The oversubscribed $10 million series A funding round Eterneva Inc. announced July 26 presented choices for the company that makes memorial diamonds from the remains of deceased loved ones and pets.

“It was a competitive round,” said co-founder and CEO Adelle Archer. She and her team enjoyed the good fortune of having three term sheets to consider. “So, we said, ‘Let’s put together the cap table we really want.’”

Archer and her colleagues ultimately chose a group of investors led by New York City-based investment firm Tiger Management, the family office of billionaire hedge fund manager Julian Robertson. Other round participants included Austin-based venture capital firms Capstar Ventures and Next Coast Ventures, as well as California-headquartered Goodwater Capital LLC, Mark Cuban, Founder Collective, Softbank Partner Lydia Jett and Upfront Managing Partner Kara Nortman.

Capstar Ventures Managing Director Kathryn Cavanaugh joins Eterneva’s board as part of the deal.

Cavanaugh chose to invest in Eterneva in part, she said, due to the company’s ability to connect with its customers. She described Archer and co-founder Garrett Ozar as “extremely thoughtful about the customer journey,” adding that “it’s pretty special that you can carry your loved ones with you” once they become diamonds.

“The business model is pretty incredible,” Cavanaugh said. Customers pay cash up front and they’re “not asking for returns,” she said. And Eterneva is acquiring customers largely organically — a rarity. Those costs “generally are very high,” Cavanaugh said, pointing out another reason investing in the company was an attractive proposition.

Eterneva has raised a total of $16.7 million to date. Archer and Ozar co-founded the company in 2017. The two appeared on the TV show "Shark Tank" in 2019, where they agreed to a $600,000 deal with Cuban, a billionaire entrepreneur who owns the NBA's Dallas Mavericks.

Archer declined to share revenue figures, but said the company remains in growth mode. It does not have a target date for profitability, she said.

“Our eyes are on building a modern unicorn in our category,” the CEO said. “There certainly will be acquisition opportunities along the way, but our goal is to actually have an [initial public offering].”

By mid-April, Eterneva had served 800 customers and grown 1,100 diamonds. Customers include Austin entrepreneurs Leon and Tiffany Chen, co-founders of warm-cookie delivery company Tiff’s Treats, and Jay B. Sauceda, founder of e-commerce fulfillment company Sauceda Industries. The diamonds start at $2,999, TechCrunch reported.

Archer has previously described the desire to become a unicorn, a privately held startup valued at $1 billion or more, in what's known as the "deathcare" industry.

With interest in traditional funerals and memorial services waning among Americans, Archer said much of the fresh capital will go toward educating the public about Eterneva’s memorial-diamond option long before people must make the decision regarding honoring their deceased loved ones.

“This will help us move the needle on this in a big way,” Archer said.

Market-research firm Statista projects the U.S. cremation rate to leap to 72.8% by 2030, up from 56.1% in 2020.

Eterneva is already making quite a splash on TikTok, the social media platform built around short videos. The company has produced 15 such videos since last year’s fourth quarter that have gone viral, attracting between 500,000 and more than 7 million “organic views,” Archer said.

That has outperformed videos created during that timeframe by global companies such as Oregon-based apparel business Nike Inc. (NYSE: NKE) and Chicago-headquartered fast-food behemoth McDonald’s Corp. (NYSE: MCD), the CEO said.

“What we’re doing already is resonating with younger people,” Archer said. “We want to take that awareness to the next level.”

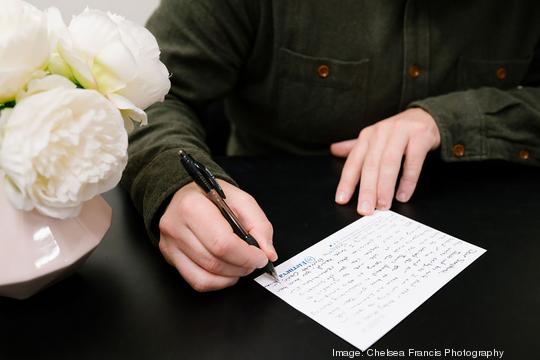

The CEO and her colleagues also have branded the company as one that doesn’t deliver a product, but rather, an experience. Eterneva employees are trained to help guide their grieving customers through the mourning process as the company transforms items from the deceased, such as hair and ashes, into diamonds. Read Austin Business Journal’s April story about that journey here.

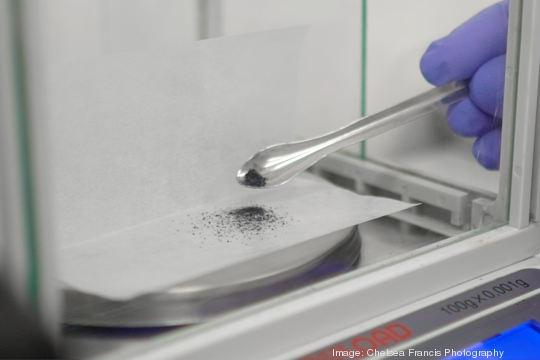

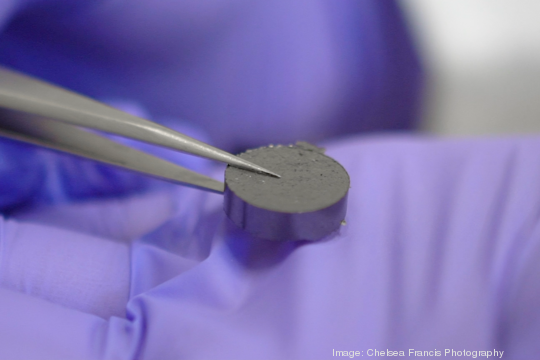

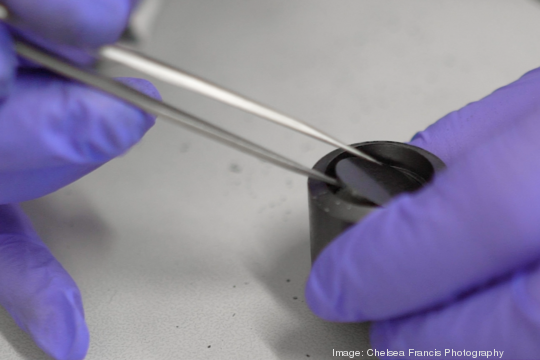

Slideshow: See what it takes to turn ashes into a memorial diamond at Eterneva

How does Eterneva turn cremated ashes into diamonds? Here's an up close and personal look

Research by Baylor University commissioned by Eterneva found the company’s process helps customers heal the wound caused by a loved one’s death. In that study, “82% of people said the Eterneva experience positively helped their grief,” the company said.

Archer said the new capital also will be used to augment the company’s funeral-home and pet aftercare channels.

Eterneva is partnering with funeral homes throughout the United States and Canada. Customers of funeral home partners may choose memorializing their loved one through an Eterneva diamond, in addition to traditional burial and cremation offerings. Funeral homes send a half-cup of ashes or hair to the company. Eterneva pays the funeral home a commission.

The company continues to hire, the CEO said. Archer plans to add a vice president of grief toward the end of the year and beef up the operations, marketing, branding, performance, channel, finance digital-product and human resources teams.

The company currently employs 26, and Archer expects to hire roughly 15 during the next 12 months.

Memorial diamonds, in particular, resonate with people because they remind the grieving of their loved ones’ lives, instead of their deaths, Archer said.

That’s among the reasons Tiger Management decided to lead the investment round.

"Eterneva has created a transformative product that answers the need to celebrate and memorialize loved ones,” said Alex Robertson, the firm’s lead investor and president, in a statement. “We believe its technology, ambitious management team, and transparent process can bring meaningful solutions to the myriad of bereaved.”

The investment from Tiger Management gives Eterneva a direct line to the Robertson family office. Julian Robertson is known for founding Tiger Global Management LLC, a major investment firm. Tiger Global's expertise includes investing in companies that operate in the software, consumer and technology sectors. The firm launched its private equity business in 2003 and participates in funding rounds ranging from series A to pre-IPO.

Eterneva earlier this month opened its 5,000-square-foot research and development and jewelry facility in the Hill Country city of Kerrville. Rob Irvin of Realty Executives in Kerrville served as its commercial real estate broker.

At the beginning of next year, Eterneva plans to move into a 30,000-square-foot diamond-growth facility.

A previous version of this story misidentified the lead investor in Eterneva's series A round, Tiger Management.