As Moonshots Capital LLC announces the close of its $36 million second fund, the Austin-based venture capital firm continues to demonstrate its commitment to non-traditional founders.

With the Texas capital smashing previous VC-funding records, questions persist whether women-led startups and early-stage companies led by other under-represented founders finally will obtain a larger piece of that pie.

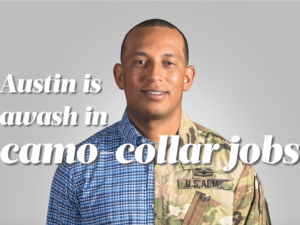

Though Moonshots’ investment thesis does not overtly state any commitment to non-traditional founders, in practice that’s precisely what it does, said co-founder and General Partner Craig Cummings. He and fellow West Point alumnus Kelly Perdew launched the Austin-based firm in 2017. Moonshots also has a Los Angeles office, where Perdew is based.

The firm’s $20 million first-fund portfolio boasts a non-traditional founder in 86% of its companies, Cummings said. As Army veterans themselves, he and Perdew consider vets non-traditional founders, along with women, people of color and “those who have overcome extreme circumstances." Moonshots closed its first fund in 2018.

Cummings said 36% of the first-fund portfolio include a Black or Latinx founder, 21% include a woman founder and 35% include a military-veteran founder.

“It’s happened completely organically,” he said. “Among the reasons we’re so drawn to veterans is because of our mentality of taking the hill, that failure is not an option. Women and people of color and LGBTQ founders have had to fight to get into that room to talk to us. They have the same DNA as veterans. They’re exactly what we’re looking for.”

The former Army Major, who served for 17 years, said the training he and Perdew received at the U.S. Military Academy in New York taught the two to lead groups of Americans across the gender, ethnic and racial, socio-economic and political spectrum.

“We learned how to lead, follow and be team members,” Cummings said. “You have to do all three to go to war and win.”

Applying those lessons to their respective careers in the Army ultimately enabled them, Cummings said, not only to lead such diverse units, but also to recognize the characteristics that compose the best future leaders: grit, perseverance “and a cannot-fail attitude.”

Cummings said that has, at least in part, enabled the Moonshots general partners to avoid the pattern-recognition bias that plagues the overwhelmingly white male world of venture capitalism. That bias causes many white male VCs to, however unintentionally, seek out previous examples of what traits indicate who will lead a successful company. For decades, the vast majority of those successes have been white men.

A 2020 Crunchbase study found a paltry 2.4% of total VC investment got funneled to Black and Latinx founders from 2015 through 2020.

Startups founded exclusively by women raised $3.2 billion last year, a plunge of $1 billion from the 2019 total of $4.2 billion, according to Crunchbase.

Cummings said he is aware of those statistics, but that the Moonshots thesis is, “We invest in extraordinary leadership,” he said. “That’s the bottom line. We look at every single leader individually, one at a time. We never force anything. This whole movement of backing non-traditional founders — we’ve already been doing it. There’s been no pivot.”

Moonshots typically invests in late seed and series A funding rounds. The firm made 14 investments from its $20 million first fund, Cummings said.

“Of the 14 companies in Moonshots Fund I, 13 are still in business, exited, or have raised follow-on funding,” he said.

As for its second fund, which officially closed July 1, Cummings said first checks “will be 50% larger, averaging $1.5 million to $2 million, and the firm is tracking to participate in larger, faster-moving deals.”

Moonshots has made seven investments so far from its second fund, Cummings said, “including unicorns ID.me and Pacaso, and emerging growth companies Cart.com, NXCR and Transmute.”

Other firm portfolio companies include Zabo, Yonder, Threatcare — which ReliaQuest acquired in 2019 — and Shep. Cummings said 37% of the two funds’ portfolio companies are based in Texas.

The firm also has raised capital outside its two funds via syndicates to give it the flexibility to invest in follow-on rounds or later-stage deals, Cummings said. Moonshots offers its limited partners the opportunity to participate in those rounds through its syndicate vehicles, he said.

As an example, Cummings said that the firm actually raised and invested an additional $25 million in syndicates during the same time period it raised and closed its $36 million second fund — for a total of $61 million raised.

Using those flexible funds, the firm has invested in companies including Robinhood, Carta and Red 6.

Cummings said the firm is currently searching for an associate in Los Angeles. That person would be the firm’s third associate and fifth full-time employee.

Moonshots will begin raising for its third fund in 2022, he said. The firm will bring on a third general partner in connection with that fund, Cummings added.