While Tesla's HQ move to Austin might be getting the most attention, Austin's startups are in the midst of a record-setting year for funding and exits, according to a new report.

Austin-area startups generated more than $2.9 billion in exits in the third quarter, according to the Q3 PitchBook-NVCA Venture Monitor report. That was driven largely by three big transactions: legal tech startup CS Disco Inc.'s $224 million initial public offering, fitness and training company F45 Training Holdings Inc.'s $300 million IPO and the $255 million acquisition of Austin last-mile logistics startup Convey Inc. by Chicago-based shipping visibility provider Project44.

Those deals were also the top three exits statewide in the third quarter.

That helped give the Austin area its biggest quarter for exit value recorded since at least 2014, which is the earliest data available in the report. The only quarters that were close were Q2 of this year, when the Austin area logged nearly $2.5 billion in acquisitions and IPOs, and Q3 last year, which had $2.1 billion in recorded exits.

It's a sign of both Austin's maturing startup scene and hearty investor appetites nationwide.

"VC-backed public listings have eclipsed previous annual records and generated $513.6 billion in exit value YTD for limited partner investors, founders, and employees. Those VC-backed IPOs also accounted for more than two-thirds of the total US listings YTD, emphasizing VC’s contribution to the health of public markets," according to the report. "The VC industry continued to build on the strength of previous quarters as it roared ahead, setting records in Q3 and putting 2021 on track for another record-breaking year for venture investment, exit activity, and fundraising, despite mixed macroeconomic signals and a prolonged pandemic."

Shifting gears to startup venture funding, Austin didn't set any records this quarter. The report showed a total of $981 million in funding deals, which was down a bit from the $1.1 billion and $1.6 billion raised in Q1 and Q2 this year.

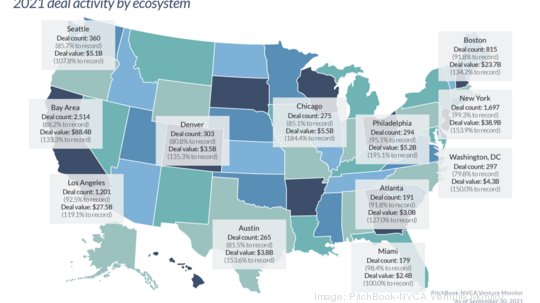

Overall, the report shows 265 deals in Austin this year, which is 85% of the way to a record in terms of deal count. Those term sheets pile up to a total of $3.8 billion invested in local companies. That's already about 154% of Austin's prior record year, which was 2020.

That comes as the number of venture capital firms operating in Austin has continued to climb with the launch of several pre-seed and early-stage funds, as well as the addition of larger coastal firms, such as 8VC, that have relocated to the city or opened offices here.

Here are the top 10 local funding deals logged in the report:

- Icon Technology - $207 million

- Elligo Health Research - $135 million

- Fetch Package - $50 million

- Self Financial - $50 million

- Olea Edge Analytics - $35 million

- ClosedLoop.ai - $34 million

- Eventus Systems - $30 million

- Billd - $30 million

- OsteoCentric Technologies - $30 million

- Rey - $26 million