AlertMedia was built to help other companies keep their employees and assets as safe as possible and maintain the flow of business despite disruptive events ranging from extreme weather to crime to a viral outbreak.

So there was no way a multi-day power and water outage during a historic winter storm amid a global pandemic was going to stop the Austin-based company from continuing its mission — or delay the close of a private equity investment worth hundreds of millions of dollars.

The startup had already initiated its investment discussions with Austin-based Vista Equity Partners when Winter Storm Uri arrived in Texas in mid-February, leading to widespread electricity and water failures.

"We were in the middle of closing," AlertMedia founder and CEO Brian Cruver said. "That might have been enough to disrupt other deals, but not us — because we are built for this."

Fourtune reported Vista invested $400 million into AlertMedia in early March to obtain a majority stake. Cruver declined to confirm that figure. But he and his team have big plans to put the new funding to use right away.

The company plans to hire 90 employees this year, bringing its total headcount, nearly all of whom are based in Austin, to the lower 300s, he said.

But even being flush with cash won't make that easy.

"Austin is super competitive for talent, and sometimes it's hard to fill these roles," Cruver said.

That's especially true on a tight timeframe.

"There's just a lot of excitement, and we're going to need a lot of people to join our company," he said. "That's the thing I lose sleep over ... how can I get all this talent to join us over the next eight months?"

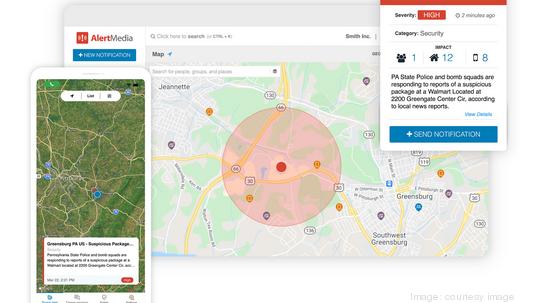

AlertMedia has a few things many other tech startups can't offer — and that's largely because it deals in global threat monitoring, messaging and emergency situations, which makes it a fit for those who thrive on breaking developments. It has a global intelligence team with about 30 analysts. Cruver said AlertMedia publishes about 200 incident reports per day, typically quicker than almost any other source.

Cruver pulled out his phone and looked at the top few incidents during our interview. There were demonstrations in Chile, a gas leak in England, protests in Jerusalem, a possible shooting outside a theater in California, a high school evacuation in Wisconsin, a structure fire in Toronto and so forth.

Clients get those types of constant, near-real-time updates wherever they have people or assets.

The action has helped AlertMedia hire former CIA employees, former military intelligence officials, journalists, a meteorologist and others experienced with emergency response.

"For us, the trend and the future is 'How can we sort through all the noise and make sure that our customers or their immediate customers are only getting what's relevant and what's important?' Because they'd be overwhelmed if they got the firehose. ... They'd be overwhelmed to sift through social media on their own."

The startup's recent traction is perhaps its best selling point.

AlertMedia, which was founded in 2013, raised about $60 million in venture funding prior to the Vista investment, and Cruver said it has doubled customers each year since about 2015.

It now has nearly 3,000 enterprise customers, which he says is less than 1% of the addressable market in the U.S.

"We have yet to go international," he said. "We have yet to go pursue some other verticals and use cases."

Just about the time most people went into work-from-home mode in March 2020, AlertMedia's already growing business experienced a spike in demand as companies worldwide sought ways to protect employees, work remotely and maintain some level of activity and connection.

New use cases, from contact tracing to return-to-work communications, started emerging.

"We did double what we had planned to do for Q1 last year," Cruver said. "We did double the number of customers and double the number of revenue in about two weeks around the end of March."

That translated to about $4 million in new revenue and bookings, he said.

Near the end of 2020, as its business was booming, Cruver said AlertMedia got a lot of acquisition interest from strategic buyers, including other software companies, and private equity groups such as Vista Equity.

"At no point during 2020 or at the beginning of this year did we plan to sell the company or do a transaction like this," Cruver said. "But at a certain point it just became obvious that this is a partner we need to take us to the next level."

The deal, he said, was a big win for everyone on AlertMedia's cap table, providing returns for primary investors including Cruver himself, as well as local venture firms Silverton Partners, Next Coast Ventures and Maryland- and California-based JMI Equity, all of which maintain stakes in the company.

But it's not like AlertMedia itself was immune from the pandemic or the winter storm in Texas.

With the pandemic and February's storm, Cruver said his team was remote and using its own software to maintain its workflow.

"It was another test for us in our own resiliency, and a test for our own software tools," he said.

Now the AlertMedia team is slowly getting back to working in its office.

In early May, the company went into phase three of its return-to-work plan, where everyone who has been fully vaccinated is invited back to the office. Cruver said about half the team is coming back between May and June. It will continue to allow those who want to work from home to do so.

"We're very much an in-office culture," Cruver said. "I think it's just because we're very collaborative and transparent."

During February's winter storm, 120 AlertMedia employees lost power or internet. Employees were volunteering to bring food, supplies and other assistance to teammates around the clock, Cruver said.

"Our culture sort of stimulates the family vibe," he said.

Editor's note: An earlier version of this story noted JMI Equity is based in California. It is based in Baltimore, Md. and La Jolla, Calif.