The cannabis industry represents a growing (pun intended) opportunity for entrepreneurs. The question is no longer “if” cannabis will be legal for adult use nationally; the question is “when?”

Public support for legalization has grown overwhelmingly across the United States year after year and Maryland is no exception. The first Maryland House bill presented for the 2022 legislative session was for the recreational, adult-use of cannabis. Even the most ardent and uneducated opponents of cannabis legalization are now admitting they see the benefit cannabis provides, both from a medical and revenue perspective. And what was once the original support for classifying cannabis as a Schedule 1 drug under the Controlled Substances Act of 1970 has since been exposed as baseless, unsupported, and false “conclusions” (shame on you President Richard Nixon – lies beget lies). But the most important question regarding cannabis legalization is not “when” Maryland will make adult-use cannabis a reality, but how?

Since California’s legalization of medical cannabis in 1996 through the Compassionate Use Act – Prop. 215, states have followed a standard approach of legalizing medical cannabis first, and then legalizing adult-use some time thereafter. Whether it be a medical or adult-use market, each state maintains its own marketplace and infrastructure which strictly prohibits cross-border sales.

As such, the licensing structure and all operational regulations surrounding the cultivation, processing, and sale of cannabis is very specific to each state. Therefore, the success of any state’s cannabis market will be first-and-foremost contingent on the licensing structure of that state.

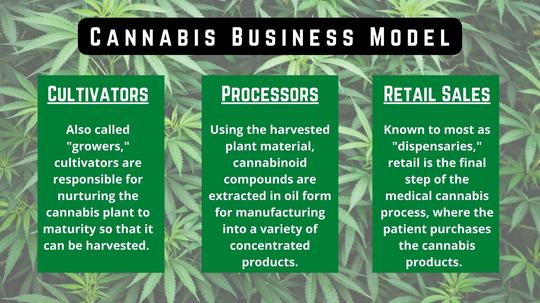

And there is variety. A cannabis license is essentially based on the function the entity performs in the industry. The core operations are those that touch the cannabis plant: cultivation, processing, and retail sales. These operations may be issued as individual licenses, or it could be issued in a combination.

To break that down further, some states have distinguished licenses in these categories based on the size of your operational footprint (i.e. one class of cultivator licenses for less than 25,000 square feet of canopy space; another class for more than 25,000 square feet). Alternatively, states have created additional licenses for broker services (wholesaler), distribution, delivery, event planning, testing laboratories, and even security guard services, to name a few.

But which state has created the best licensing structure? In other words, which state has developed a licensing structure that will allow a business to best succeed financially? That answer probably depends on who you ask.

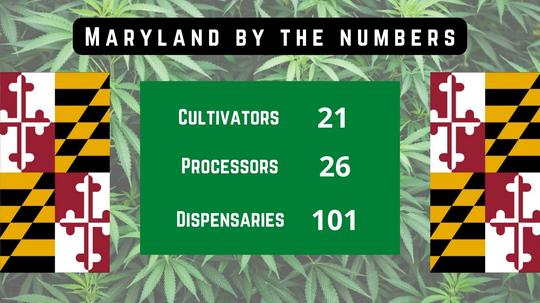

In Maryland, “vertically integrated” licenses were issued first, which ultimately gave a choice few a license to cultivate, process, and dispense cannabis under one license. After that initial award, additional processing licenses were also awarded, and two dispensary licenses were awarded per senatorial district. Approximately two years later, in response to claims of minority exclusion, a second round of licenses were awarded to minority owned businesses only. All told, there are 21 cultivators, 26 processors, and 101 dispensaries. No additional licenses will be awarded for the medical cannabis market in Maryland. 14 cultivators are vertically integrated – again, meaning they have a license to grow, process, and sell.

Based on these numbers and this structure, there is an obvious imbalance which has led to major product supply shortages. Moreover, when supply is at its worst, those cultivators that are vertically integrated sell very little to the individual license holders, primarily the dispensary owners, and simply feed their own affiliated (integrated) dispensary with product. When independent dispensaries are able to squeeze supply out of the cultivators, they do so at a premium, cutting into an already otherwise modest profit margin.

So if you ask the vertically integrated cultivators in Maryland what they think about the Maryland cannabis license structure, you will hear resounding support – don’t change anything. If you ask the independent license holders, you will hear nothing but issues related to lack of supply, inability to make a profit (many still operating at a loss), and being second-class subjects to an obvious oligarchy. Still, believe it or not, Maryland’s current licensing structure is better than most and not a bad starting point for the adult-use transition.

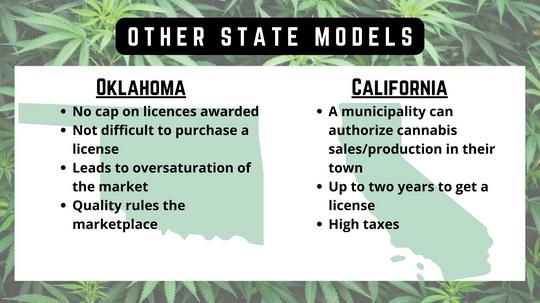

In Oklahoma, there is no cap on the number of licenses awarded, and it is not overly difficult to purchase one. Therefore, the license does not become an asset worth selling, and the licensee in Oklahoma must create a profitable business in a heavily saturated market. Many expect that Oklahoma and similar state license structures will ultimately create a craft/artisan approach where quality rules the marketplace. Still, to implement a wide-open, no-cap license structure for a medical market where the number of patients (the end consumer) are capped by qualifying medical conditions is a head scratcher.

In my opinion, this was a cop out by the state of Oklahoma. It looks like the state was more concerned with preventing necessary long and arduous grading procedures for itself, as well as the litigation that ensues after licenses are awarded, than they were with putting meaningful and purposeful thought into a licensing structure that will truly allow both: patients to receive affordable access to the medication they need; and business owners to thrive. Do they not try to achieve those goals for other industries in their state?

Bottom line, Oklahoma’s license structure for a cannabis market is simply illogical. 2022 started with bill submissions in Oklahoma’s state legislature to address laws around cannabis, and this may be the only way to save an otherwise poorly structured market.

California provides another example, but in an adult-use market setting. There is no surprise California state legislators over-regulated their cannabis industry, as they have done for years over many industries. But California’s mistakes are unique. For one, California allows a municipality to authorize cannabis sales and production in their town, which ultimately means a licensee must submit themselves to a dual license process, which is lengthy, expensive, and not guaranteed. Also, it can take up to two years to get a license and the initial costs to open a regulated retail shop is about $250,000, again, without a guarantee for license award. That’s quite a risk hurdle for a small operator.

And with many municipalities choosing not to allow such sales, there is a major shortage of retail sale locations and a massive back-up in supply. Third, as California is infamous for, the state has over-taxed cannabis, starting with a cultivation tax and adding a 15% excise tax on top that, which ultimately is pushed down to the end consumer. In only two years of California’s adult-use market, California licensees are formally pleading to the state to stop the madness and make significant industry overhauls, starting with the licensing of retail operations. “Our industry is collapsing,” said a letter to Gov. Gavin Newson signed by more than two dozen industry executives and advocates, citing their inability to compete with the illicit market which is selling at two and sometimes three times less than the legal market rates.

Based on these examples, and the examples of many states before Maryland that have transferred from a medical market to adult-use, how will Maryland approach its transformation? It is a matter of balance. You cannot undercut the current licensees who have taken the significant financial risks in entering this industry to provide quality cannabis medicine to its patient base. And you cannot ignore the current supply issues Maryland faces, nor the effect this has had on the independent dispensary license holder.

Maryland is too small geographically, so it is clear that more retail locations are unnecessary. Moreover, as logic of supply and demand dictates, more cultivation options are necessary, at the least. Keeping the above in mind, why not allow the current independent license holders to gain competitive traction in the marketplace by opening cultivation and processing licenses to them only?

This is the only real change that is necessary in Maryland. Creating additional retail licensees in the marketplace will not only diminish financial returns for current licensees, but it will also create an unnecessary competitive burden on a market that is already facing supply chain issues; having more licensees will likely just exacerbate these issues.

Final thoughts

Do not make the mistake Oklahoma did. Allow current, non-vertically integrated Maryland dispensary licensees to level out the playing field and add the much-needed supply to the marketplace. To be clear, if the demand for cannabis product is high in a medical market where your consumer numbers are essentially capped, that demand will be at least three-fold in an adult-use market.

Logic tells us that compliance issues will be minimal when your new suppliers are those that are already operating in the market, and market dynamics suggest that all licensees will then finally have an equal chance to flourish. As a result, the battle of product quality becomes the market’s driving force instead of product availability. And for everyone’s sake, if we learn anything from California, don’t over tax it.

Whether you are finding your niche in the cannabis space, ready to form a cannabis organization, or are an established licensed provider, our team of attorneys provides legal and operational expertise to help launch, protect, support and scale your business. Contact Nemphos Braue to learn more.

George Nemphos and Tim Braue started Nemphos Braue LLC in 2016, combining big firm expertise with the flexibility and creativity of a boutique practice. From venture capital and private equity to intellectual property, mergers and acquisitions and general corporate counsel, Nemphos Braue is a different kind of law firm. www.nemphosbraue.com.

Before joining Nemphos Braue, Of Counsel Bill Huber served as in-house counsel for a large multinational cannabis organization, addressing the full spectrum of corporate formation and product development from seed-to-sale, and co-founded a Maryland-based medical cannabis dispensary. His business, legal and hands-on entrepreneurial expertise helps support startups across industries.