A few years ago, I asked a then-current Major League Baseball player if he would consider donating any amount of money to build a batting cage for a school. He declined, saying, “A million dollars isn’t a million dollars anymore.” In other words, a dollar doesn’t go as far as it used to.

The same thought crossed my mind when I recently attended the Venture Atlanta conference, where dozens of hopeful entrepreneurs pitch annually to raise money to fund their startups.

As a business valuation consultant, I have actively tracked technology sector valuations for over a decade. The only constant in valuations is change.

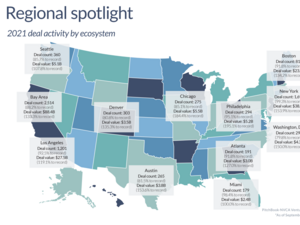

They change instantly during trading hours in public equity markets. Shifts in private company valuations are much more difficult to discern. Such data is not readily available, subject to delayed reporting, and influenced by factors such as region, sector and media bias toward outliers.

Still, my profession requires me to frequently assess the value of early-stage companies with little to no revenue, let alone profit.

By definition, a company is worth what someone is willing to pay for it. It isn’t uncommon in the current market for professional fund managers to invest in companies with less than $1 million in revenue in attractive sectors, such as SaaS software, at valuations approximating $10 million.

This valuation milestone, which many companies seek, represents an increase of approximately 100% since 2014, according to an analysis of PitchBook data. Such a growth rate may not seem unreasonable until considering the pressures facing startups in the COVID economy, including inflation, supply chain issues, labor shortages, etc.

At first glance, escalating valuations in this context don’t seem to make sense. However, venture capital firms are under constant pressure to deploy capital. Thus, with plenty of “dry powder,” they continue to bid up valuations to levels that, on average, have traditionally not yielded attractive returns on investment.

As funding transaction values increase while terms to liquidity events extend, the stakes for investors become higher. Fund managers, especially on the West Coast, are doubling down on their investment philosophies, spinning esoteric terms like “J-curves,” promising that unprofitable unicorns are worth the risk if and when they figure out how to make money.

However, angel investors are under no such pressure to write checks. Thus, valuations for the earliest stage companies that professional funds avoid are struggling to keep pace with those that have previously raised capital and have gained market traction.

Especially in the Southeast where investors are more conservative, young company executives should consider the potential downsides of funding delays and low returns caused by pitching at overly high valuations. They need to clear the valuation hurdle to get Mr. or Mrs. Wonderful to write a check in the "Shark Tank.”