The future looks bleak for Atlanta startups raising money.

The latest quarter was the third in a row that venture capital declined, according to PitchBook and National Venture Capital Association's latest report.

Georgia startups saw a 28% decrease of funding overall from the prior quarter. Nationwide, there was a 20% drop in venture deals from the first quarter’s record high. It was the lowest count since the last three months of 2020.

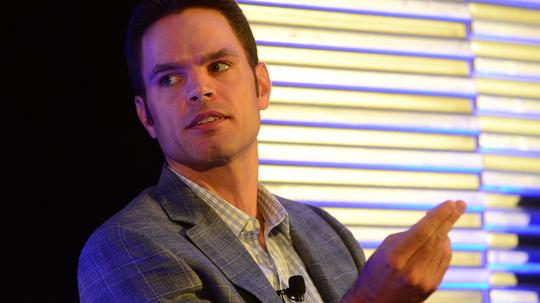

“I think we’ve got a cold winter ahead of us from a venture funding point of view,” said David Cummings, CEO of Atlanta Ventures and founder of Atlanta Tech Village. "The same amount of dollars are out there in terms of commitment, but the deployment has been dramatically throttled back, which translates into fewer deals."

Because investors have changed their focus from growth to profitability, the serial entrepreneur told Atlanta Inno in April that Atlanta could be in a "two-year drought of new unicorns" since company valuations have gone down as much as 70% after a record year of funding.

Here's what Cummings thinks founders need to know to navigate this climate.

What are the right and wrong things for startup founders to do right now?

There are two big failures entrepreneurs make.

One is they build a product that is a little better than what’s already in the market, but it’s not a must have. It's not something revolutionary, it's evolutionary. The big challenge for an entrepreneur is to build a product good enough to get people to change. Human behavior is the biggest thing an entrepreneur battles against. The only way to get people to change is to provide something dramatically better.

The second thing an entrepreneur struggles with is pricing the product according to the value the customer received. Most entrepreneurs price their product too low because they think it isn’t fully baked, so they shouldn't charge because they don't know what it's worth. Soon enough it's hard to see how the business model will work in terms of scaling revenue or potential profits.

Why are we seeing a consecutive drop in funding?

VCs have limited partners that supply capital. Venture valuations went up so high that their own asset allocation got out of whack. They were going to have 10% to venture and 40% to public equities, but then venture had such big markups in 2021. They had to say, ‘We don’t want to deploy more capital to venture because we're already at a higher percentage than we want to be.’ So they went back to their venture funds and said, ‘I know we committed millions to these funds, but we want you to slow deployment.' Before they might have deployed over 24 months, now they're deploying over four or five years.

What are the impacts you're seeing on Atlanta Tech Village startups?

The biggest impact is that there will be a flight to quality. Startups showing metrics like customer acquisitions or revenue per customer will get all the attention. In 2021, things were so frothy that you could raise capital if you could tell a good story. Now the bar is much higher, so companies who are just doing OK will have a harder time.