For a company that has idle cash from payroll, inventory or taxes, they can put their money to work with Atlanta startup Poplar.

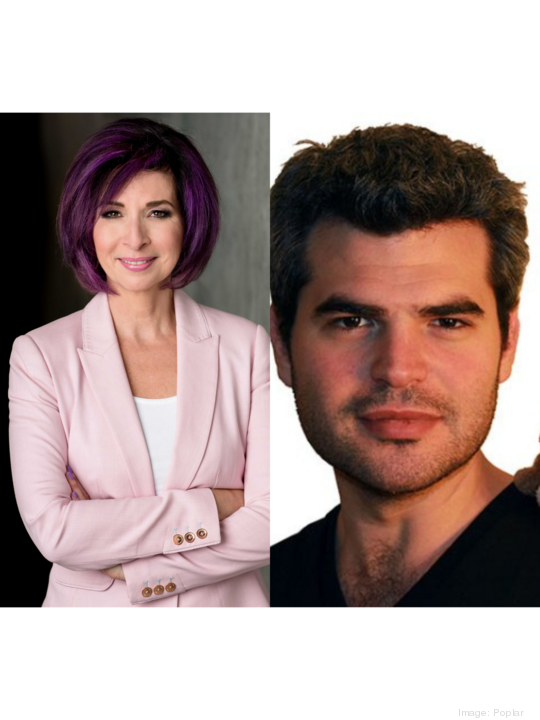

In mid-June, Atlanta serial entrepreneurs Lior Weinstein and Genevieve Bos launched the startup's Yield as a Service platform. The mission of the company is that money should never sleep for small to medium-sized businesses.

“Big businesses have treasurers handling billions of dollars, but when you're a smaller business, you don't have access to those technologies or specialties,” said Weinstein. “It takes a lot of proficiency to invest and manage money for a business.”

Businesses can grow their wealth by investing either cryptocurrency or fiat currency that they wouldn't have otherwise invested. Non-financial corporations in the U.S. are sitting on a little over $4 trillion dollars as of 2020, according to the Harvard Business Review, allowing Poplar to enter into a massive market.

Weinstein has a cybersecurity background, and the company has a network based in Israel that monitors risks in the market. If there is an active hack, the platform can pull a user’s money out before the hack is finished.

Poplar has raised half of a $5 million raise. Investors include blockchain company Lukka Inc., online accounting company AccountingDepartment.com LLC, among others.

The company currently has 15 full-time employees. Bos and Weinstein are based in Atlanta while the rest currently reside in Israel, Canada and Ohio.

It currently has 30 enterprise customers on its beta pipeline. By the end of the year following the closing of its raise, it aims to have between 60 and 100 enterprise customers.

Investing unused funds

Enterprises have the opportunity to take their unused funds and invest them into brokerage accounts or deposit them in high-yield savings accounts on Poplar. Cryptocurrency has emerged as another option for companies to invest their idle cash.

Last year, Tesla purchased $1.5 billion worth of bitcoin at the same time it announced it would start accepting payments in bitcoin in exchange for its products. In May of 2022, the company reported that its Bitcoin investment hit nearly $2 billion.

For Graham Gintz, a mentor at the Zane Venture Fund and analyst for the Atlanta Technology Angels, founders should be on the same page with their board about the risk/reward of investing capital.

“If the company has a solid understanding of the crypto market compared to traditional public markets or real estate, that totally makes sense to put the capital there, but most early companies need 100% liquidity and having capital invested could become a problem that’s easy to avoid,” said Gintz in an email.

History in entrepreneurship

Being long-time colleagues and friends, Weinstein and Bos realized they had an opportunity for another entrepreneurial endeavor in 2021 while mentoring other business owners on how to invest their crypto and fiat assets.

“Having been the CEO of smaller businesses, we have the same anxiety of looking at balance sheets, understanding where to make money, why is the cash not doing anything,” said Weinstein. “This is not some pie-in-the-sky concept, we know it's valuable because we've been the customer for this for many years and it just didn't exist.”

Bos and Weinstein have spent the last few decades starting several companies that became profitable.

Weinstein, who moved to Atlanta from Israel in 2011, founded six companies in his career including image search and procurement startup Ginipic, which was acquired in 2010 and engagement platform Appoxee, which was acquired analytics company Teradata Corp. in 2014.

Bos, who’s originally from Montreal, Canada and moved to Atlanta as a child, founded four companies: software-as-a-service platform IdeaString, which was sold to General Electric Company in 2014, and national media company Little PINK Book, which grew to a readership of almost a million.