Austin startups had their slowest fundraising quarter of the year to close out 2021. But the $924 million in deals logged, according to a new report, is still more than any other quarter outside of 2021 — a sign of what a massive year it was.

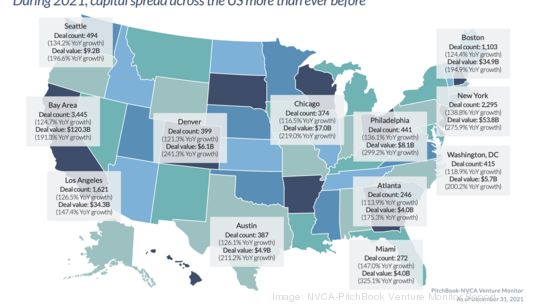

Overall, Austin ranked No. 7 in the nation for the amount of venture dollars flowing to locally-based companies with $4.7 billion of equity funding across 387 deals, according to a PitchBook-NVCA Venture Monitor report.

The Bay Area, once again, led the way with $120 billion spread across 3,445 deals. That was followed by No. 2 New York with $53 billion. Los Angeles, Boston, Seattle and Philadelphia also topped Austin's funding activity. Denver, Washington, D.C., and Chicago rounded out the top 10.

Nationwide, $329.9 billion was invested through 17,054 deals, the data show. That's nearly double 2020's record-setting investment figures. And there's no sign of a slowdown as venture firms in Austin and nationwide have reloaded their investment funds to continue placing bets with startups. VCs raised $128.3 billion, which is the first time in the history of the PitchBook-NVCA report that investors have crested the $100 billion mark.

“The best news about these record achievements is that we are creating more American made entrepreneurs than ever before,” NVCA President and CEO Bobby Franklin said in a statement. “Entrepreneurs are our nation’s job creators who plant the seeds for the new high growth companies of tomorrow. To ensure their future success we need policymakers to think about the long game when it comes to the startup ecosystem."

The past year also brought a record number of startups landing their first investment round, a promising sign for aspiring entrepreneurs. The report showed more than 4,000 first funding rounds nationwide, totaling $23.8 billion.

Zooming into Texas data, Austin had five of the top 10 venture capital funding deals in Texas last year.

The top deal in the state was a $1.3 billion funding round for Dallas-based vaccines company Vaxxinity in March last year. That round gave the company, which was formed through the combination of C19 Corp. (dba as COVAXX) and United Neuroscience Ltd., a $4.4 billion valuation. Austin-based real estate company Homeward had the state's second largest venture round.

Here's a look at the Austin metro area's top 10 funding deals of 2021 from the report, with post-funding valuations where applicable.

- Homeward: $371 million on May 14 at a $836 million valuation

- Workrise: $300 million on May 20 at $2.9 billion valuation

- ICON Technology: $207 million on Aug. 11 (no valuation provided)

- Everly Health: $200 million on March 23 at $2.9 billion valuation

- ZenBusiness: $200 million on Nov. 9 at a $1.7 billion valuation

- The Zebra: $150 million on April 12 at $1.1 billion valuation

- CrowdOut Capital: $150 million on Feb. 17 (no valuation provided)

- Ambiq Micro $145 million on March 23 (no valuation provided)

- Elligo Health Research: $136 million on Sept. 23 at $395 million valuation

- Outdoorsy: $100 million on June 24 at $1.7 billion valuation

And here are the top five deals for Austin startups in the fourth quarter of 2021.

- ZenBusiness: $200 million

- Royal Markets: $55 million

- UpEquity: $50 million

- 8fig: $50 million

- Ontic: $40 million

The top exit was Disco's $1.8 billion IPO over the summer, followed by Devolver Digital's $901 million IPO in November; Volcon Epowersports' $46 million IPO in October; and Big Swig's $2.5 million merger in October. That, however, appears to leave out several other exits this year, including Convey's $255 million acquisition by project44.

In a sense, all the venture capital record breaking is getting repetitive as Austin, among other cities, sees record startup funding deals and ballooning venture capital funds year after year. The data are among many signs that entrepreneurship is booming despite the uncertainty caused by the Covid-19 pandemic.

Meanwhile, funding for women founders is also on the climb after years of major disparities. Funding for women-led startups increased from about $23 billion in 2020 to nearly $55 billion in 2021, the report said.

Despite the big gains for venture funding in 2021, the future largely hinges on whether those investments provide returns.

"Given the current backlog of highly valued VC-backed companies, we expect public listing activity will need to continue in 2022 at a rapid pace for VC investors to realize the current potential return in their portfolios," the report said. "Because of this growing reliance on these public exit routes, the volume of IPO activity in Q1 2022 will be critical to the returns of the VC strategy in the short term."

For a list of the most active VC firms in the area, click here. ABJ's latest list of local angel investors can be found here.