Venture capital funding in female-founded startups has dropped for the first time in more than a decade, according to a new report from PitchBook.

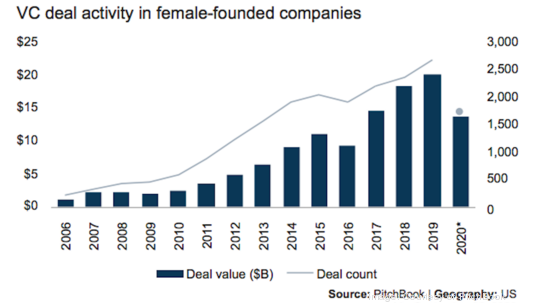

In the first three quarters of 2020, startups with at least one woman on their founding team raised a collective $13.8 billion in VC funding — a 31 percent decline from the same period in 2019.

The Covid-19 pandemic has taken a special toll on female founders, according to the authors of the report, which was sponsored by Microsoft for Startups and Beyond the Billion, and developed in partnership with All Raise. They cite a survey by the Female Founders Alliance, which found that pre-pandemic, 87 percent of respondents were “somewhat or highly likely to start a company,” but six months later, more than half had delayed or scrapped those plans.

But Boston-area investors and founders note that founders aren’t the source of the problem. The dip is also fueled by investors, whose checks have gone to a smaller portion of female-founded startups than in years past.

“It seems that Covid has made investors double down on what is familiar, both literally (they have reserved investment for current portfolio companies, which tend to be already white-male-led), and they have fallen back on pattern-matching habits for what they perceive are ‘safe’ investments (tech companies led by men),” reads an email from Marie Meslin, executive director of The Capital Network, a Boston-based nonprofit that works to connect entrepreneurs with funding.

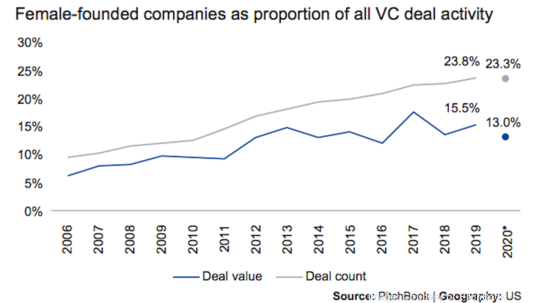

Female-founded companies based in the U.S. represent 23.3 percent of all VC rounds closed by Sept. 30, down from 23.8 percent in full-year 2019, according to PitchBook’s analysis.

Sarah Hodges, a partner at Pillar VC, points out that even if founders had scaled back their plans for 2020, there are still plenty of women starting companies. In fact, the last two investments Pillar VC made were in women-led startups.

“This isn’t a pipeline problem,” she said. “If we want to solve this problem, we as investors have to commit to building diverse networks, opening access to capable founders who are being overlooked today.”

Rana el Kaliouby, founder and CEO of Boston-based AI startup Affectiva and a member of the steering committee of All Raise’s Boston chapter, had this to offer: “When we started our raise, my co-founder and I experienced first-hand how difficult it is for women to gain access to VC,” she told the report's authors. “Investors tend to invest in people who look like them, and there we were, two female scientists from MIT talking about emotions and technology. Then, I wore a hijab and was a new mother. And while we persisted, successfully raising $53 million to date, it concerned me that there is little diversity within venture firms.”

That is not to say that female founders haven’t made great strides over the last 10 years. According to PitchBook’s analysis, female-founded exits increased 16 percent year-over-year, while male-founded exits actually declined by 2 percent. And although it remains to be seen what the fourth quarter will bring, 2020 is on pace to be the 10th straight year that female-founded companies exited faster than their male-founded counterparts.

It is also possible — though not necessarily likely — that Q4 will alter the landscape of dealmaking before we close out the year. The New York Times reported this week that startups are fielding a sudden influx of investor calls in an end-of-year “frenzy.”

Now, all eyes will be on what kinds of founders receive those checks.

“The U.S. is becoming a minority-majority country,” Meslin said. “If you don't start investing in new-majority founders and women at some point, you won't find many investments, have a competitive portfolio and increase your returns by addressing new markets.”