Atlanta startup Groundfloor launched a new program that aims to fight against resident displacement that happens in gentrifying neighborhoods.

The program helps residents finance accessory dwelling units (ADUs), which are units on their property that other people could live, such as a tiny house or in-law suite. With an ADU, a resident can get a secondary source of income through rent payments, helping them keep up with rising property values and stay in their homes.

Groundfloor CEO Brian Dally said Atlanta's loosened zoning restrictions on ADU's spurred the program. Now that the city allows them, Groundfloor gives residents a way to finance them.

"We allow people to obtain financing to improve their property, provide space for more people to live on the property and make money from it,” Dally said.

Meet Groundfloor

Groundfloor, founded in 2013, provides short-term real estate loans to individuals looking to build or renovate their houses. The loans are financed through retail investors, who make their money through the interest rates.

Groundfloor gets its revenue through charging the borrower an origination fee and accruing interest on the loans before it distributes them, Dally said.

Dally said the startup makes real estate investing accessible to more people while also providing loans to people without having to go through a bank, which Dally said don’t usually finance real estate projects.

“We felt like organizing individual investors to become directly involved and have a financial stake in the world around them would create positive change in the world,” Dally said.

The startup has about 50 employees, Dally said, and grants about 50 to 60 loans per month at an average of a 10.5% interest rate.

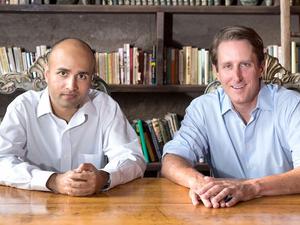

Dally said he didn’t initially see the financial technology platform as a way to combat against resident displacement. He and his co-founder Nick Bhargava just wanted to give residents and individual investors more agency in the real estate market.

An innovative solution to gentrification

When Atlanta changed its policy a few years ago to allow for more ADUs, Dally saw an opportunity for local homeowners and the startup.

In addition to helping the homeowner with an additional income source, the ADU increases the density of the area, allowing for more rentable space in the city.

Ellen Dunham-Jones, an urban design professor at Georgia Tech, said ADUs are a viable option to combat displacement and increase affordable housing.

"Increasing the supply of housing is one way to actually reduce the incredible price escalation that we see in these really desirable neighborhoods,” Dunham-Jones said.

ADUs also support the trend of more people wanting denser, walkable areas to live, Dunham-Jones said. Despite the country’s metro areas being mostly zoned for single-family homes, Dunham-Jones said the nation is made up of mostly one- to two-person households.

"Gently densifying neighborhoods can bring a lot of amenities that are meeting the demographic demands and interests while also making fun places to gather,” Dunham-Jones said.

However, despite the benefits of ADUs and city support, the Atlanta Department of City Planning found people had trouble financing those ventures, according to a December 2020 report.

Dally hopes Groundfloor can change that. The startup has already funded three ADUs projects and has plans for more.

A growing platform

Interest in Groundfloor’s real estate investing platform skyrocketed in 2020, Dally said. Groundfloor saw 50% year-over-year growth in investor activity, which he attributed to people becoming more interested in alternative investments during the Covid-19 pandemic.

Groundfloor had allowed some institutional investors on the platform before the pandemic, but Dally said those investors “ran for the exits” when the pandemic hit, which caused about a 20% loss to Groundfloor business.

“We emerged from it stronger and better,” said Dally, who closed off the platform to institutional investors after that. “The pivot in the middle of the year was terrifying. We furloughed 70% of our employees, but started rehiring them back really quickly, and were back to full strength by August.”

During the pandemic, the startup also reduced fees by 1% and interest rates by up to 1.5% for borrowers to help alleviate some financial burden.

The startup has raised more than $3.6 million through crowdfunding on SeedInvest, according to a Groundfloor spokesperson. Groundfloor now has 4,700 shareholders who own about a quarter of the company. Groundfloor has a total of about $26 million in capital from this crowdfunding and venture capital.

The startup makes loans in about 27 states, Dally said, and has received recognition on Deloitte’s Technology Fast 500 list and Inc. Magazine’s 5,000 list for its continued growth.