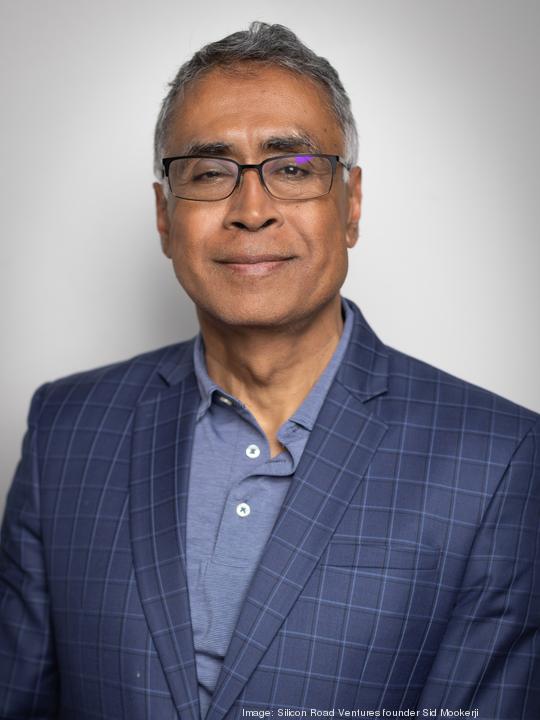

In 2021, a record year for funding into Atlanta's tech ecosystem, numerous venture capital firms spent a majority of their cash, as they saw an opportunity in companies whose valuations were inflated, said managing director of Silicon Road Ventures Sid Mookerji.

During that time, smaller firms such as his own also found themselves outcompeted in investment deals by larger firms more capable of bidding for those companies.

"I know a lot [of firms] were knocked out by large funds who said, ‘We are raising $5 million and we want to put in $4 million, and I want to get these other funds to fund the remaining amount and that's my condition.'" said Mookerji. "Smaller firms that supported these guys in early rounds were knocked out without getting any products out."

But some of those firms may now find themselves in trouble, with portfolio companies low cash and not able to provide a return. Mookerji said his firm acted more conservatively by spending approximately a quarter of its funds. Now, Silicon Road remains bullish on its investments.

"What we should do is have a moment of silence for the death of irresponsible investments, because that will change," said Mookerji. "The valuations were just out of this world. How do you justify a valuation at 300 times revenue?"

Mookerji spoke with Atlanta Inno on the decisions made by firms during economic upswing, and what we can expect now. This interview was condensed and edited for clarity.

You were more conservative with your spending. Why did you make that decision? Did you have any foresight, or was it just luck? What we did was actually more conventional. Typically you invest 25% of your fund every year in existence. These other funds got carried away, I guess seeing all the activity, saying, ‘I can get in now and maybe in three years, I can exit.' That was a mistake. We have been conservative in two different ways. One is that we didn't put all our money out there, and two is that we were thoughtful about the kinds of companies [we invested in]. We didn’t invest in companies that were at 300 times revenue.

Are there examples of funds getting carried away like this and what happened to them? One of the things that happens with downturns is a lot of small funds will have to go away. Just like how a lot of the startups will end up with no cash and shut down, these VC funds will do the same. So funds that were able to make smart investments through 2008 and 2011, when the markets were down, did very well.

You mentioned some of these funds went away. Will the same number reemerge or will there be a net loss? The amount of available capital for private equity will probably shrink a little for a period of time. But private equity as an asset class has not been a force as much as it is right now. In the past several years, private equity has outperformed the market more than anything else, so the landscape is different.

Now that valuations have decreased, will this mean that smaller funds will increase investment and compete better with bigger funds? It’s not about being larger or smaller as much as how much capital they have to deploy. People are going to be a lot more conservative irrespective of the size of their funds, but there will be a lot more opportunities. Investors are going to start looking for more prediction metrics that define company success, things like revenue growth, road to profitability, cost of getting customers, more than just saying, ‘I’m going to sign up users or get eyeballs," things that don’t point to future profitability.

Will this have an impact where from now on, VC firms will be more responsible with money? What effect do you think that has economically? For the next several years they will but then it comes back. People forget and it will repeat itself. But VC investments and private equity have matured. There are established processes and playbooks, so they'll be more structured to how people think about it. That doesn't exclude people making bad decisions. With cash available, there will be bidding wars for companies that seem to have a great upside, so I'm sure that's something that will come back.

How will tech companies get capital during this time? You have to go back to your roots. Figure out an established idea and first fund it yourself, then go to friends and family, then through angels. That is the first line of defense, which hopefully carries you through to when the market is back up. If you have an established company with some private equity, then it's important to do some careful analysis of how to get a positive cash flow, even if it requires difficult decisions in reduction in workforce or maybe founders not taking as much of a salary to make sure they are able to take the company through tough times.