A Google search + a cold email = Austin lands another promising startup

That's the equation that played out for Disco, an e-discovery company with a software platform that helps lawyers discover and manage evidence. The startup was born out of Kiwi Camara's Houston law office. Once Camara and his team began further developing legal software, he decided he'd need to raise venture capital to succeed. He initially pitched Austin Ventures, at a time when it had already mostly stopped its early-stage investment.

Then, he Googled "Austin VC" and spotted LiveOak Venture Partners and ended up filling out an online contact form.

"I think it may be the only cold email deal they have ever done," he said in a June 21 conversation on audio app Clubhouse. "But I think that is a nice example of what makes Austin really great to be in. It's just anybody on this call and any of the folks around town will respond to that kind of cold outreach and pitch in and help, and it's just a wonderful sense of community."

He gave a nod to Austin's blooming venture capital community, which has helped his Disco raise $234 million in total funding and move to Austin in 2018.

"For me, the catalyst was literally our Houston lease expired, and we were either going to re-up on big space in Houston, or make the move to Austin. So we thought about that for a while, and honestly one of the deciding factors was when we would try to recruit executives to move to Texas from [Silicon] Valley or from New York, you tell them 'What do you think about relo to Houston?' and they hang up. You tell them 'What do you think of relo to Austin?' and that's usually a super easy sell. And so it's the combination both of the local talent market, which is great with UT and all the tech companies that have been built here, but it's also just incredibly easy in this climate to convince people to relocate to Austin."

It was the type of candid conversation about Austin venture capital increasingly playing out in Clubhouse rooms, which thrived during the pandemic and have proved enduring even as many organizations start to resume in-person meetups and events. In many ways, the platform has become a go-to place for founders to find niche conversation rooms to vent on the headaches of startup life, as well as promote themselves and their brands.

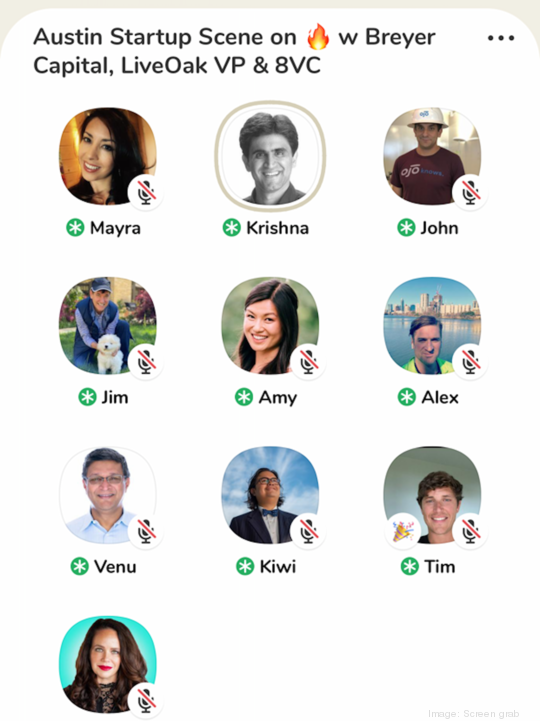

In this case, more than 100 people were tuned into a conversation about venture capital and Austin's startup scene. The panel, hosted by LiveOak Venture Partners, also included OJO Labs founder and CEO John Berkowitz; Breyer Capital CEO Jim Breyer; Homeward founder Tim Heyl; 8VC Partner Alex Moore; LiveOak founding partners Venu Shamapant and Krishna Srinivasan; Amy Sun, founder of stealthy startup Daylight Labs and a former Sequoia Capital investor and product manager at Facebook and Uber; and moderator Angel Gambino, CEO of Alchemist Collective.

While the high-profile venture capitalists and founders showered Austin with praise for collaboration and openness in its startup ecosystem, they also noted how shifts to work-from-home and remote work have tilted the table in Austin's favor.

Sun said she never planned to move to Austin. She was out exploring the country early in the pandemic with her newlywed husband and decided to stay in Austin, with plans for a remote team for her new startup.

"I guess I'm the newest Austinite in this group, although I've been here for about nine months. It feels like I've been here forever at this point," Sun said. "I love it, so far. And I do think that some of the conversation around where to live, especially on Twitter, feels very zero sum, like, 'oh my city versus your city' or 'are you abandoning SF?' or, like, 'why do you choose Austin?' When in reality, I think that in this new era where everyone is online ... that you can actually truly have the best of both worlds. You can have employees in Austin, and in San Francisco and in New York and maybe even in Miami."

Moore moved to Austin last year when 8VC moved its headquarters to the Texas capital from the Bay Area. He's the former director of operations at Palantir Technologies and one of the leaders of 8VC’s Build program.

He said the Build program aims to create and operate four to five new startups a year with $5 million to $10 million investments, across a broad variety of high-tech verticals.

"We're going to build all of our future companies here," he said, noting he moved to Austin about six months ago. "This is the most exciting for me as, sort of as more of an operator than a VC-type person. So I'm just really excited to build great companies and hire a lot of smart people."

Breyer, among the most prominent in a flurry of venture capitalists to move to Austin, said Michael and Susan Dell were instrumental in his decision to relocate to the Texas capital. He said he hopes to stay in Austin for decades to come.

"It's in some ways similar to perhaps what Silicon Valley looked like 20-25 years ago," he said, noting how well founders and ecosystem leaders collaborate and build each other up.

"I think Austin, more than any other geography in the country right now, perhaps any other geography in the world, has that level of camaraderie; the expertise of UT Austin is extraordinary," he said.

Srinivasan split Austin's tech evolution into three phases: the early days of Tivoli and Dell, the dark ages when Austin Ventures wound down its early-stage investing and its recent evolution as an emerging powerhouse for startups, big tech companies and a growing field of venture firms.

"The market has diversified immensely from being an enterprise software market with these spikes in prop tech, in legal compliance tech and health care tech... list goes on," he said. "There is a surge across a variety of markets here in Austin. We're just creating this outstanding virtuous cycle and this golden era of entrepreneurship. And so the secret is out, you see migration underway."

But, as it goes on Clubhouse, you kinda had to be there to really get it all.

"One of the frequent topics of conversations I think that come up in a lot of the startup ecosystem rooms or shows that are here on Clubhouse are about investors who can really provide more value than just the capital itself," Gambino said. "It's not just the capital itself, it's the contacts, and the customers. So if an investor can help with customer development, then you know that's going to give you an increased competitive mode."