Anik Khan took his family on their first vacation using rewards from credit cards — paying out of pocket only for food.

The 2014 trip to San Francisco and Yosemite with his parents and younger brother was the first of many Khan financed with rewards.

Now he’s helping others do the same.

“I realized there’s a lot of money in this,” Khan said.

A manager at a previous job at Accenture had encouraged him to use his cards smartly.

“He said ‘You’re going to be spending a lot on business expenses, you should maximize your credit card rewards,’ ” Khan said. “That really got me interested in learning more about this. That was in 2013 right after I graduated.”

The Georgia Tech graduate founded MaxRewards, a digital wallet app that helps consumers make the most of points, rewards and other perks, a little more than a year ago. He’s hoping to raise $2 million in a seed round still this year.

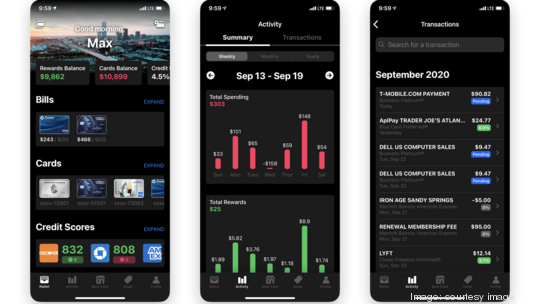

MaxRewards helps users determine which credit card is best to use with each purchase to maximize rewards and discounts and activate discounts. Users also can see when bills are due and how much of their credit they’re utilizing.

The app has 15,000 users across the country who have earned more than $25 million in rewards in the past year, the company said.

MaxRewards was a winner in the 2018 FinCon Startup Competition and a finalist in the 2019 FinTechSouth Innovation Challenge. It was one of 10 companies selected to be part of the 2019 Techstars Atlanta Accelerator.

Khan has long been an entrepreneur, starting his first company — a web design and development firm — at age 14. Before MaxRewards, he was a consultant at Accenture’s Global Life Sciences Strategy, working with biotechnology and pharmaceutical companies across Europe and North America.

He started MaxRewards “with a website and much smaller vision,” Khan said. Self-funded in the beginning, “we had a couple hiccups like a lot of startups.”

The Techstars program was invaluable, Khan said.

MaxRewards received $120,000 from Techstars and raised $50,000 from angel investors. It was planning on raising a seed round in March, but then Covid-19 hit.

MaxRewards allows users to upload their credit card account information, and the company helps consumers choose the best card for a specific purchase using a feature called Best Card. MaxRewards also auto-activates offers and quarterly bonuses.

The app connects with approximately 80% of all credit cards.

“Obviously we want to get to 100%,” Khan said.

Consumers can directly add any cards that MaxRewards can’t automatically connect.

Khan said MaxRewards takes consumer privacy seriously.

“We don’t sell location or transactional data, and we never will,” he said. “It’s against our privacy policy to sell user data.”

MaxRewards has doubled its user base in the past couple of months, Khan said.

The company is “continuously making improvements to the app,” he said. “We have some pretty exciting changes to the app coming up.”

That includes support to connect Apple card.

MaxRewards also is adding functionality to customize rewards, Khan said.

“One thing trying to do next year is build a commerce platform,” Khan said. “We want to cut out the middle man and work directly with consumers. As a temporary name, we’re calling it MaxDeals.”