When illicit drugs crept into Liz Read’s life, she began looking for a way to help her family – and millions of others like hers.

That call to help others and take action when encountering hardships due to a loved one’s drug use disorder is how Birmingham-based ClearMIND was born

The subscription-based digital platform provides a family-focused approach to monitoring substance use with randomized drug testing and results sharing, as well as education, in an effort to rebuild trust.

Read, founder and CEO of ClearMIND, was able to recently secure over $1 million in funding. Her strategy has involved participating in local competitions and gathering funding from several angel sources, including the Gorrie family, Jemison Investment Co., Liz Pharo and Alan Ritchie, who ultimately joined ClearMIND.

But Read said obtaining funding for the first time wasn’t easy, especially in a realm she’s passionate about – and being in Alabama has a lot to do with the difficulties associated with raising capital.

“No one tells you this in the beginning, but raising money for something that you’re passionate about is challenging because obviously you have a goal you have to hit in order to do what you want to do with your business and getting it off the ground,” Read said. “But it’s also incredibly emotional because you care so much about what you’re doing, and you want that mission to be something that others can relate to and want to support.”

Experts say there are very few sources for funding in the state, and while there are multiple issues to tackle, different organizations and the Alabama Innovation Commission are working to attract more investors.

Funding sources

Having a great idea and product is critical in any startup or entrepreneurial venture. Obtaining funds early in the process and attracting investors are also important elements.

Haley Medved Kendrick, director of the Bronze Valley Accelerator, said the organization has worked with national organization Gener8tor to develop relationships with some out-of-state investors in an effort to get more eyes on the Birmingham startup scene.

While many other states, cities and regions may enjoy a large venture capital cash pool, Alabama is a little less fortunate. There is some venture capital and regional funding activity from larger investors, but many startups in the state are reliant on early angel investments and pools from friends and family to receive that initial boost of cash.

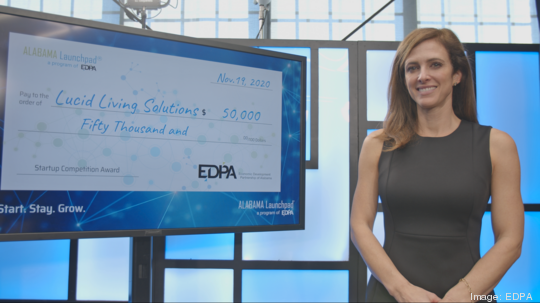

Joshua Jones, CEO of the Alabama Capital Network, said in the earliest stage, funds often come from one-off prizes such as the Alabama Launchpad, family and friends or grants from a university. Once a company gets off the ground and grows revenue, a seed round or a Series A can come from a venture capital firm such as Eastside Partners or the Alabama Futures Fund.

Rigved Joshi, director of the Invention to Innovation Center at the University of Alabama in Huntsville, said the bulk of startup funds in North Alabama comes from angels and angel groups. He said this is because there is a lack of venture capital firms investing in startups in the area, and the startup scene in the north part of the state is very new with a much smaller ecosystem than Birmingham.

Franz Lohrke, the Lowder Endowed Chair in Entrepreneurship and Professor of Entrepreneurship at Auburn University, said angel networks are traditionally the primary source for early-stage companies because many entrepreneurs can be reluctant to give ideas to larger companies for fear they will take their idea. Lohrke said getting funds at concept stage is a challenge for many startups, and seeking funding from an angel network can be critical for some of them.

Matt Hottle, a manager at the Alabama Futures Fund, said if the region wants to stay competitive, it needs to grow its funding sources or may need to look outside the market for funds, which poses its own risks.

“As an ecosystem, if we want to be competitive, we’re probably going to have to overperform in the areas of getting money and (tending to) the ecosystem from sources that haven’t participated before or haven’t been actively participating up to this point,” Hottle said. “Or what we’ll end up seeing is more and more of the financing coming from outside the market, which may be OK, but it also could result in companies being recruited away, going towards the funding sources. So, there’s the risk that we can’t maintain the growth if we don’t continue to grow participation and capital sources in town.”

Where is it going?

There are several major areas where funding from angels and other sources is going in Alabama.

Jones said it is determined by region.

In Birmingham, he said biotech industry and software companies are receiving a fair amount of investment. The state’s agriculture tech scene is a major recipient as well, he said. Companies specializing in drug discovery, health care, life sciences and medical devices are also popular areas of investment.

Kendrick said a lot of funding is going to B2B software as a service companies as well.

She said entrepreneurs in Birmingham and the region have been more conservative, creating traditional companies instead of venturing into crypto or blockchain startups – the kind that grab the attention of Silicon Valley-type investors.

While other sectors and industries located in different areas of the state do see funding, Birmingham is one of the biggest recipients of startup capital.

“When you look at the state of Alabama, the most funding from a region standpoint that we have seen coming through is in the greater Birmingham area; there’s no question about that,” Joshi said. “When you look at Alabama Launchpad, a lot of the startups that get funded are focused on that region.”

Joshi said the lack of investment in Huntsville creates a cascading effect on the area’s startup industry. He said creating and investing in more incubators and the startup ecosystem could attract more funds.

Educating the ecosystem

Charisse Stokes, executive director of TechMGM, said a major hindrance for startup funds is lack of education, resulting in an environment where people don’t understand the process or know where to go for resources.

“Because of that lack of education and that lack of exposure and knowledge base, it basically closes us off from opportunities that we could take advantage of,” Stokes said. “So, a good bit of it is our ability to educate that entire ecosystem on a process, on the resources that are available, but then also we have a huge university network that we could leverage in a different way. If we start to do more partnering from a large to small business, as well as academia, and really try to close that loop, we would have the ability to take advantage of so much more.”

Jones agrees there is an educational issue, albeit largely on the investor side. He said a critical step is raising awareness of venture investing for people who have available funds to invest.

That’s one reason the Alabama Capital Network is taking over the Birmingham Venture Club.

“In some cases, an investor invests because they know the entrepreneur; they trust that person,” Jones said. “But in a lot of cases the investor invests not only because of that but because they know the pain points that the entrepreneur is solving, and it’s something they can relate to or understand. The odds of that happening by random are not great. So, one of the things that ACN endeavors to do is give these entrepreneurs exposure to a large pool of investors so they have greater odds of being able to connect with someone who not only has investable funds but can relate to and understand what that particular business is and what the pain points they’re solving are.”

Read said funding doesn’t have to come from one place for budding startups. She said the process is a twisting road but one that’s worth the journey.