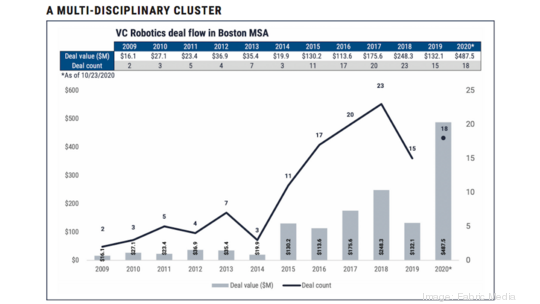

Since 2014, Massachusetts' robotics industry has been booming. And according to a new report from Fabric Media powered by the New England Venture Capital Association, much of that boom can be attributed to one subsector: microlocation.

With their ability to pinpoint and drive to hyperspecific locations on factory floors, microlocation robots like those being developed at Locus Robotics and Vecna Robotics — are poised to drive a revolution in warehouse operations, according to the report. In fact, Locus Robotics is the top venture capital-backed startup in Greater Boston, now valued at $360.9 million. (BostInno was the media partner for the report but did not have a hand in its development.)

Coming in close behind, each with more than a $200 million valuation, were Vecna Robotics, Berkshire Grey and Humatics. Each of these companies has recently expanded its footprint in Massachusetts: Vecna announced it would double its headcount, to up to 300 people, after a Series B round a year ago, and Humatics tripled its headcount after closing its Series A financing.

The microlocation technology underpinning these companies has a wide range of possibilities. It also allows for autonomous driving — earning Sea Machines, the self-driving ship startup, a place in the report — and also holds promise to further automate warehouse operations.

The market for autonomous robots is expected to grow as more warehouse operators adopt the technology, MassRobotics executive director Tom Ryden told BostInno in an interview. In addition to "picking" robots, which pick inventory from warehouse shelves and deliver them to humans, local roboticists are also developing robotic arms with mobile manipulation capabilities, meaning that they can move almost like a human hand could. Ryden says that's the "holy grail" of robotics manufacturing right now, but adds that we're still in the early days of deployment on factory floors.

While warehouse robot adoption has increased significantly over the last several years, it has still been slow to ramp up due to the systematic overhaul adding robots requires. Ryden thinks the Covid-19 pandemic could light a fire underneath potential buyers.

"The pandemic has changed the nature of how we buy, but that doesn't mean that last year, everybody suddenly automated their warehouses," Ryden said. "I think we're at the start of that. I think the pandemic has highlighted a number of different areas where robots can help. We've seen disinfecting robots, which have been in development for about a year, start to come online locally."

In the report, the authors detail several key technologies that are responsible for the growth of Massachusetts' robotics industry: cobots (a portmanteau of "collaborative robots"), ultra-wideband radio, 3D visioning and robotics sensing platforms. The full report is available for download here.

Multiple robotics investors told Fabric Media that Massachusetts is perhaps the only place in the U.S. with an ecosystem that is adequately developed to support new hardware startups. “If I was going to start a robotics company, it would be in Boston, because the caliber of the network would improve the probability of success,” Denver-based Trevor Zimmerman said in the report.

Much of that is fueled by the local academic environment — MIT, Harvard University, Boston University, Northeastern University and Tufts University all have relatively robust robotics programs, Ryder pointed out. But it is also fueled by the long success of hardware companies in the area. Kiva Systems' acquisition by Amazon in 2012 spurred the creation of one of the nation's most innovative robotics firms: Amazon Robotics. Meanwhile, iRobot, founded more than 30 years ago, is responsible for a slew of spinout startups, including Tertill and Root Robotics.

Plus, there are incubators dedicated to hardware or that have hardware-specific tracks. When MassRobotics launched in 2015, it was among the first robotics incubators in the U.S.; now, it houses 57 startups at a recently expanded facility in the Seaport District.

"Massachusetts really does have a very strong ecosystem," Ryder said. "A substantial amount is driven by the fact that we have great universities; that's starting to feed into the development of new companies. There are other cities that have great robotics universities, but they might not have the VCs. They might not have the support community — the lawyers and everybody else who knows how to do startups."